To start your company in Sharjah Mainland, you’ll first need to choose a suitable legal structure (for instance, a Limited Liability Company or a Sole Proprietorship) and determine your core business activities. Then, you’ll register with the Sharjah Department of Economic Development (DED) by obtaining initial approvals, reserving a trade name, and applying for the appropriate license (Commercial, Professional, or Industrial). Once the necessary documents (like the Memorandum of Association, lease agreement, and external approvals if required) are in order, you’ll pay the fees, collect your trade license, set up a corporate bank account, and finalize any visa requirements. Comply with Economic Substance Regulations (ESR), Anti-Money Laundering (AML-CFT) rules, and Ultimate Beneficial Ownership (UBO) regulations to ensure long-term compliance. In this guide, we’ll walk you through each step in detail so you can confidently launch and grow your Sharjah Mainland business.

Complete Guide Of Business Setup and Company Formation in Sharjah Mainland

Sharjah is the third-largest emirate in the United Arab Emirates (UAE), following Dubai and Abu Dhabi. Known for its balanced business environment, Sharjah has become a popular destination for foreign investors. The Sharjah Department of Economic Development (DED) regulates business activities here, ensuring entrepreneurs can easily navigate the necessary steps for company formation and license issuance.

Often described as an industrial powerhouse, Sharjah Mainland is ideal for sectors like manufacturing, logistics, and warehousing. At the same time, it’s a hub for education, consulting, and service-based businesses, partly due to the region’s strong academic reputation and supportive governance.

Whether you’re a small startup or a multinational corporation seeking regional expansion, Sharjah Mainland offers numerous opportunities. If you’ve been eyeing the Middle East market and need a cost-effective approach to business setup in the UAE, you’ll want to keep reading.

Why Consider Sharjah Mainland for Your Business?

Sharjah Mainland stands out as a cost-effective, well-connected, and culturally rich environment where businesses can flourish. Here’s a closer look at some of its most compelling advantages.

A. Cost-Effective Environment

Unlike other emirates, Sharjah offers a more affordable standard of living, which directly translates into lower operational costs. From office rentals to labor expenses, you can typically save more while still enjoying access to world-class infrastructure. Cost-effectiveness makes Sharjah particularly attractive to small and medium enterprises (SMEs).

B. Strategic Location & Connectivity

Sharjah Mainland has direct links to major ports on both the Arabian Gulf and the Indian Ocean. Its prime geographic position allows businesses to reach North African and South Asian markets rapidly. This connectivity extends to land routes and airports, making import-export more streamlined and efficient.

C. 100% Foreign Ownership for Specific Activities

Previously, foreign investors needed a local sponsor with a 51% share in an LLC. Following recent reforms, however, the government permits 100% foreign ownership in certain “strategic” or “approved” activities. This development is a game-changer for investors who want total control over their companies without a local partner.

D. Zero Personal Taxes & Low Corporate Tax

One key draw for international entrepreneurs is the UAE’s tax environment. In Sharjah Mainland, you won’t pay personal income tax. For corporate taxes, a 9% corporate tax now applies to businesses earning over AED 375,000 in annual profits. Still, this rate remains highly competitive compared to other regions, and smaller ventures may pay zero corporate tax if their profits don’t exceed the threshold.

E. Access to Major Economic Areas

Sharjah’s extensive network of industrial areas accounts for a substantial portion of the UAE’s industrial output. With over 19 industrial zones contributing to nearly half of the country’s total industrial production, Sharjah Mainland is an ideal base for manufacturing, assembly, and supply chain operations. Neighboring Sharjah Free Zones like Hamriyah Free Zone, SAIF Zone, and Sharjah Publishing City Free Zone enhance the region’s overall commercial appeal.

F. WHO Health City Recognition

Sharjah has been recognized as a Health City by the World Health Organization (WHO), partly due to its robust public health policies, cultural heritage programs, and its steps to limit vices like alcohol consumption. This recognition underscores Sharjah’s commitment to quality of life for residents and businesses alike, ensuring a stable and healthy environment.

Key Entities & Governing Bodies

Before diving into the setup process, it’s crucial to understand the various authorities you’ll encounter.

