Company Formation & Business Setup in Abu Dhabi

Are you thinking about starting a business in Abu Dhabi? Whether you want to set up your business in Dubai or Abu Dhabi, both places offer amazing opportunities. Abu Dhabi is the capital of the United Arab Emirates (UAE), and it’s known for its strong economy, great location, and business-friendly environment.

Starting a business in Abu Dhabi is easier than it might seem, but you’ll need to know the right steps. There are different ways to set up a business. You can choose to start your company on the mainland, where you might need a local partner, or you can go for a Free Zone, where you can own 100% of your business. Both choices have their own advantages, so it’s important to figure out which is the best for your business.

The process of company registration in Abu Dhabi can be tricky, with lots of rules and paperwork. That’s where a business setup consultant in Dubai or Abu Dhabi comes in. These experts can help you understand the rules, fill out forms, and make sure everything is done correctly and quickly.

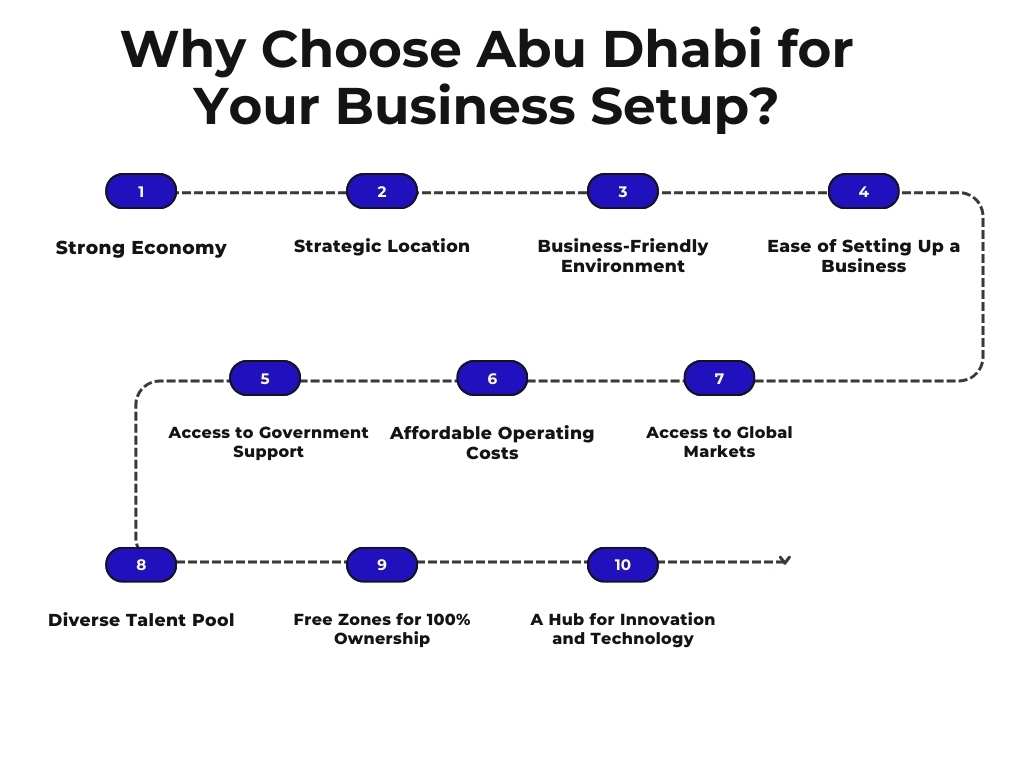

Why Choose Abu Dhabi for Your Business Setup?

Why Choose Abu Dhabi for Business Setup?

Abu Dhabi, the capital of the United Arab Emirates (UAE), is a popular destination for business owners and entrepreneurs looking to start a business. With its strong economy, strategic location, and business-friendly environment, it’s no surprise that Abu Dhabi is attracting both local and international investors. Let’s explore why business setup in Abu Dhabi is a great choice.

