How to Get Business License in Abu Dhabi, UAE – 2025 Complete Guide

Abu Dhabi is fast becoming a top destination for investors, entrepreneurs, and growing companies from around the globe. With its robust infrastructure, world-class facilities, and strategic location, the emirate has lots of opportunities for businesses of all sizes. Whether you plan to launch a small e-commerce startup or establish a large manufacturing facility, you will need a business license in Abu Dhabi to operate legally.

This comprehensive guide will walk you through the essentials of getting a business license in Abu Dhabi, explaining its many benefits, the different license types, and the step-by-step process to obtain one. We’ll also discuss costs, renewal procedures, and how to verify an Abu Dhabi trade license. Along the way, we’ll touch on helpful tips and potential challenges, as well as how professional consultants (including those offering company formation in Dubai services) can streamline your journey.

Our focus here is on clarity and readability. By the end of this guide, you should have a strong grasp of how to navigate Abu Dhabi’s licensing system, choose the right license for your activities, and set up a fully compliant business that thrives in the emirate’s dynamic economy.

- Why Choose Abu Dhabi for Business?

- What Is a Business License in Abu Dhabi?

- Benefits of Having a Business License

- Key Authorities and Regulations

- Types of Business Licenses in Abu Dhabi

- Mainland vs. Free Zones

- Steps for How to Get a Business License in Abu Dhabi

- Step 1 : Choose Your Business Activity

- Step 2: Determine the Legal Structure

- Step 3: Trade Name Reservation

- Step 4: Initial Approval

- Step 5: Draft a Memorandum of Association (If Required)

- Step 6: Secure an Office (If Needed)

- Step 7: Obtain Additional Approvals (If Any)

- Step 8: Final Approval and License Issuance

- Documents Required Business License in Abu Dhabi

- Business License Cost in Abu Dhabi

- How to Verify a Business License in Abu Dhabi

- Renewing Your Business License

- A. Check Your License Expiry Date

- B. Verify Required Documents

- C. Settle Any Outstanding Fines or Fees

- D. Submit the Renewal Application

- E. Await Approval and Collect Your New License

- F. Renewing a Business License in Free Zones

- I. Avoiding Common Renewal Pitfalls

- J. Getting Help from a Business Setup Consultant

- Company Registration: The Role of PRO Services

- Common Challenges and How to Overcome Them

- Getting Help from a Business Setup Consultant in Dubai or Abu Dhabi

- Frequently Asked Questions (FAQ) – Abu Dhabi Business Licensing

- Q1. Do I need an office for every type of Abu Dhabi business license?

- Q2. How much does a business license in Abu Dhabi cost?

- Q3. Can I expand my license to add more business activities later?

- Q4. How long does it take to get a trade license in Abu Dhabi?

- Q5. What happens if my license expires?

- Q6. Is free zone registration in Abu Dhabi simpler than mainland?

- Q7. Where can I verify my Abu Dhabi trade license?

- Q8. Can a Dubai-based consultant help me register in Abu Dhabi?

- Q9. Can foreigners own 100% of a business in Abu Dhabi?

- Q10. Is there a difference between a trade license and a business license in Abu Dhabi?

- Conclusion

Why Choose Abu Dhabi for Business?

Abu Dhabi is not just the capital of the United Arab Emirates (UAE); it’s also a rapidly growing commercial and cultural hub. Let’s explore some of the reasons why entrepreneurs and companies choose Abu Dhabi over other locations:

A. Strategic Location

- Situated at the crossroads of Europe, Asia, and Africa.

- Easy access to global markets with state-of-the-art airports and seaports.

B. Stable Economy

- Abu Dhabi’s economy remains strong thanks to government investment in diverse sectors such as finance, technology, tourism, renewable energy, and real estate.

- Growing emphasis on innovation, sustainability, and future-focused industries.

C. Infrastructure and Connectivity

- Modern highways, well-connected airports, advanced telecommunication networks, and top-tier logistics facilities.

- Smart city initiatives that embrace cutting-edge technology and efficient public services.

D. Pro-Business Policies

- The emirate offers a supportive environment with streamlined procedures, transparent regulations, and potential tax advantages.

- Initiatives like Tajer Abu Dhabi and various free zone offerings encourage both local and foreign investment.

E. Quality of Life

- Abu Dhabi consistently ranks among the safest and happiest cities in the world.

- Offers excellent healthcare, education, and entertainment options.

For those who might be comparing company formation in Dubai versus Abu Dhabi, consider that Abu Dhabi’s rising status, lower costs in some areas, and strong government backing make it a fantastic alternative—or even a complementary base for expansion.