A. Sharjah Department of Economic Development (DED)

The Sharjah DED is your primary touchpoint for licensing and company formation. They oversee everything from initial approvals to trade license issuance.

B. Ministry of Labour & Ministry of Economy

- Ministry of Labour: Regulates employment contracts, labor permits, and workforce-related matters.

- Ministry of Economy: Focuses on broader economic policies, intellectual property rights, and ensuring fair trade practices.

C. Sharjah Municipality

Handles building permits, environmental health standards, and certain business-specific approvals. If your venture involves health, safety, or environmental compliance, you’ll likely need Sharjah Municipality’s clearance.

D. Gulf Cooperation Council (GCC)

The GCC is a regional intergovernmental union. While Sharjah is within the UAE, being mindful of GCC-wide regulations can be beneficial, especially if you plan to operate across multiple member states.

E. World Health Organization (WHO) Recognition

While not a direct regulating body for businesses, the WHO’s Health City recognition indicates Sharjah’s global standing and its dedication to creating a healthy, sustainable community.

Types of Business Licenses in Sharjah Mainland

Securing the right license is foundational for your business. The Sharjah DED issues three main license categories in the Mainland, each tailored to distinct sectors and activities.

A. Commercial License

A Commercial License allows trading activities, such as:

- Import & Export

- Wholesale & Retail

- Warehousing & Storage

- General Trading

If your primary goal is distributing, selling, or storing goods, this license is your go-to.

B. Professional (Service) License

A Professional License—sometimes called a Service License—covers service-oriented ventures like:

- Consultancy Services (management, accounting, IT, and more)

- Design & Creative Services (marketing, graphic design, photography)

- Professional Skill-Based Services (investment advisories, legal advisories, etc.)

Applicants must typically prove their qualifications through degrees, certifications, or professional exams.

C. Industrial License

An Industrial License is mandatory for activities that involve:

- Manufacturing, Mining, Quarrying

- Heavy or Light Industrial Processes

- Oil & Gas-Related Activities

Because of environmental and safety considerations, securing an Industrial License often requires external approvals from bodies like the Ministry of Labour and the Ministry of Economy.

Legal Structures for Company Formation

Your choice of legal structure affects liability, taxation, and compliance. Below are the common structures available in Sharjah Mainland.

A. Limited Liability Company (LLC)

- Requires 2 to 50 shareholders.

- Each shareholder’s liability is limited to their share in the company.

- 100% foreign ownership is now allowed for certain approved activities.

- Previously, a UAE national sponsor was required, but the law has evolved to allow more flexibility for foreign investors.

B. Partnership Company

- Formed by two or more shareholders.

- All shareholders must be UAE nationals if it’s a Partnership Company in Sharjah Mainland.

- Liability and profit-sharing depend on individual shareholdings.

C. Local Service Agent License Company / Sole Proprietorship

- Owned by a single individual.

- Foreign entrepreneurs need a Local Service Agent (LSA) if they’re not a GCC or UAE national.

- The LSA doesn’t hold ownership; they facilitate government approvals and licensing procedures.

D. Public/Private Shareholding Company

- Share capital is divided into equal-value shares.

- Suitable for businesses seeking to raise capital by offering shares to the public or private investors.

- Founding members sign the Memorandum and Articles of Association.

E. Branch Companies

- An existing foreign or UAE-based company can open a branch in Sharjah Mainland.

- Branches must adhere to the Mainland regulations but can capitalize on the parent company’s brand reputation.

- Best suited for expanding established businesses looking for a Sharjah presence.