A. Strong Economy

Abu Dhabi is known for its strong and diverse economy, driven by oil and gas, real estate, construction, tourism, and manufacturing industries. Over the years, the government has worked hard to create a stable economy by investing in sectors outside of oil, which makes the market even more appealing for new businesses. Whether you’re starting a small business or a larger one, Abu Dhabi offers a solid foundation for growth.

B. Strategic Location

Abu Dhabi’s location in the UAE makes it an ideal place for international businesses. It is centrally located between major global markets, including Asia, Europe, and Africa. This makes it easy to connect with customers and partners worldwide. Whether you’re looking to expand your business into the Middle East or use Abu Dhabi as a launchpad for global trade, its strategic location offers excellent opportunities.

C. Business-Friendly Environment

The UAE government has put in place several policies that make it easy to start and run a business in Abu Dhabi. These policies include tax exemptions, 100% foreign ownership in many sectors (especially in Free Zones), and easy visa processes. Businesses in Abu Dhabi Free Zones can benefit from these perks, which help reduce operating costs and increase the potential for success.

D. Ease of Setting Up a Business

Setting up a business in Abu Dhabi is relatively quick and straightforward, especially when you have the right support. Whether you choose to set up in the Abu Dhabi Mainland or one of the many Free Zones, the government has streamlined the business setup process. You can even get your company registration completed within a few days, thanks to the efficient processes in place.

E. Access to Government Support

The UAE government offers several support programs for businesses, especially in sectors like technology, renewable energy, and tourism. Abu Dhabi has specific initiatives and grants for companies operating in these sectors. For example, the Masdar City is a hub for renewable energy and clean technology businesses, providing ample resources and incentives.

F. Affordable Operating Costs

Compared to other major global cities, business setup in Abu Dhabi can be more affordable. The cost of living and operating a business is relatively low, especially when compared to cities like London, New York, or Tokyo. Additionally, with lower taxes and fewer regulations for business owners, Abu Dhabi offers a great value for new entrepreneurs.

I. Access to Global Markets

Abu Dhabi’s strong infrastructure, including modern airports and ports, allows businesses to easily access global markets. Whether you’re involved in trade, logistics, or e-commerce, being based in Abu Dhabi can open doors to a larger market. This access to international markets is one of the reasons many businesses choose to set up shop in Abu Dhabi.

J. Diverse Talent Pool

Abu Dhabi offers a diverse talent pool, with professionals from around the world living and working in the UAE. The city is home to many highly skilled individuals, particularly in sectors like finance, technology, and engineering. By setting up a business here, you can tap into this global talent pool, helping your business grow with the best possible expertise.

K. Free Zones for 100% Ownership

Abu Dhabi has several Free Zones, such as the Abu Dhabi Global Market (ADGM) and Khalifa Industrial Zone Abu Dhabi (KIZAD), where foreign investors can have 100% ownership of their business. Free Zones offer advantages like tax exemptions, simplified customs procedures, and easy access to a wide range of services. This can be particularly appealing for entrepreneurs who want to fully own their company without the need for a local partner.

L. A Hub for Innovation and Technology

Abu Dhabi is focusing on becoming a leader in innovation and technology. The city has developed several tech-focused free zones like Masdar City, which aims to create a sustainable and green economy. If you are in the technology, innovation, or sustainability sectors, Abu Dhabi offers many resources and support to help grow your business.

Types of Business License in Abu Dhabi

CWhen you decide to set up a business in Abu Dhabi, one of the first things you’ll need to do is apply for a business license. A business license is a legal document that allows you to legally operate your business in Abu Dhabi. Depending on the type of business you plan to start, there are different types of licenses available. Let’s take a closer look at the most common types of business licenses in Abu Dhabi.

A. Commercial License in Dubai

A Commercial License is the most common type of license for businesses that involve trading activities. This includes businesses that buy and sell goods, import and export products, or provide services related to products. If you plan to run a shop, a retail business, or an import/export company in Abu Dhabi, you will most likely need a Commercial License.

