Dubai International Financial Centre (DIFC) is a free zone in central Dubai. It offers 100% foreign ownership, a tax-free system, and an English common law framework. The Dubai Financial Services Authority (DFSA) and the Registrar of Companies oversee DIFC, helping businesses in banking, fintech, insurance, and more. With a quick Commercial Licence process and strong compliance standards, DIFC connects you to the MEASA region’s growing markets. Whether you’re starting a new company or expanding a global branch, zero corporate tax and simple incorporation pave the way for growth, innovation, and global recognition.

Business Setup and Company Formation in DIFC Free Zone (Dubai International Financial Centre)

The Dubai International Financial Centre (DIFC) is a top financial hub in the Middle East, Africa, and South Asia (MEASA) region. It is located right in the center of Dubai. DIFC is famous for its friendly business environment. It uses a legal system based on English law and has a strong regulatory authority. There are over 2,500 registered companies in DIFC.

Whether you are a fintech startup, a global bank, a professional services firm, or a large multinational company, setting up in DIFC can help you reach profitable markets in the region and beyond.

This guide will help you understand how to set up a business in the Dubai International Financial Centre. It covers the legal rules, types of licenses, the setup process, and what you need to follow. By the end of this guide, you will have a clear, step-by-step plan to start your business in one of the world’s most active financial centers. Let’s begin.

What Is the Dubai International Financial Centre (DIFC)?

The DIFC is an independent free zone covering around 110 acres in central Dubai. It was established in 2004 and works under its own legal and regulatory rules, separate from the rest of the UAE. This independence helps DIFC follow international best practices, attract top financial institutions, and encourage new ideas in different financial areas like:

- Banking (Investment, Private, Commercial)

- Insurance and Reinsurance

- Asset Management

- Corporate and Professional Services

- Fintech, InsurTech, and RegTech

- Brokerage and Capital Markets

Over the past 15+ years, DIFC has become a well-known place for finance and investment. It includes:

- Dubai Financial Services Authority (DFSA) – the regulator that gives out licenses for regulated activities.

- DIFC Courts – a separate court system based on English common law.

- Registrar of Companies (ROC) – handles setting up and registering all legal entities in DIFC.

In 2022, DIFC had a workforce of 25,600 and 2,584 registered companies. This includes banks, insurance companies, law firms, and consultancies that cover many professional and commercial activities.

Why Choose DIFC for Your Business Setup?

Company Formation in DIFC has many benefits beyond its great location. Here are some key advantages:

A. 100% Foreign Ownership:

- Entrepreneurs and investors can fully own their businesses without needing a local partner.

B. Tax-Friendly Regime:

- 0% corporate tax and 0% income tax if you meet the rules.

- No taxes on capital repatriation or profit transfers.

C. Independent Regulatory Environment:

- The DFSA oversees financial services with clear rules that match international standards like the Basel Accords, AML, and CFT regulations.

D. Robust Legal System:

- DIFC Courts use English common law, which means fair and predictable legal processes. This builds confidence for global investors.

E. Strategic Location :

- MEASA Access Located between East and West time zones, DIFC is a gateway to the growing MEASA markets rich in natural resources and investments.

F. Wide Range of Financial & Non-Financial Activities

- From fintech and insurance to retail and professional services, DIFC supports many sectors, promoting teamwork and growth.

G. High-Quality Infrastructure & Lifestyle:

- DIFC has Grade A offices, advanced telecoms, upscale shops, restaurants, art galleries, and luxury hotels like the Ritz-Carlton and Four Seasons.

H. Global Reputation and Brand Authority:

- Being part of DIFC’s list of top banks, asset managers, and insurers boosts your brand’s credibility and helps build important partnerships.

By joining DIFC, your business gains from top standards, more trust from investors, and many chances to network and grow.