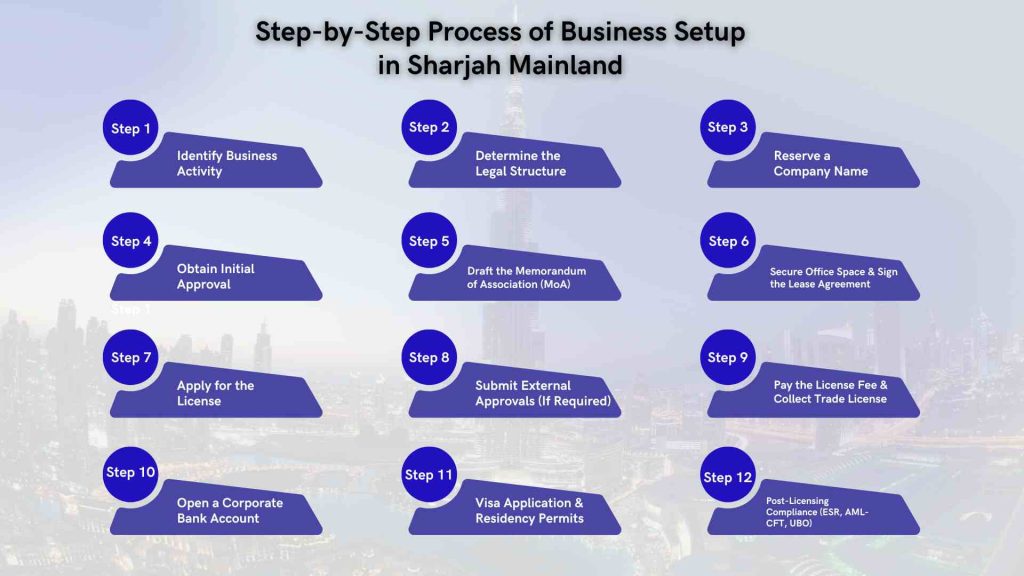

Steps For Business Setup in Sharjah Mainland

Below is a comprehensive roadmap to help you navigate licensing, approvals, and documentation.

Step 1: Identify Business Activity

Start by defining what you plan to do. Choose from a wide range of activities:

- Trading & Retail

- Consultancy & Professional Services

- Industrial & Manufacturing

- Educational & Training Programs

- Healthcare & Wellness

Ensure your chosen activity is allowed under Sharjah Mainland regulations, as certain specialized areas require external clearances.

Step 2: Determine the Legal Structure

Pick a suitable structure—LLC, Sole Proprietorship, Partnership, or Public/Private Shareholding Company—based on your capital, liability preferences, and sector requirements.

Step 3: Reserve a Company Name

- Choose a name that complies with UAE naming conventions (no religious or offensive terms, etc.).

- Submit this proposed name to the Sharjah DED for approval.

Step 4: Obtain Initial Approval

- Provide details about your business activity, proposed legal structure, and shareholders.

- The DED reviews your application and issues an initial approval, allowing you to proceed.

Step 5: Draft the Memorandum of Association (MoA)

- MoA outlines share distribution, capital contributions, and management roles.

- The document must be attested and notarized by a notary public.

- For some legal structures, an Articles of Association (AoA) might also be necessary.

Step 6: Secure Office Space & Sign the Lease Agreement

- Mainland companies require a physical office lease.

- The space must be suitable for your declared activities and meet Sharjah Municipality’s criteria.

- Get a Ejari (tenancy contract registration) or the local equivalent to legalize the lease agreement.

Step 7: Apply for the License

- Submit the MoA, lease agreement, and other required documents to the Sharjah DED.

- Specify whether it’s a Commercial, Professional, or Industrial license.

Step 8: Submit External Approvals (If Required)

Some business activities (e.g., healthcare, education, oil & gas) need extra approvals from authorities like the Ministry of Economy, the Ministry of Labour, or the Sharjah Municipality.

Step 9: Pay the License Fee & Collect Trade License

- Once approved, settle the license fee.

- The Sharjah DED issues your official trade license, granting you legal permission to operate.

Step 10: Open a Corporate Bank Account

- Select a UAE-based bank that aligns with your business needs (local vs. international presence).

- Provide your trade license, MoA, and shareholder documents.

- Submit any additional KYC requirements to finalize your corporate banking.

Step 11: Visa Application & Residency Permits

- Apply for employee visas, investor visas, or dependent visas as needed.

- The Ministry of Labour handles work permits, while the General Directorate of Residency and Foreigners Affairs (GDRFA) manages residency permits.

- Sharjah Mainland businesses can expand their visa quota by leasing additional office space.

Step 12: Post-Licensing Compliance (ESR, AML-CFT, UBO)

- Economic Substance Regulations (ESR): Certain businesses must prove “substantial presence” in the UAE.