Some examples of businesses that would need a Commercial License include:

- Retail stores

- Wholesalers

- Import/export companies

- Trading companies

B. Professional License in Dubai

If your business involves providing professional services, such as consulting, legal services, or accounting, you will need a Professional License. This license is designed for businesses that offer expertise and services to clients, rather than trading goods.

Examples of businesses that need a Professional License include:

- Consulting firms

- Law firms

- Marketing agencies

- Accounting and bookkeeping services

- IT support services

C. Industrial License in Dubai

An Industrial License is required for businesses that are involved in manufacturing, production, or processing goods. This includes factories, warehouses, and industries that produce or process raw materials into finished products. If you plan to set up a manufacturing business in Abu Dhabi, you will need an Industrial License.

Examples of businesses that require an Industrial License include:

- Factories

- Manufacturing plants

- Assembly lines

- Food processing units

- Construction materials production

D. Tourism License

A Tourism License is for businesses in the travel, tourism, and hospitality sector. This license is required for companies offering travel services, accommodation, or related tourism activities. If you plan to start a hotel, a travel agency, or a tour guide business in Abu Dhabi, you will need a Tourism License.

Some examples of businesses that require a Tourism License include:

- Hotels and resorts

- Travel agencies

- Tour operators

- Event management companies

- Car rental services

E. Agricultural License

An Agricultural License is for businesses involved in agricultural activities, such as farming, livestock, fishing, or forestry. This license allows businesses to operate in the agricultural sector, including the production, processing, and sale of agricultural goods.

Examples of businesses that require an Agricultural License include:

- Farms

- Livestock breeding businesses

- Fishing businesses

- Agricultural product processing

F. Food and Beverage License

If you plan to open a restaurant, cafe, or any other business related to the sale of food and drinks, you will need a Food and Beverage License. This license ensures that your business meets all the necessary health and safety regulations set by the authorities. It’s essential for any business that serves food to customers, whether it’s in a restaurant, café, or catering service.

Some examples of businesses that require a Food and Beverage License include:

- Restaurants

- Cafes

- Catering services

- Food trucks

- Bars and lounges

G. Health and Medical License

If your business is related to health care, such as opening a clinic, a pharmacy, or a medical laboratory, you will need a Health and Medical License. This license is required for any business that deals with medical services, health care products, or pharmaceuticals.

Examples of businesses that require a Health and Medical License include:

- Hospitals and clinics

- Medical labs

- Pharmacies

- Physical therapy centers

- Diagnostic centers

H. Media License

A Media License is needed for businesses involved in any form of media, such as publishing, television, radio, or online media. If you plan to start a media company in Abu Dhabi, you will need a Media License to operate legally.

Some examples of businesses that require a Media License include:

- Television production companies

- Radio stations

- Publishing companies

- Online media platforms

- Advertising agencies

Pro Tips

There are various types of business licenses in Abu Dhabi, each tailored to specific industries and business activities. Choosing the right license is an essential part of setting up your business. It ensures that your business is legally compliant and helps you avoid any legal issues down the road. If you’re unsure about which license is best for your business, it’s always a good idea to consult with a business setup consultant in Abu Dhabi who can guide you through the process and help you select the right license for your business.

Remember, whether you’re applying for a commercial license, industrial license, or any other type, each license will come with its own requirements and fees. Make sure you research thoroughly and plan ahead to ensure a smooth business setup experience in Abu Dhabi.