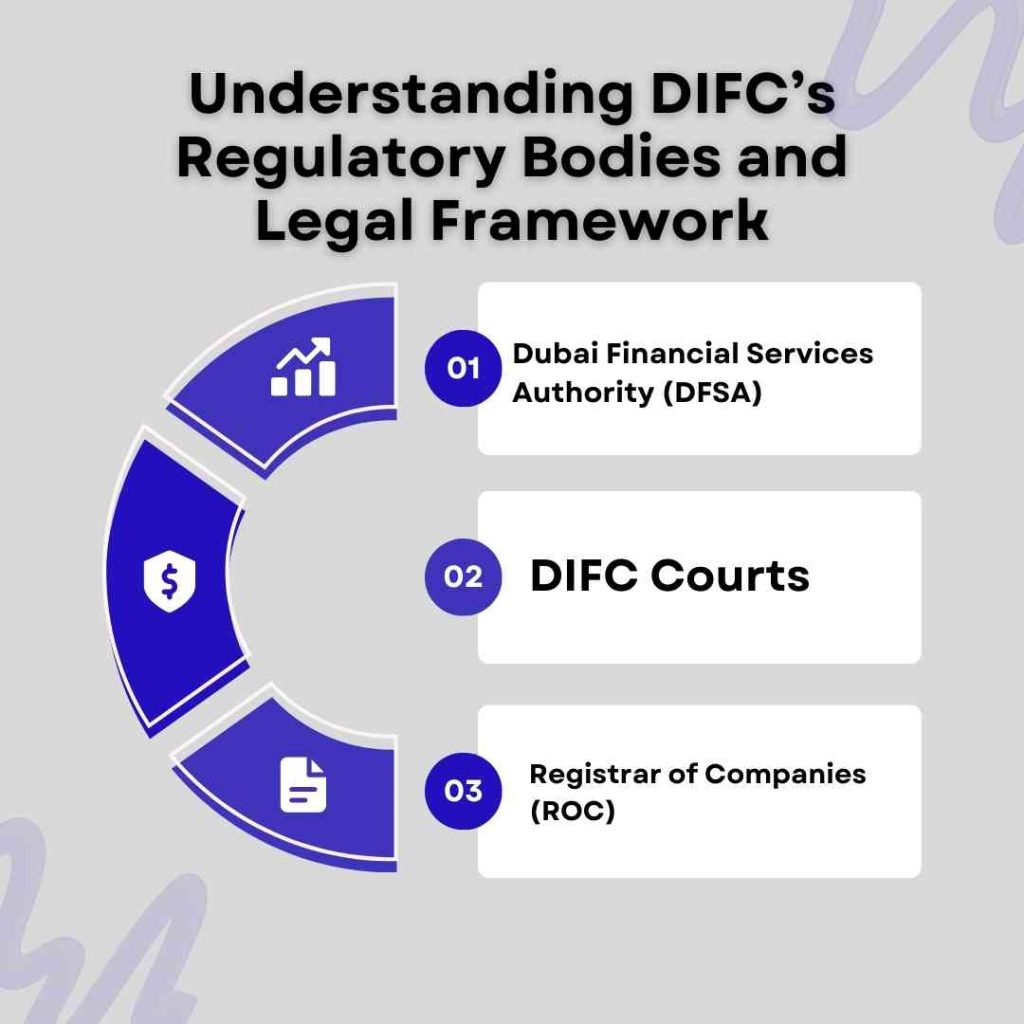

Understanding DIFC’s Regulatory Bodies and Legal Framework

Three main groups keep DIFC running smoothly:

A. Dubai Financial Services Authority (DFSA)

- Role: Regulates and supervises financial activities like banking, insurance, and investment services.

- Focus: Checks applications for financial service licenses and ensures businesses follow global standards.

- Rules: Maintains high levels of market integrity, protects consumers, and manages risks.

B. DIFC Courts

- Structure: Independent courts that follow English common law.

- Job: Handles civil and commercial disputes within DIFC.

- Team: Includes international judges from places like England, Singapore, and Hong Kong.

- Benefits: Provides quick and fair ways to solve business disputes, creating a safe business environment.

C. Registrar of Companies (ROC)

- Responsibility: Manages the incorporation and registration of all DIFC entities.

- Tasks: Issues and renews Commercial Licenses.

- Compliance: Makes sure businesses follow the Companies Law, General Partnership Law, Limited Liability Partnership Law, Limited Partnership Law, Non-Profit Incorporated Organisations Law, and Foundations Law.

Together, these groups help DIFC stay a top financial hub by combining the best in regulation, law, and corporate governance.