What Is a Business License in Abu Dhabi?

A business license in Abu Dhabi is a legal permit issued by government authorities (mostly under the Abu Dhabi Department of Economic Development, or ADDED). It gives individuals or entities the right to carry out commercial, industrial, or professional activities within the emirate.

- It’s mandatory to have the right license before you start operating your business.

- A valid license shows your customers, partners, and investors that you’re fully compliant with local rules and regulations.

In short: No matter what your venture is—industrial manufacturing, professional services, or even an online store—getting the correct trade license is your first step to operating in Abu Dhabi legally and securely.

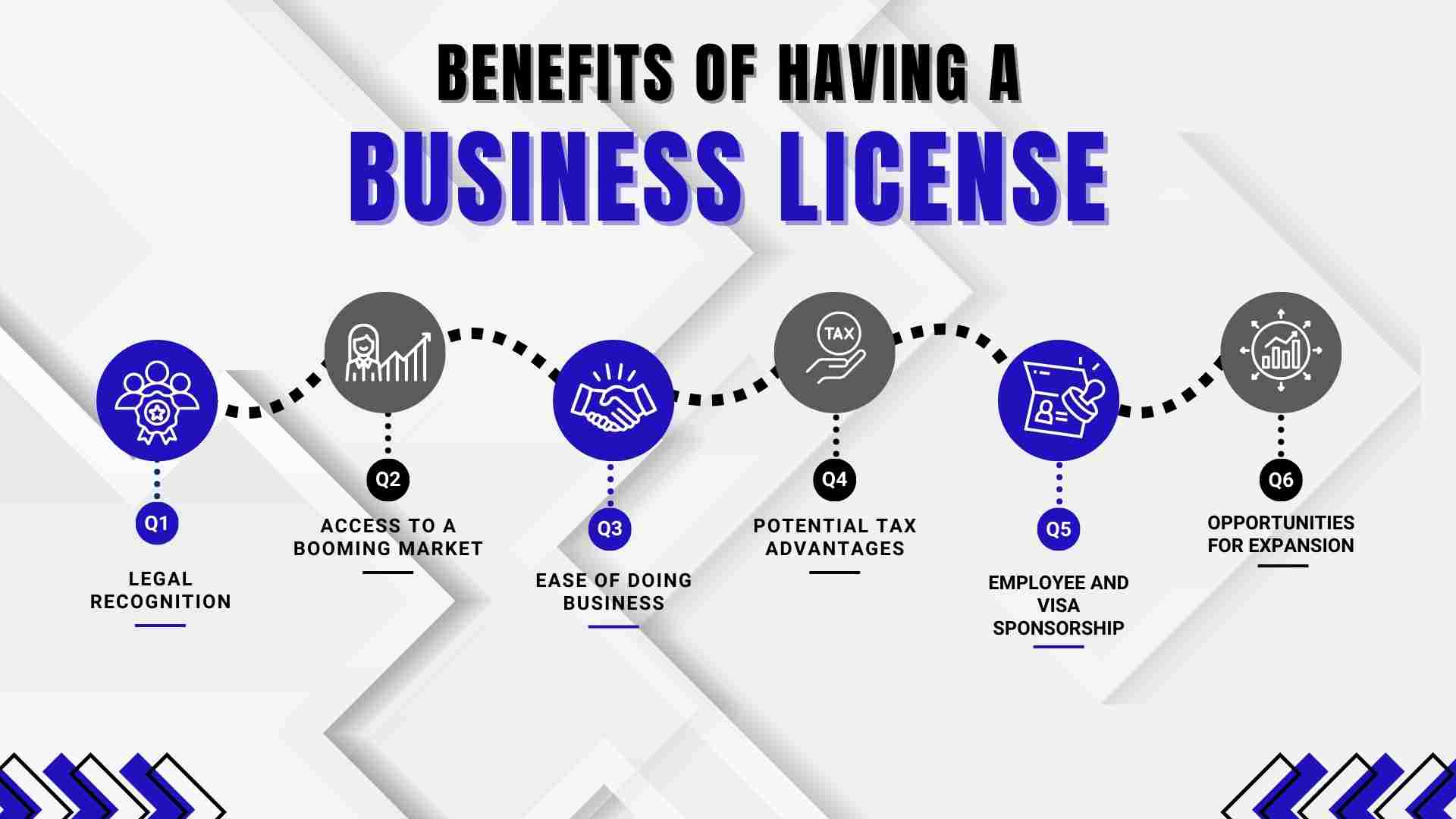

Benefits of Having a Business License

Having a business license in Abu Dhabi isn’t just a legal requirement; it also brings several practical advantages:

A. Legal Recognition

- Grants your business official status in Abu Dhabi.