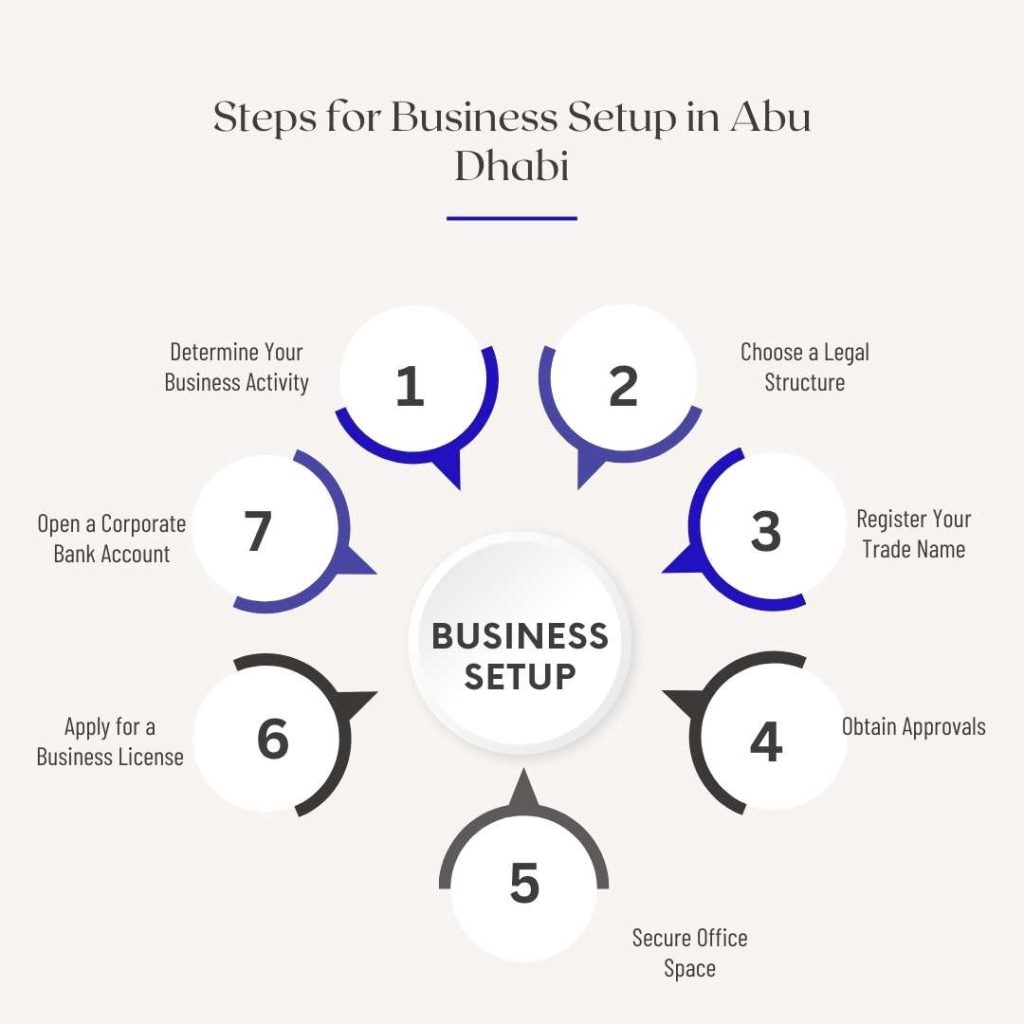

Steps for Business Setup in Abu Dhabi

The process of business establishment in Abu Dhabi is slightly complicated and can be described as follows: Here’s a streamlined process:

Step 1: Determine Your Business Activity

- To begin with, it would be wise to select the type of business activity that would be suitable to the goal set. These cover businesses such as buying and selling activities, production, and even service delivery professions.

Step 2: Choose a Legal Structure

- In this case, make a decision on which type best suits the needs of the organization.

Step 3: Register Your Trade Name

- Your trade name should seem to be close to your business activity and should not contravene any laws in the United Arab Emirates.

Step 4: Obtain Approvals

- Seek first clearances from the bodies of jurisdiction. These may include economic departments and specialized regulators as well.

Step 5: Secure Office Space

- To execute a business in Abu Dhabi, you require a physical business location, which can be in the free zone or on the Abu Dhabi mainland.

Step 6: Apply for a Business License

Acquire the right license with which to start the process of operation. Options include:

- Commercial License

- Industrial License

- Professional License

Step 7: Open a Corporate Bank Account

- Given the characteristics of the financial transactions undertaken by businesses, the banks in Abu Dhabi propose appropriate solutions to ensure that these transactions are as smooth as possible.