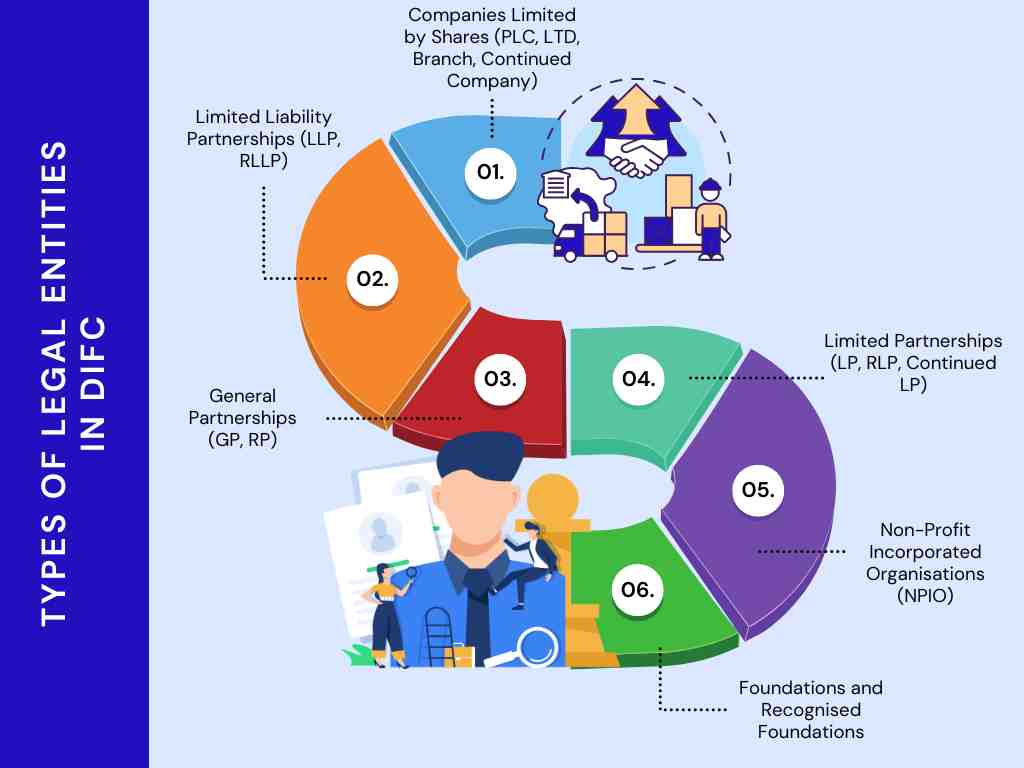

Types of Legal Entities in DIFC

DIFC offers different types of business structures to fit various needs. Whether you are a branch of a foreign firm, a large corporation, a partnership, or a special entity like a foundation or non-profit, there is an option for you. Here are the main types:

A. Companies Limited by Shares (PLC, LTD, Branch, Continued Company)

- Public Company (PLC)

- Can sell shares to the public.

- Good for large companies that want to raise money by selling shares.

- Private Company (LTD)

- Limits who can buy and sell shares.

- Best for small to medium businesses or companies that want to keep ownership controlled.

- Branch of a Pre-Existing Foreign Company (Recognised Company)

- Acts as a part of a foreign parent company.

- Does not have its own legal identity separate from the parent.

- Continued Company

- A foreign company can move its registration to DIFC while keeping its history.

- Works as if it was always set up under DIFC’s Companies Law.

B. Limited Liability Partnerships (LLP, RLLP)

- Limited Liability Partnership (LLP)

- Needs two or more partners (at least one must be an individual).

- Partners share profits and have limited personal liability, making it popular for professional services.

- Branch of a Pre-Existing Foreign LLP (RLLP)

- Foreign LLPs can open a branch in DIFC.

- The branch remains connected to the parent company.

C. General Partnerships (GP, RP)

- General Partnership (GP)

- Two or more people or companies share unlimited liability.

- Good for partners who want to share both risks and rewards equally.

- Branch of a Pre-Existing Foreign General Partnership (RP)

- Extends a foreign general partnership’s work into DIFC.

- Liabilities stay connected to the foreign parent.

D. Limited Partnerships (LP, RLP, Continued LP)

- Limited Partnership (LP)

- Has general partners (with unlimited liability) and limited partners (liability limited to their investment).

- Common for private equity and venture capital.

- Branch of a Pre-Existing Foreign Limited Partnership (RLP)

- Extends a foreign limited partnership’s work into DIFC.

- Liabilities stay connected to the foreign parent.