- Builds credibility and trust with customers, partners, and suppliers.

B. Access to a Booming Market

- Tap into one of the region’s most dynamic and fast-growing economies.

- Serve both local and international clients with confidence.

C. Ease of Doing Business

- A valid license streamlines key processes like:

- Opening a bank account

- Leasing office space

- Applying for financing

- Demonstrates compliance, reducing future regulatory hurdles.

D. Potential Tax Advantages

- Certain licenses and free zones offer zero or reduced corporate and income taxes.

- More profits can be reinvested into growing your business.

E. Employee & Visa Sponsorship

- Legally sponsor employee work visas.

- Simplifies global hiring and onboarding of top talent.

F. Opportunities for Expansion

- A recognized entity makes it easier to scale operations.

- Possibility to add multiple activities under one license (subject to ADDED approval).

Key Authorities and Regulations

Before diving into the types of business licenses and the step-by-step guide, it’s helpful to understand the main regulatory bodies and laws governing business activities in Abu Dhabi:

- Abu Dhabi Department of Economic Development (ADDED)

- The principal authority that issues most trade licenses in the emirate.

- Oversees commercial, industrial, agricultural, and professional licenses.

- Law No. (2) of 2009

- Primary regulation for the issuance of licenses in the emirate of Abu Dhabi.

- States that no one can engage in an economic activity without an official license.

- Other Government Entities

- Abu Dhabi Tourism and Culture Authority (ADTCA): Issues tourism licenses.

- Higher Corporation for Specialized Economic Zones (ZonesCorp): Handles industrial licensing in specific zones.

- General Directorate of Residency and Foreigners Affairs (GDRFA): Approves investor and employment visas.

- Ministry of Health and Prevention (MOHAP) or local health authorities: Approvals for healthcare or food-related businesses.

- Ministry of Economy: May be involved in trademark registrations or additional approvals.

Understanding which authorities you need to approach or comply with depends on your selected business activities. If you’re unsure, you can always consult a business setup consultant in Dubai or Abu Dhabi for clarity—especially if your plans involve cross-emirate operations.

Recommended: Business Setup Abu Dhabi – COFOCSP

Types of Business Licenses in Abu Dhabi

A business license in Abu Dhabi is a legal document that allows you to run specific business activities in the emirate. It proves to customers and government authorities that your company is legitimate and follows the law. Obtaining the right license not only helps you follow local regulations but also builds trust and credibility for your operations.

Below are the main types of business licenses you can apply for in Abu Dhabi. Each license fits different industries and business setups, whether you want to operate on the mainland or in a free zone. If you need guidance, a business setup consultant in Dubai or Abu Dhabi can help with company registration and company formation in Dubai or elsewhere in the UAE.

A. Commercial License

- Commercial License Covers: Buying, selling, and trading goods or services. This license is great for retail shops, real estate agencies, and general trading businesses.

- Issuing Authority: Abu Dhabi Department of Economic Development (ADDED).

- Key Benefit: Lets you trade freely in most commercial sectors.

B. Tourism License

- Industrial License Covers: Manufacturing, processing, or assembling products. This includes big factories, steel plants, and automotive units.

- Issuing Authority: Primarily ADDED or specialized free zone authorities like ZonesCorp.

- Key Benefit: Access to industrial hubs and raw material sources.

C. Professional License

- Professional License Covers: Service-based work, such as consulting, legal advice, design, or engineering.

- Issuing Authority: ADDED.

- Key Benefit: Ideal for businesses relying on talent, skills, or specialized knowledge.

D. Agriculture License

- What It Covers: Farming, livestock, fisheries, and related agricultural activities.

- Issuing Authority: ADDED.

- Key Benefit: Suited for companies focusing on crop production, aquaculture, or animal farming.

E. Tourism License

- Tourism License Covers: Hotels, travel agencies, tour operators, and any business tied to hospitality or visitor activities.

- Issuing Authority: Abu Dhabi Tourism Authority (sometimes known as the Abu Dhabi Tourism and Culture Authority).

- Key Benefit: Taps into Abu Dhabi’s growing tourism sector, known for world-class attractions.

F. Occupational License

- What It Covers: Specialized crafts or activities that depend on personal expertise, like carpentry, tailoring, or other hands-on professions.

- Issuing Authority: ADDED.

- Key Benefit: Simplifies the process for artisans, freelancers, and skilled workers.