- Anti-Money Laundering (AML-CFT): Maintain transparent financial records and report suspicious transactions.

- Ultimate Beneficial Ownership (UBO): Disclose the real owners who ultimately control the company.

- Non-compliance can result in heavy fines or license revocations.

Important Documents for Sharjah Mainland Registration

To streamline the process, keep the following paperwork on hand:

- Business Registration Application

- MoA and AoA (where applicable), attested and notarized

- Lease Agreement or Ejari certificate

- Passport Copies of all shareholders and managers

- Proof of Address (recent utility bill or bank statement)

- Bank Reference Letters (if required)

- Power of Attorney (if you’re appointing a legal representative)

- Board Resolution (for branch companies or corporate shareholders)

- Business Plan (especially for industrial or specialized activities)

Compliance Requirements & Regulations

Staying on the right side of UAE law is non-negotiable. Sharjah Mainland has specific rules and frameworks you must respect.

A. Economic Substance Regulations (ESR)

Companies in categories like holding, shipping, or intellectual property must demonstrate economic substance—meaning they conduct core operations and decision-making in the UAE.

B Anti-Money Laundering & Combatting Financing of Terrorism (AML-CFT)

The UAE is strict about financial transparency. Businesses must keep records of all transactions, identify customers (KYC), and immediately flag suspicious activity.

C. Ultimate Beneficial Ownership (UBO)

You must declare the individuals who have ultimate control or benefit from the company. This step reduces the risk of shell companies or hidden ownership structures.

D. Local Sponsor vs. 100% Foreign Ownership

Many entrepreneurs wonder if they still need a local sponsor in Sharjah Mainland. Since June 2021, the UAE Cabinet relaxed requirements, letting certain activities have 100% foreign ownership. However, a local sponsor might still be mandatory if your business falls under specific categories or you require special government approvals.

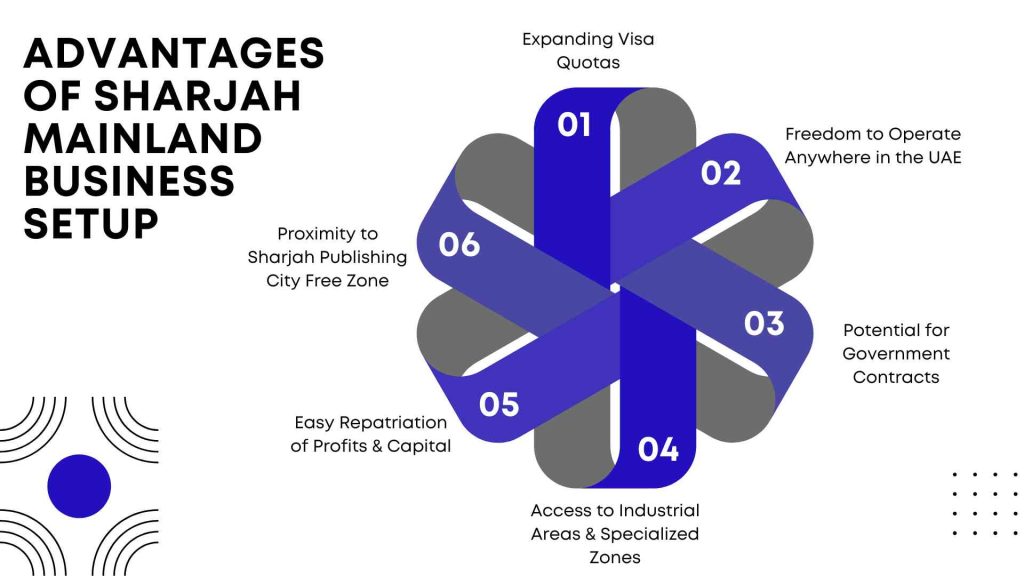

Advantages of Sharjah Mainland Business Setup

A. Expanding Visa Quotas

As your company grows, you can request more visas. The only restriction is ensuring you have sufficient office space for each visa slot, making it simple to expand your workforce.

B. Freedom to Operate Anywhere in the UAE

Mainland licenses aren’t restricted by geographic zones. You can do business across the entire UAE, partner with government entities, and even expand internationally without limitations.