- Continued Limited Partnership (Continued LP)

- A foreign limited partnership can move its registration to DIFC while keeping its history.

E. Non-Profit Incorporated Organisations (NPIO)

- Non-Profit Incorporated Organisation (NPIO)

- For charitable, community, educational, or philanthropic projects.

- Can also move an existing non-profit to DIFC.

F. Foundations and Recognised Foundations

- Foundations

- Set up to hold assets, manage estates, or achieve charitable goals.

- Have their own legal identity.

- Recognised Foundation (Branch of a Pre-Existing Foreign Foundation)

- Extends a foreign foundation’s structure into DIFC.

- Can also transfer an existing foundation to DIFC.

Each type of entity has different rules, capital needs, and compliance requirements. Choose the one that fits your business goals best.

Regulated vs. Non-Regulated Business Activities

A. Regulated Activities

- What They Are: Include banking, insurance, brokerage, asset management, and other financial services.

- License Needed: Require a DFSA licence.

- Process: The DFSA checks your business plan, financial health, and ability to manage risks to protect consumers and ensure safety.

B. Non-Regulated Activities

- What They Are: Include consultancy, professional services (like accounting and law firms that don’t handle client funds directly), marketing, and retail.

- License Needed: Do not require a DFSA licence. They just need to register with the Registrar of Companies (ROC).

Common Requirement

- Commercial Licence: Both regulated and non-regulated businesses need a Commercial Licence from the ROC to operate in DIFC.

Extra Layer for Regulated Activities

- If your business is regulated, you need an extra licence from the DFSA on top of the Commercial Licence.

Key Steps For Business Setup in DIFC

Setting up a business in DIFC involves several clear steps to make sure you follow local rules and international best practices:

Step 1. Pre-Application: Defining Your Business Activity

- Identify Your Core Activities: Decide if you need a regulated or non-regulated licence.

- Check Legal Structures: Choose the type of entity (e.g., LTD, LLP, GP, Foundation) based on how much liability you want, your capital needs, and how you plan to run your business.

- Contact Business Development: Reach out to DIFC Authority’s Business Development Department for initial help and to connect with the right resources.

Step 2. Meeting DIFC Business Development & DFSA (If Regulated)

- Introductory Session: If your business is in financial services, set up a meeting with the DFSA to talk about your plans, how much capital you have, and what licenses you need.

- Letter of Intent (LOI): For regulated companies, you usually need to send an LOI before the formal application. This letter explains what your business will do and how it will work.

Step 3. Submitting the Application to the Registrar of Companies (ROC)

Once you know your entity type, follow these steps:

- Complete Application Forms: Get the forms from the ROC or the DIFC online portal.

- Required Documentation: Provide information like the identities of shareholders or partners, your business plan, how your capital is structured, and any important documents if you are setting up a branch from a foreign company.

- Pay Initial Fees: Fees vary based on the type of entity. For example, a non-regulated LTD may need less capital than a regulated financial services company.

Step 4. Getting Your Commercial Licence and Certificate of Incorporation

- ROC Review: The ROC team checks your application to make sure everything is complete and follows the rules.

- Certificate Issuance: Once approved, the ROC gives you a Certificate of Incorporation (for entities like LTD, PLC, LLP, etc.) or a Certificate of Registration (for Recognised Companies and Partnerships).

- Commercial Licence: At the same time, you get a non-regulated commercial licence to operate and handle business matters. If you are in a regulated sector, you also need final approval from the DFSA before starting your business.

Step 5. Office Setup and Bank Account Opening

- Office Space: Find a suitable commercial space in DIFC. You can choose from co-working spaces, business centres, or private offices.

- Bank Account: Open a Business Bank Account in a local or international bank. You will need to show your Commercial Licence, incorporation documents, and other compliance information.

Step 6. Post-Incorporation Compliance

- Capital Remittance Proof: Some regulated businesses must show that they have deposited their capital with the DFSA.

- Employee Visas & Residency: Arrange UAE residency permits for investors and employees through DIFC’s easy processes.

- Operational Setup: Set up your internal management, ensure your IT systems are secure, follow AML/CFT rules, and finalize any business contracts needed to start working.

Key Requirements: Share Capital, Licensing, and Timelines

- Share Capital

- Non-Regulated LTDs: Typically need a minimum share capital of USD 10,000.