Bonus: E-Commerce License (Tajer Abu Dhabi)

If you plan to run an online business or use social media to sell goods, the Tajer Abu Dhabi license is your best bet. It often requires no physical office space, making it easier and more affordable for startups and small enterprises.

Why These Licenses Matter

Each license is unique to specific business activities, so choose carefully. A commercial license might let you open a store or trade goods, while an industrial license could help set up a factory. Missing the correct license can lead to fines or closure, so it’s crucial to follow the rules laid down by the Abu Dhabi Department of Economic Development and any other relevant authorities.

Mainland vs. Free Zones

When planning your business license in Abu Dhabi, one key decision is whether you want to operate on the mainland or within a free zone. Both have their advantages, and your choice will depend on your business goals:

A. Mainland Business License

- Issued By: ADDED (Department of Economic Development).

- Market Reach: Mainland businesses can operate both within the local UAE market and internationally.

- Office Requirement: Typically requires an office space or warehouse depending on the nature of activities (though certain e-commerce licenses allow exemptions for the initial year).

- Visa Quotas: Usually determined by the size of the office space.

- Government Tenders: Can bid for government projects and deals.

- Ownership: Recent reforms allow 100% foreign ownership for many activities, but some strategic sectors still require local involvement or special approvals.

B. Free Zone Business License

- Description: Free zones are designated areas offering special tax and import/export benefits.

- Issuing Authorities: Each free zone (e.g., Masdar City, twofour54, ZonesCorp, Khalifa Industrial Zone) has its own authority.

- Key Advantages:

- Often 100% foreign ownership.

- Zero or reduced taxes on corporate income, import duties, or personal income.

- Streamlined licensing processes aimed at specific industries or business clusters.

- Drawbacks:

- Generally limited to conducting business inside the free zone itself or internationally.

- May need a local distributor or mainland license to trade directly within the wider UAE market.

Some entrepreneurs start in a free zone and later expand to the mainland, while others jump straight into a mainland license to access local opportunities. If you’re also exploring company formation in Dubai, you’ll find a similar dynamic of mainland vs. free zones with comparable pros and cons.

Steps for How to Get a Business License in Abu Dhabi

Now that we’ve covered the basics, let’s break down the licensing process step by step. Each step is important, so follow them carefully for a smooth experience.

Step 1 : Choose Your Business Activity

- Identify your sector: Are you in retail, manufacturing, consulting, or e-commerce?

- Multiple activities: You can combine activities (e.g., marketing services + IT consulting) under one license, provided ADDED approves them.

- Check restricted activities: Some sectors, like defense or oil & gas, may need further approvals from specialized authorities.

Step 2: Determine the Legal Structure

- Sole Proprietorship: Owned by a single individual.

- Limited Liability Company (LLC): Common form for multi-shareholder businesses.

- Branch of a Foreign Company: Ideal for large corporations expanding to the UAE.

- Partnership: Often used by professional firms or local/foreign alliances.

Your legal structure will dictate tax implications, liability, ownership, and the type of business license required.

Step 3: Trade Name Reservation

- Unique Name: Check that your desired trade name isn’t taken or too similar to existing businesses.

- Acceptable Words: Avoid using offensive or misleading terms, and be mindful of local cultural sensitivities.

- Follow ADDED Guidelines: You typically add the legal form to your name, like “LLC” or “FZE” (Free Zone Establishment) if required.

Step 4: Initial Approval

- Submit Application: Provide details about the business activity, shareholders, and other basic information.

- Investor Visa Clearance: Foreign shareholders usually need approval from the General Directorate of Residency and Foreigners Affairs.

- Not the Final Step: Getting initial approval means you can proceed with other formalities but doesn’t allow you to start operations yet.

Step 5: Draft a Memorandum of Association (If Required)

- What Is It?: A Memorandum of Association (MOA) outlines the roles, responsibilities, capital contributions, and profit-sharing structure among business partners.

- Who Needs It?: Companies like LLCs, private/public joint-stock companies, and partnerships.

Step 6: Secure an Office (If Needed)

- Physical Space: Mainland licenses typically require you to show a tenancy contract or proof of a registered address.

- Ejari and Tawtheeq: In Abu Dhabi, certain commercial lease agreements must be registered through the municipality (Tawtheeq).

- E-Commerce Exception: If you opt for Tajer Abu Dhabi, you might not need physical space for the first year.

Step 7: Obtain Additional Approvals (If Any)

- Special Sectors: Healthcare facilities, food businesses, clinics, and educational institutions often need extra clearances.