The Role of Business Setup Consultants in Abu Dhabi

Starting a business in Abu Dhabi can be a great opportunity, but it can also be confusing and overwhelming. There are a lot of rules, paperwork, and approvals you need to get through. That’s where business setup consultants come in. These experts can help you make the process of starting your business smoother and easier.

In this section, we’ll explain why business setup consultants are so important and how they can help you every step of the way.

A. Choosing the Right Business Structure

The first big decision you need to make when starting a business is what kind of business you want to set up. In Abu Dhabi, there are several options like:

- Limited Liability Company (LLC)

- Sole Proprietorship

- Joint Venture

Each option has its own set of rules, benefits, and costs. A business setup consultant helps you choose the best option for your needs. They’ll explain what’s required for each type of business and help you make the right decision based on what kind of company you want to build.

They will also guide you on ownership options, especially if you are a foreign investor, as some businesses may require a local partner. A business setup consultant will help you avoid mistakes and ensure you’re making the right decision from the start.

B. Handling Paperwork and Documentation

When setting up a business, there is a lot of paperwork involved. From registering your business name to getting the right licenses, it can be easy to miss something important.

Business setup consultants take care of all the paperwork for you. They help with:

- Preparing the required documents like passport copies, address proof, and bank statements.

- Filling out forms correctly to avoid any mistakes.

- Submitting all your documents on time.

- Translating documents when necessary.

By handling all the paperwork, consultants save you time and make sure everything is done correctly.

C. Understanding the Legal and Regulatory Requirements

Every country has rules and regulations that businesses need to follow, and Abu Dhabi is no different. There are strict rules about taxes, labor, and other areas that businesses must follow. If you’re new to the area, it can be hard to understand what you need to do.

A business setup consultant knows all the laws in Abu Dhabi and can make sure your business follows them. They help you with:

- Understanding what licenses and approvals are needed for your business.

- Getting any special permits for your industry (like oil and gas or healthcare).

- Ensuring that your business complies with local regulations like labor laws and tax rules.

With their help, you won’t have to worry about breaking any laws or missing important steps.

D. Choosing the Best Location for Your Business

Where you set up your business is important. In Abu Dhabi, you can choose from different locations like:

- Mainland Abu Dhabi: This is the heart of the city and great for businesses that want to serve local customers.

- Free Zones: These are special areas that offer benefits like 100% foreign ownership and fewer restrictions.

A business setup consultant can help you decide which location is best for your business. They will:

- Explain the benefits and limitations of each location.

- Help you choose a location based on your business goals.

- Advise on office space and rental costs.

By working with a consultant, you can make the best choice for your business and avoid making an expensive mistake.

E. Getting the Right Visas

If you are a foreigner setting up a business in Abu Dhabi, you will need the right visas for yourself, your employees, and possibly even your family. Getting the wrong type of visa or missing paperwork can cause delays and complications.

Business setup consultants can help you with all your visa needs. They will:

- Help you apply for the correct business visa.

- Make sure you have the right visas for your employees and any foreign partners.

- Help with visa renewals and any changes to your status in the future.

Having a consultant take care of your visa applications ensures that your business stays legal and runs smoothly.

G. Helping You Set Up a Business Bank Account

After setting up your business, you will need a bank account to manage your money. The process of opening a business account in Abu Dhabi can be complicated, especially if you’re not familiar with the local banking system.

A business setup consultant can help you open a business bank account by:

- Helping you choose the best bank for your business.

- Assisting with the required documentation for opening an account.

- Advising you on how to manage your business finances.

With the consultant’s help, you can get your business finances set up properly and avoid unnecessary delays.

H. Providing Ongoing Support After Your Business is Set Up

Even after your business is officially set up, a business setup consultant can continue to help you. There are many tasks to keep up with as your business grows, such as renewing licenses, hiring employees, and filing taxes.

A consultant can provide ongoing support by:

- Helping you renew your business license and other permits.

- Assisting with HR and labor law compliance.

- Providing financial and tax advice.

- Helping with business expansion if needed.

With their ongoing help, you can focus on running your business while they take care of the rest.