C. Potential for Government Contracts

One huge perk for Mainland businesses is the ability to bid on government tenders. These contracts can be lucrative and often require strong compliance and a Mainland license.

D. Access to Industrial Areas & Specialized Zones

Sharjah is home to multiple industrial and specialized clusters. Whether you’re in manufacturing, logistics, or tech, you’ll find supportive ecosystems with modern infrastructure.

E. Easy Repatriation of Profits & Capital

The UAE allows you to transfer profits and capital back home without currency restrictions, making Sharjah Mainland investment-friendly for global entrepreneurs.

F. Proximity to Sharjah Publishing City Free Zone

Although free zones differ from Mainland structures, Sharjah Mainland businesses can still collaborate with free-zone entities like Sharjah Publishing City Free Zone (SPC Free Zone) or Hamriyah Free Zone. This cross-collaboration can expand your market reach and diversify revenue streams.

Comparing Sharjah Mainland With Free Zone Options

Sharjah Mainland isn’t your only option. Here’s a quick comparison with nearby free zones:

A. Sharjah Airport International Free Zone (SAIF Zone)

- Ideal for aviation, logistics, and warehousing.

- Quick setup processes but restricted to free zone boundaries.

- 100% foreign ownership with no corporate or personal tax.

B. Hamriyah Free Zone

- Great for heavy industries, maritime services, and trading.

- Access to deep-water seaports and ample land for industrial plants.

- No local sponsor required, but you can’t trade directly in the UAE Mainland without a local distributor.

C. Sharjah Publishing City Free Zone (SPC Free Zone)

- Focused on media, publishing, and knowledge industries.

- Provides modern co-working and shell-and-core facilities.

- Offers fast, simplified company formation with the option for unlimited visas on certain packages.

Mainland vs. Free Zone: The biggest difference is your trading rights and location flexibility. Mainland lets you operate anywhere in the UAE, while free zone companies can face restrictions when it comes to direct Mainland trading.

Common Challenges & How to Overcome Them

Even though Sharjah Mainland is business-friendly, you might encounter hurdles.

A. Obtaining Special Approvals

Sectors like healthcare, pharmaceuticals, education, and food services need clearances from additional authorities (e.g., Ministry of Health). Research these prerequisites to avoid bottlenecks.

B. Understanding Tax & Corporate Law Changes

Although the UAE is known for minimal taxation, recent years introduced a 9% corporate tax for certain incomes. Keep an eye on federal laws and adapt your accounting practices accordingly.

C. Navigating the Visa Application Process

Work visas, investor visas, and dependent visas each have distinct procedures. Partner with a business setup consultant or a PRO service to streamline your applications.

D. Cultural & Business Etiquette

The UAE values relationships, respect, and courtesy. Building strong local partnerships often involves personal rapport, not just a strong business pitch. Familiarize yourself with local customs and social norms.

Industry Highlights in Sharjah Mainland

Over the past decade, Sharjah has nurtured a variety of growth sectors.

A. Trading & Retail

The emirate’s ports and proximity to Dubai make it a prime spot for import-export, wholesaling, and retail distribution.

B. Industrial & Manufacturing

Sharjah’s industrial areas host factories, assembly lines, and processing plants—often in synergy with Hamriyah Free Zone for specialized zones.

C. Education & Training

With top universities and educational institutions, Sharjah fosters an ecosystem where education consultancies and specialized training centers thrive.

D. Professional & Business Services

Consultancies, marketing agencies, auditing firms, and law offices find a stable environment due to Sharjah’s consistent regulations and growth potential.

E. Tourism & Hospitality

While Dubai is famous for luxury tourism, Sharjah preserves cultural and family-oriented appeal. Tour operators, boutique hotels, and event organizers flourish here, especially around festivals and international expos.

Cost of Setting Up a Business in Sharjah Mainland

One of the most common questions entrepreneurs ask is, “How much will it cost to establish a company in Sharjah Mainland?” The answer varies depending on:

- Business License Type (Commercial, Professional, or Industrial)

- Office Space Requirements (Size, location, and amenities can significantly affect costs)

- Number of Visas (Each visa has associated fees for processing, medical tests, and Emirates ID)

- Government Fees (Sharjah DED licensing fees, initial approvals, notary charges, local municipality fees)

- External Approvals (Healthcare, education, or other specialized areas often require added approvals and fees)

A rough ballpark estimate could range anywhere from AED 15,000 to AED 40,000+ for a straightforward LLC setup, excluding additional costs like premium office space or specialized approvals. Consultancy or service-based businesses generally incur lower overheads than industrial or manufacturing activities, which require more robust infrastructure.