- Tourism: Need approvals from the Tourism Authority.

- Industrial Activities: May require environment clearance, specialized factory permits, or safety certifications.

Step 8: Final Approval and License Issuance

- Pay the Fees: Usually must be done within 30 days of receiving your payment voucher.

- Receive the License: Once confirmed, you can legally operate under your chosen activity.

- Register with Chamber of Commerce: Often a final step to complete the process, enabling membership in Abu Dhabi Chamber of Commerce & Industry.

Documents Required Business License in Abu Dhabi

While each business may have unique paperwork requirements, here’s a general list of documents commonly requested:

- Trade Name Certificate: Confirming your approved business name.

- Shareholders’ Passports and Visas: Copies for all partners/investors.

- Emirates ID Copies: For UAE nationals or residents involved in the business.

- Memorandum of Association (MOA) or Partnership Contract: If required by your legal structure.

- Initial Approval Certificate: Proof that you can proceed with final steps.

- Tenancy Contract and Tawtheeq: For mainland businesses that need physical premises.

- Special Permits/Approvals: If the business deals with health, environment, tourism, education, etc.

- No Objection Certificates (NOCs): If needed from local sponsors, current visa sponsors, or specialized regulators.

Business License Cost in Abu Dhabi

When planning for a business license in Abu Dhabi, it’s important to have a clear picture of the fees involved. While the exact cost can vary based on your specific activities and approvals, the table below provides approximate ranges for different license types. Remember that fees may change due to promotions, government updates, or additional permissions required for certain industries.

| License Type | Approximate License Cost (AED) | Remarks |

|---|---|---|

| Commercial License | 10,000 – 15,000 | For general trade activities such as retail, logistics, and real estate. Costs can be higher if extra visas or permits are needed. |

| Industrial License | 15,000 – 30,000 | Suited for large-scale manufacturing or factories. Typically includes safety checks and industrial area fees. |

| Professional License | 10,000 – 20,000 | Ideal for service-based or consultancy firms. May require proof of qualifications or specific certifications. |

| Tourism License | 10,000 – 25,000 | Covers hotels, travel agencies, and tour operations. Extra charges apply for tourism permits and approvals. |

| Agriculture License | 7,000 – 15,000 | For farming, livestock, and aquaculture. Environmental or health certifications might add to the cost. |

| Occupational License | 7,000 – 15,000 | For specialized crafts or skilled trades (e.g., carpentry, metalwork). Extra tools or site inspections may raise fees. |

| E-Commerce License (Tajer Abu Dhabi) | 6,000 – 10,000 | Focuses on online retail or services. Usually does not require a physical office (for the first year in many cases). |

Note: These costs are approximate. Actual expenses vary depending on:

- Business Activity: Highly regulated fields (e.g., healthcare) often incur additional approval fees.

- Office Space: A mainland license usually needs a valid tenancy contract, which adds to your overall budget.

- Visa Requirements: The more visas you apply for, the higher your fees (including medical tests, Emirates ID, and possible bank guarantees).

- Additional Approvals: Some businesses need clearance from the Ministry of Health, the Securities and Commodities Authority, or other government departments.

A. Other Potential Costs

- PRO Services & Document Clearing

- What It Covers: Translation, attestation, and legal filings.

- Why It Matters: Saves time and avoids penalties for missing documents. A business setup consultant in Dubai or Abu Dhabi can help you handle these details.

- Office Rent and Utilities

- What It Covers: Annual rent, registration (Tawtheeq in Abu Dhabi), and monthly bills (internet, electricity, etc.).

- Why It Matters: Mainland businesses must show proof of a registered office, which is factored into overall costs.

- Renewal Fees

- What It Covers: Most Abu Dhabi business licenses last 1 year and need annual renewal.

- Why It Matters: Late renewals can lead to fines, so budget for these fees well in advance.

- Banking and Financial Services

- What It Covers: Some banks require minimum balances to open corporate accounts. There may also be service charges.

- Why It Matters: Proper banking is crucial for managing revenue, paying employees, and meeting legal requirements.

B. Tips to Save on Costs

- Bundle Services

- Certain free zones or business centers offer packages that combine licensing, visas, and office facilities at a fixed rate.

- E-Commerce Advantage

- An online business under Tajer Abu Dhabi might eliminate the need for a physical office in the first year, cutting rental expenses.

- Plan Ahead

- Consulting a business setup consultant in Dubai or Abu Dhabi can help you accurately estimate costs and avoid hidden charges when doing your company registration.