Pro Tips

Starting a business in Abu Dhabi doesn’t have to be stressful or confusing. With the help of a business setup consultant, you can get through the process quickly and correctly. From choosing the right business structure to handling paperwork and getting visas, a consultant is there to guide you every step of the way. They’ll help you make informed decisions and avoid costly mistakes.

If you’re thinking about starting a business in Abu Dhabi, it’s a good idea to work with a business setup consultant to make sure everything is done right.

Company Formation in Dubai vs. Abu Dhabi: A Simple Comparison

Here is a simple comparison table to help you understand the main differences between company formation in Dubai and Abu Dhabi. This will help you decide which city is better for starting your business.

| Aspect | Dubai | Abu Dhabi |

|---|---|---|

| Business Environment | Dubai is fast-paced and great for tourism, retail, and finance. | Abu Dhabi is better for energy, manufacturing, and large projects. |

| Business Licenses | Offers licenses for trade, professional work, tourism, and more. | Offers the same types of licenses, with focus on industrial activities. |

| Free Zones | Many free zones like Dubai Media City, DIFC, and Jebel Ali. | Free zones like ADGM, KIZAD, and Masdar City focus on energy and industry. |

| Company Setup Costs | Setting up a business can cost more, especially in the city center (AED 20,000 to AED 50,000). | Costs less, especially for industrial or energy businesses (AED 20,000 to AED 45,000). |

| Local Ownership Requirement | Mainland companies usually need a local sponsor (except for certain businesses). | Same rules for mainland businesses with a local sponsor required. |

| Visa and Immigration | Fast visa process with options for family visas. | Similar visa process with options for family visas. |

| Business Focus | Ideal for businesses in global trade, tourism, real estate, and finance. | Best for companies in energy, manufacturing, and large-scale projects. |

| Office Space Cost | Office space in central areas is more expensive. | Office rents are usually lower compared to Dubai. |

| Setup Speed | Faster company setup (1-3 weeks for free zones). | Slightly longer setup process (2-4 weeks). |

| Market Access | Great for connecting with international markets. | Strong local market access, especially for industrial businesses. |

Pro Tips

Both Dubai and Abu Dhabi offer great opportunities for starting a business. However, they are different in some ways:

- Dubai is perfect for businesses that want to be involved in global trade, tourism, or finance. It’s a fast-paced city with easy access to international markets.

- Abu Dhabi is ideal for businesses related to energy, manufacturing, and large-scale projects. It is a more stable environment with a focus on industrial growth.

Think about your business type, budget, and long-term goals when deciding between company formation in Dubai or Abu Dhabi. Both cities can help your business succeed in the UAE!

Free Zone vs. Mainland Business Setup

Free Zone Setup

- 100% foreign ownership.

- Free access to the foreign market from import/export duties.

- Having the best sports training facilities from all over the world.

Mainland Setup

- Operate anywhere in the UAE.

- Absolutely no restrictions on the operations of the business.

- The chance to have the company work with government contracts.

Whether to set up the business in a free zone or in the mainland location depends on the objectives of the launching business venture. For example, if your emphasis is on local markets, a mainland setup is advisable.

Recommended: Business Setup in Dubai Mainland: Your Best 2025 Guide

Business Setup in Abu Dhabi Free Zones

There are many benefits of free zones in Abu Dhabi, as highlighted in this paper. Key free zones include:

A. Abu Dhabi Global Market (ADGM)

- Industry Focus: Financial services, banking, and fintech.

- Overview: ADGM is a leading international financial center that offers a wide range of services, including corporate services, legal frameworks, and regulatory support for businesses in the financial sector.

- Benefits: It has its own legal system, allowing businesses to operate according to international standards. ADGM offers 100% foreign ownership, tax exemptions, and a strong focus on the financial industry.

Recommended: ADGM LICENsE

B. Khalifa Industrial Zone Abu Dhabi (KIZAD)

- Industry Focus: Manufacturing, logistics, and industrial sectors.

- Overview: KIZAD is one of the largest industrial free zones in the world. It offers a variety of facilities, including warehouses, industrial plots, and transportation links to major ports and airports.