Tip: Always request an itemized quote from your business setup consultant or local authorities. This helps you compare different license packages, estimate future expansions, and allocate your startup budget more effectively.

Real-Life Example & Storytelling

Let’s consider “Aisha,” an entrepreneur from the UK who wanted to open a digital marketing agency in the Gulf region. She compared Dubai’s higher rent costs and free zone limitations against Sharjah Mainland’s flexible visa quotas and lower overhead. By choosing Sharjah Mainland:

- Aisha secured a Professional License with 100% foreign ownership (since digital marketing is among the approved activities).

- She leased a modest office, saving nearly 30% on rent compared to similar spaces in Dubai.

- The Mainland license allowed her to pitch services to government institutions and local corporations without additional local distributors.

- Within six months, she hired five employees and expanded her visa quota by simply upgrading to a larger office space.

Aisha’s story demonstrates that Sharjah Mainland isn’t just for traditional industries—it’s also a haven for creative and digital entrepreneurs seeking cost efficiency and broad market reach.

Frequently Asked Questions (FAQs)

Q1: What authorities oversee business setup in Sharjah Mainland?

A1: The Sharjah Department of Economic Development (DED) primarily regulates mainland business activities, while the Ministry of Labour, Sharjah Municipality, and Ministry of Economy may also require approvals depending on your sector.

Q2: Can foreign investors own 100% of a Sharjah Mainland company?

A2: Yes, thanks to recent legal reforms, you can hold 100% foreign ownership in many approved sectors. Check with the DED or a business consultant to confirm your specific activity.

Q3: How long does it take to register a company in Sharjah Mainland?

A3: It can range from a few days to several weeks, depending on the complexity of your activity, the need for external approvals, and how quickly you gather the required documents.

Q4: Do I need a local service agent for a professional license?

A4: Foreign entrepreneurs may need an LSA if they don’t qualify for 100% ownership in their chosen activity. That said, many professional activities now allow complete foreign ownership without a local sponsor.

Q5: Is there a minimum capital requirement for Sharjah Mainland companies?

A5: Generally, there’s no fixed minimum capital for many activities. However, certain sectors (like banking or finance) might require proof of capital. Always verify with the DED for your specific business type.

Q6: Can I operate anywhere in the UAE with a Sharjah Mainland license?

A6: Absolutely. Mainland licenses let you trade across all emirates without any geographical restrictions.

Q7: Do I need to rent an office or physical space?

A7: Yes. Most Sharjah Mainland businesses must have a physical address. The space size often correlates with your visa quota.

16. Conclusion & Key Takeaways

Setting up a business in Sharjah Mainland can be a smart and strategic move for entrepreneurs aiming to tap into the Middle East market without bearing the hefty overhead costs often associated with larger emirates. Its cost-effective nature, supportive government policies, strategic access to global trade routes, and flexible 100% foreign ownership options (for approved activities) make it a compelling choice for businesses of all sizes.

- Key Entities: Sharjah DED, Ministry of Labour, Sharjah Municipality

- Major Benefits: Zero personal taxes, potential 9% corporate tax (if earnings exceed AED 375,000), easy repatriation of profits, and an established industrial ecosystem

- Compliance: ESR, AML-CFT, and UBO are essential to avoid legal pitfalls

- Flexibility: Mainland structure allows operation across the entire UAE and the freedom to trade globally

- Best Fit: From consultancies to industrial plants, Sharjah Mainland accommodates a wide range of ventures

If you’ve been searching for a location to maximize your growth potential while minimizing upfront costs, Sharjah Mainland is more than ready to welcome you. By following the steps outlined in this guide—and by leveraging local or international consultants when necessary—you’ll set yourself on the path to success in one of the UAE’s most dynamic and entrepreneur-friendly environments.