Staying informed about costs and fee structures helps you create a realistic budget for company formation in Dubai or Abu Dhabi, ensuring your business license journey runs smoothly and efficiently. By understanding these details, you can invest more time and resources into growing your venture instead of managing unexpected bills.

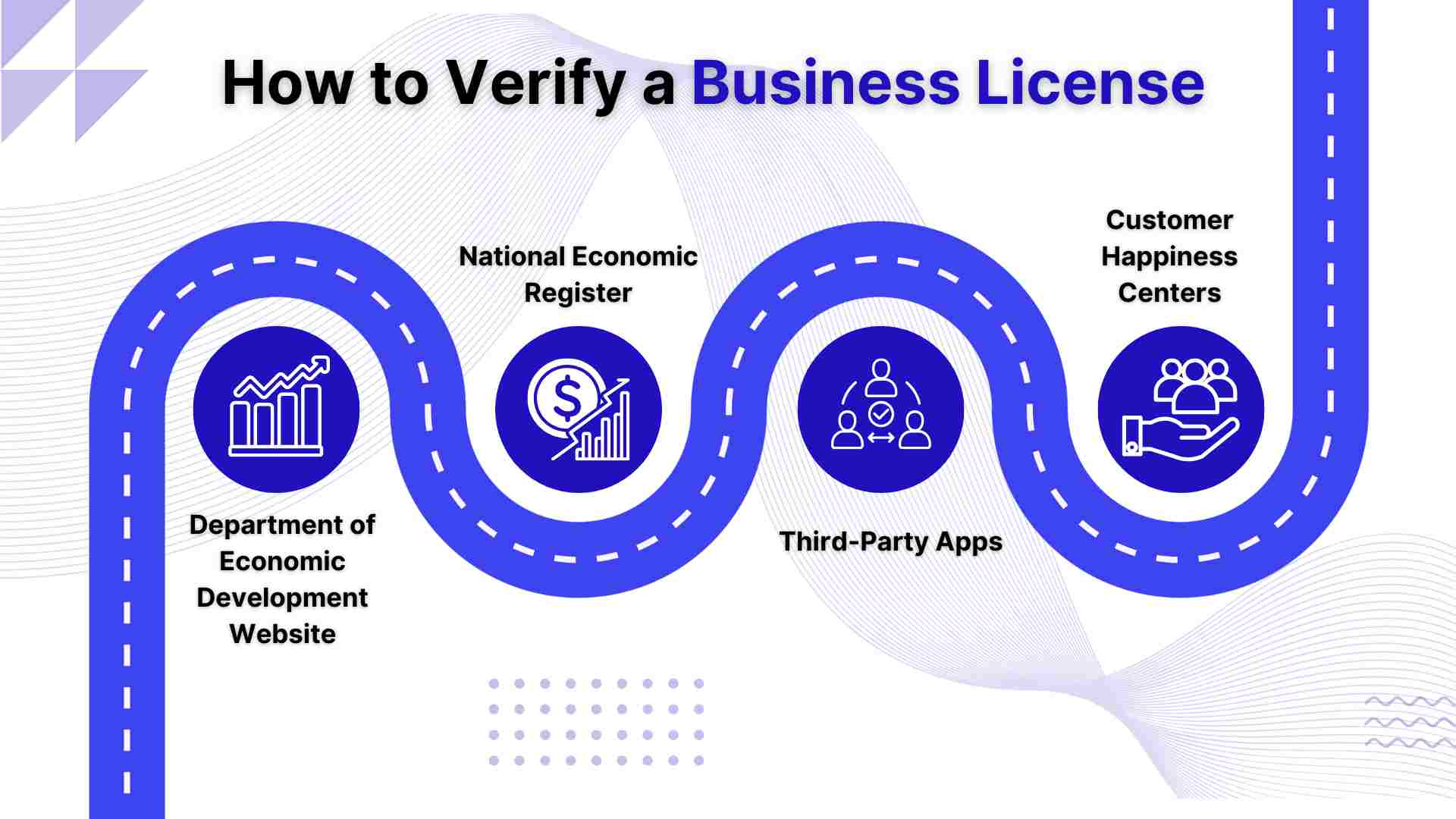

How to Verify a Business License in Abu Dhabi

Verifying a business license can help ensure you’re dealing with a legitimate, registered company. Abu Dhabi provides several tools:

- Department of Economic Development Website: Each emirate’s DED site has a look-up function. For Abu Dhabi, visit the ADDED portal.

- National Economic Register: A federal platform for inquiring about commercial registrations across the UAE.