- Benefits: Businesses in KIZAD can benefit from its proximity to Abu Dhabi’s Khalifa Port, one of the fastest-growing ports in the region. It also offers competitive lease rates and tax exemptions.

C. Masdar City Free Zone

- Industry Focus: Clean technology and renewable energy.

- Overview: Masdar City is a sustainable urban development focusing on clean energy and environmental innovation. This free zone offers a platform for businesses in the renewable energy and sustainability sectors.

- Benefits: The free zone offers excellent incentives for companies focusing on green technologies and renewable energy. It also has state-of-the-art infrastructure for these industries and a strong network of support.=

- Industry Focus: Media, entertainment, and digital industries.

- Overview: Twofour54 is a media-focused free zone designed to foster creativity and innovation in the media, entertainment, and digital industries.

- Benefits: The zone offers media-related companies a chance to set up their businesses in an ideal location with facilities and support tailored to their needs. It also provides access to government support and international media companies.

D. Abu Dhabi Airport Free Zone (ADAFZ)

Benefits: ADAFZ offers low-cost office spaces, tax exemptions, and easy access to the airport’s facilities, making it ideal for logistics and transport businesses.

Industry Focus: Aviation, logistics, and trade.

Overview: Located next to Abu Dhabi International Airport, ADAFZ is perfect for businesses in the aviation, logistics, and trade sectors. The proximity to the airport makes it ideal for companies dealing with transportation and global trade.

Cost of Business Setup in Abu Dhabi

Setting up a business in Abu Dhabi comes with various costs depending on your business type, location, and legal requirements. To make it easier to understand, we’ve broken down the main costs into categories. Here’s a simple table that shows the estimated cost for each part of setting up a business in Abu Dhabi.

| Cost Type | Estimated Cost | Details |

|---|---|---|

| Business License Fees | AED 10,000 – AED 50,000 | Varies depending on the business activity, size, and type of business license (mainland or free zone). |

| Office Space Rental | AED 20,000 – AED 100,000/year | Prices depend on location, office size, and whether it’s mainland or free zone. |

| Investor Visa | AED 3,000 – AED 5,000 | Required for business owners. Prices vary depending on the visa type and duration. |

| Employee Visas | AED 3,000 – AED 7,000 per employee | Fees depend on the type of work and position. |

| Family Visa | AED 3,000 – AED 5,000 per family member | If sponsoring family members to live in the UAE. |

| Local Sponsor Fees | AED 10,000 – AED 20,000/year | For mainland businesses, UAE nationals must hold 51% of the company. |

| Local Service Agent Fees | AED 5,000 – AED 15,000/year | For a local service agent to handle government and legal matters. |

| Notary and Document Fees | AED 1,000 – AED 3,000 | Legal costs for document certification and approvals. |

| Trade Name Reservation | AED 500 – AED 1,000 | Fees for reserving your business name. |

| Bank Account Setup Fees | AED 1,000 – AED 3,000 | Includes account setup and minimum deposit requirements. |

| Employee Salaries | AED 5,000 – AED 20,000 per month | Depends on the position and industry. |

| Marketing and Advertising | AED 2,000 – AED 10,000/month | Costs depend on the type of marketing (digital, print, TV, etc.). |

Detailed Breakdown of Business Setup Costs

Now that we’ve seen the basic costs, let’s break them down further to understand where the money goes when setting up a business in Abu Dhabi:

A. Business License Fees

- Business license fees are one of the first expenses you’ll face. These fees can range from AED 10,000 for smaller businesses to AED 50,000 or more for larger businesses. Mainland businesses tend to cost more due to the legal requirements for local sponsorship and other regulations.

B. Office Space Rental

- If you’re setting up a mainland business, you’ll need a physical office. Office space can cost anywhere between AED 20,000 and AED 100,000 per year, depending on where the office is located. For free zone businesses, you may have options for smaller, shared office spaces, which could reduce costs.