- Third-Party Apps: Some emirates have dedicated mobile apps to check license validity by trade name or license number.

- Customer Happiness Centers: You can also visit a DED or Chamber of Commerce service center in person.

Renewing Your Business License

Renewing your business license in Abu Dhabi is an essential step to keep your operations legal and avoid any penalties. Most licenses in the emirate have a validity of one year, though this can vary for certain free zones or special permits. Once your license period ends, you must renew it promptly to prevent fines, disruptions, or potential blacklisting. Below is a simple overview of how to renew your license and the key points to consider.

A. Check Your License Expiry Date

- Mark the Calendar: Knowing when your license will expire helps you start the renewal process early.

- Grace Period: Some authorities offer a brief grace period (often a month) post-expiry, but fees and fines may apply if you miss the exact renewal date.

B. Verify Required Documents

Just like when you first applied for a trade license, renewing it also involves paperwork. Commonly needed documents include:

- Existing Trade License: A copy of your current license certificate.

- Valid Tenancy Contract: Must be attested (often through Tawtheeq in Abu Dhabi) and valid for at least one more year, if you operate on the mainland.

- Emirates ID and Passport Copies: For business owners or sponsors (if changes were made during the year).

- No Objection Certificates (NOC): If your business activities have changed or if you need approval from other authorities (e.g., Ministry of Health, Tourism Authority, etc.).

- Renewal Form: The Department of Economic Development (ADDED) or your free zone authority may have a specific application form.

C. Settle Any Outstanding Fines or Fees

- Clear Violations: Make sure to resolve any fines or violations from previous years before renewing.

- Confirm Payment Receipts: Keep evidence that you have paid off pending dues or administrative costs.

D. Submit the Renewal Application

- Online or In-Person: Depending on your situation, you can often renew your license online via the ADDED portal or by visiting their customer happiness centers. Free zones typically have their own digital platforms for renewals.

- Attach Required Documents: Ensure all forms, NOCs, and payment proofs are included to avoid delays.

- Pay the Renewal Fees: You’ll receive a payment voucher or an online invoice showing your total costs.

E. Await Approval and Collect Your New License

- Processing Time: Renewal approvals can take anywhere from a few hours to several days based on your activities and how quickly you upload documents.

- Download or Print: Once you get confirmation, you can download a digital version of your renewed license or request a printed copy.

F. Renewing a Business License in Free Zones

If you operate in a free zone, your renewal process will follow that zone’s rules. Some free zones bundle license renewals with office space rental or visa renewals to make your process simpler. But even if it’s a bundled package, you still need to submit your paperwork and pay any required fees on time.

I. Avoiding Common Renewal Pitfalls

- Expired Tenancy Contracts

- Make sure your office lease or warehouse agreement is still valid and attested.

- Late Filing

- Delays can lead to extra fees or, in worst cases, suspension of your business activities.

- Changes in Business Activity

- If you’ve added or removed activities, you may need a license amendment first, before renewal.

- Missing Approvals

- Industries like health, energy, or education need extra permissions. Check if any require renewal too.

- Visa Issues

- Make sure your employee visas and sponsor details are up to date. Changes might affect the renewal fee.

J. Getting Help from a Business Setup Consultant

Navigating the renewal process can feel daunting, especially if you have other tasks on your plate. This is where a business setup consultant in Dubai or Abu Dhabi can help. They offer services like:

- Document Preparation: Gathering and filing all the paperwork on your behalf.

- Compliance Checks: Ensuring your activities and facilities are fully compliant before renewal.

- Time Savings: Handling tedious procedures so you can focus on growing your company.

- Advice on Expansion: If you plan to add new activities or move to the mainland or a different free zone.

Whether you’re focusing on company formation in Dubai or already running a venture in Abu Dhabi, professional assistance can make the renewal process smooth and stress-free.

Renewing your business license in Abu Dhabi is vital for staying within the law and keeping your operations running. Prepare ahead by tracking your license’s expiry date, keeping documents updated, and settling any dues. If needed, a company registration specialist or business setup consultant can simplify the renewal, especially if your business has grown or changed since you first opened. By following these steps and staying organized, you’ll be well on your way to maintaining a legally compliant and prosperous business in Abu Dhabi.

Company Registration: The Role of PRO Services

Public Relations Officer (PRO) services can be extremely helpful for:

- Visas and Immigration: Handling residency permits, work visas, and even family visa applications.

- Document Clearing and Attestation: Making sure all your paperwork complies with legal requirements.

- Regulatory Compliance: Staying updated on changes in labor laws or economic regulations.