C. Visa Costs

- For yourself and your employees, you’ll need to apply for visas. The cost of an investor visa is typically between AED 3,000 and AED 5,000. For employees, the cost of a visa can range from AED 3,000 to AED 7,000 per person.

D. Local Sponsor or Service Agent Fees

- For mainland businesses, you must partner with a local sponsor (a UAE national) who owns 51% of your business. This partnership costs between AED 10,000 and AED 20,000 annually. Alternatively, if you need a local service agent to handle administrative tasks, they charge a fee of AED 5,000 to AED 15,000 annually.

E. Additional Costs for Setting Up

- Other costs like notary and document fees, trade name reservation, and corporate bank account setup fees should also be considered. These smaller fees range from AED 500 to AED 3,000.

F. Ongoing Costs

- Running your business will have additional ongoing costs like employee salaries and marketing. Employee salaries can vary significantly based on the role and industry. For instance, an entry-level employee might earn AED 5,000 a month, while a senior manager could earn AED 20,000 or more. Marketing costs can also vary widely depending on your strategy, with digital marketing being more affordable than traditional advertising.

Summary of Costs

Here’s a quick reference to the overall costs you can expect when setting up your business in Abu Dhabi.

| Cost Item | Mainland | Free Zone |

|---|---|---|

| Business License | AED 10,000 – AED 50,000 | AED 7,000 – AED 30,000 |

| Office Rent | AED 20,000 – AED 100,000/year | AED 15,000 – AED 50,000/year |

| Visa (Investor) | AED 3,000 – AED 5,000 | AED 3,000 – AED 5,000 |

| Employee Visa | AED 3,000 – AED 7,000 per person | AED 3,000 – AED 7,000 per person |

| Local Sponsor Fees | AED 10,000 – AED 20,000/year | N/A |

| Local Service Agent Fees | AED 5,000 – AED 15,000/year | N/A |

| Notary and Document Fees | AED 1,000 – AED 3,000 | AED 1,000 – AED 3,000 |

| Trade Name Reservation | AED 500 – AED 1,000 | AED 500 – AED 1,000 |

| Bank Account Setup Fees | AED 1,000 – AED 3,000 | AED 1,000 – AED 3,000 |

| Employee Salaries | AED 5,000 – AED 20,000/month | AED 5,000 – AED 20,000/month |

| Marketing and Advertising | AED 2,000 – AED 10,000/month | AED 2,000 – AED 10,000/month |

Pro Tips

The cost of setting up a business in Abu Dhabi can vary depending on several factors, such as the type of business, whether it’s on the mainland or in a free zone, and the services you need. However, with careful planning, understanding the fees involved, and possibly consulting with a business setup consultant, you can ensure that your investment is well-managed.

By using the table above, you can get a clearer idea of what to expect when starting a business in Abu Dhabi. Always keep in mind that while costs may vary, investing in the right business setup service can help reduce unexpected expenses and streamline the process.

Frequently Asked Questions

Q1. Generally, is it possible for a foreigner to invest and own his or her business in Abu Dhabi?

Yes, 100% foreign ownership is allowed only in free zones and some sectors of the mainland.

Q2. In a typical setting, how long does it take to set up the firm?

Ideally, it may take about 1 to 4 weeks or maybe even longer in case of a certain type of business and various approvals needed.

Q3. What legal licenses can one business obtain for another business?

There are generic licenses for commercial, industrial, personal, and professional use.

Q4. Are there tax benefits?

Yes, most businesses are privy to the tax-exempt system, and this makes the place attractive for business, Abu Dhabi.

Q5. What measures have to be taken to abide by UAE legal systems?

Business setup consultants in Abu Dhabi for your business guarantee that they have complied with all the operating legalities.

Conclusion

The process of entering this area as a business venture remains attractive for various entrepreneurs and investors that are on the hunt for development and new opportunities. With the help of reliable business setup consultants in Abu Dhabi, the process will be smooth and successful. Irrespective of your preference, the free zone or the mainland, the business environment in Abu Dhabi has been structured for success.

Ready to start your journey? Follow our company formation in Dubai and business setup in Dubai free zone to know the best match for your business.