- Time and Cost Savings: Simplifying processes so business owners can focus on core operations.

For business registration, hiring a reliable PRO or a business setup consultant in Dubai or Abu Dhabi can reduce stress and errors. Especially if you’re new to the region, a skilled consultant saves you from repeated trips to government offices and helps you navigate Arabic-language paperwork.

Common Challenges and How to Overcome Them

Starting a business in a new environment always brings certain challenges:

- Language Barriers

- Solution: Use translation services or a bilingual PRO/consultant to handle Arabic documents.

- Complex Regulations

- Solution: Keep updated with ADDED guidelines, or get professional help to ensure compliance.

- Cultural Differences

- Solution: Respect local customs and traditions in marketing, business conduct, and communications.

- Choosing the Right License

- Solution: Clarify your current and future business activities so that you pick a license that covers them all.

- Funding and Banking

- Solution: Present a well-prepared business plan and maintain clean financial records to build trust with banks.

- Office Space Requirements

- Solution: For small businesses, consider a shared workspace or the e-commerce license route (Tajer Abu Dhabi) if relevant.

By anticipating these hurdles and making proper arrangements, you’ll find the journey to be far smoother.

Getting Help from a Business Setup Consultant in Dubai or Abu Dhabi

Although the Abu Dhabi government has simplified many steps, the legal framework can still feel overwhelming to newcomers. Business setup consultants or professional agencies (including those that typically handle company registration in the UAE) provide:

- End-to-End Guidance: From drafting documents to dealing with visa applications.

- Localized Knowledge: Up-to-date info on licensing requirements, current offers, or regulatory changes.

- Time-Saving Support: Minimizes the number of visits to government offices.

- Cost Optimization: Helps you avoid hidden fees and choose the most cost-effective approaches.

If you’re already exploring company formation in Dubai, you can compare those processes to Abu Dhabi’s. But keep in mind that each emirate has its own set of guidelines, free zones, and licensing costs.

Frequently Asked Questions (FAQ) – Abu Dhabi Business Licensing

Q1. Do I need an office for every type of Abu Dhabi business license?

Not necessarily. For example, the Tajer Abu Dhabi (e-commerce license) allows certain businesses to operate without a physical office initially. However, most other license types do require a valid commercial address.

Q2. How much does a business license in Abu Dhabi cost?

Costs typically range from AED 10,000 to AED 30,000, depending on:

- Type of license

- Nature of business activity

- Number of visa allocations

- Additional approvals or requirements

Q3. Can I expand my license to add more business activities later?

Yes. You can apply for an amendment through ADDED, pay the necessary fees, and obtain approval for any new activities.

Q4. How long does it take to get a trade license in Abu Dhabi?

- Standard licenses: A few days to a few weeks

- Instant licenses (for select activities): Can be issued within a single business day, if all documents are in order

Q5. What happens if my license expires?

Operating with an expired license is illegal. Consequences may include:

- Fines

- Business closure

- Legal penalties

It’s critical to renew your license before it expires.

Q6. Is free zone registration in Abu Dhabi simpler than mainland?

Free zones often have streamlined, business-friendly processes. Whether they’re “simpler” depends on:

- Your business model

- Desired ownership structure

- Target market (free zone companies are often restricted to operating within the zone or internationally)

Q7. Where can I verify my Abu Dhabi trade license?

You can verify licenses through:

- The ADDED online portal

- The National Economic Register

- Some emirates also offer dedicated verification apps

Q8. Can a Dubai-based consultant help me register in Abu Dhabi?

Yes. Many business setup firms in Dubai and other emirates offer full support for Abu Dhabi licensing and inter-emirate business registration.

Q9. Can foreigners own 100% of a business in Abu Dhabi?

Yes, in many sectors. Thanks to recent legal reforms, 100% foreign ownership is now permitted in most industries. However, some strategic sectors may still require a local partner or special approvals.

Q10. Is there a difference between a trade license and a business license in Abu Dhabi?

No real difference in practice. The terms are often used interchangeably. ADDED issues trade licenses, which function as your official business license in Abu Dhabi.

Conclusion

Obtaining a business license in Abu Dhabi allows businessmen to venture into infinite possibilities to establish their business. Be it a small startup firm or a global giant, Abu Dhabi ensures that a competitive environment for the growth of a firm is available. Low taxes, liberal licenses, and good infrastructure make it a top place to start or expand a business.

We have listed them below. If you are willing to start now, feel free to connect with our business setup consultants in Dubai. If you are struggling with business license cost in Abu Dhabi or trade license Dubai, we can assist you immediately.