- Regulated Companies: May require higher capital based on DFSA rules and the type of business.

- Licensing & Timelines

- Non-Regulated Entities: Usually take 6-8 weeks to get approved.

- Regulated Entities: Take about 4-6 months because of the extra DFSA review.

- Special Purpose Companies (SPCs): Can be set up in around 2 weeks due to faster processes.

- Annual Renewals

- Commercial Licence: Must be renewed every year within 30 days after it expires.

- Regulated Entities: Need to follow ongoing DFSA compliance checks, and any changes to your licence might need extra review.

Costs and Fees in DIFC

Costs can vary a lot depending on your business activity and legal structure. Here are some common fees:

- Application & Registration Fees: Paid to the ROC when you set up your company.

- Commercial Licence Fee: Renewed every year.

- DFSA Licence Fee (if regulated): Changes based on the type of license (like banking, insurance, asset management).

- Office Rental: DIFC real estate is expensive. Co-working spaces are cheaper, while big offices cost more.

- Compliance and Consultancy: If your business is regulated, you might need to hire compliance officers, get legal advice, or work with consultants to follow DFSA rules.

Even though the costs might be higher than other UAE free zones, the prestige, transparency, and network access in DIFC often make it worth the investment for businesses aiming for high-end markets and smart clients.

Compliance and Governance

Businesses in DIFC must follow strict governance and compliance rules:

- Economic Substance Regulations (ESR)

- Shows that your business has a real presence in DIFC for certain activities.

- Anti-Money Laundering (AML) & Combating the Financing of Terrorism (CFT)

- Businesses must have strong AML/CFT policies, especially those under DFSA supervision.

- Common Reporting Standard (CRS) & FATCA

- CRS: Helps share financial information with tax authorities globally.

- FATCA: Requires businesses handling U.S. or international funds to report financial accounts to tax authorities.

- Annual Financial Audit

- Non-Regulated LTDs, PLCs, and other corporate types need to submit audited financial statements to the ROC.

- Special Purpose Companies may be exempt but still need to keep proper accounts.

These rules help keep DIFC a safe and clear market, supporting its EEAT (Experience, Expertise, Authority, and Trustworthiness) qualities.

Recommended: Business Setup in Dubai – Hassle-Free Company Formation

Managing Your DIFC Entity: Renewal, Expansion & Ongoing Obligations

A. Licence Renewal and Audit Reports

Your Commercial Licence needs to be renewed every year through the ROC. Here’s what to do:

- Pay Renewal Fees: Do this on time to avoid fines or stopping your business.

- File Annual Returns: Update the ROC with any changes in your company, like new shareholders or directors.

- Submit Audited Financials: Most businesses need to send in audited financial statements to show they are transparent and honest.

If your business is regulated, you also need to keep up with extra DFSA reports, like checking your capital and how you manage risks.

B. Economic Substance Regulations (ESR), AML, CFT, and FATCA

DIFC follows global rules to stop illegal money flows and tax evasion. Here’s what you need to know:

- ESR: Some businesses must prove they have real operations in DIFC.

- AML/CFT: All businesses must have strong measures to find and stop suspicious money activities. DFSA regularly updates these rules to match FATF recommendations.

- FATCA & CRS: If you handle U.S. or international client funds, you must follow FATCA rules. The UAE shares financial data with other countries to help with tax compliance.

By following these rules, DIFC builds global trust and keeps its reputation as a top financial center.

C. Expanding Your Business in DIFC

Once your business is running smoothly in DIFC, you might want to grow. Here are some ways to do that:

- Adding Regulated Activities: If you start with non-regulated services but want to add financial services, you’ll need a DFSA licence.

- Introducing New Shareholders or Investors: Update your incorporation documents to show any new owners or investors.

- Relocating/Upgrading Office Space: As your business grows, you might need bigger offices or more co-working spaces.

- Mergers & Acquisitions: DIFC’s strong legal system makes it a safe place for buying or merging with other companies.

Keep in touch with the Registrar of Companies and the DFSA (if regulated) to make sure your expansion stays within the rules.

Recommended: Dubai-international-financial-center

4. Frequently Asked Questions (FAQ)

Below are some common questions people have about setting up a business in the Dubai International Financial Centre:

Q1. How Much Is the Company Setup Cost in DIFC?

Costs depend on your entity type, whether you need a DFSA licence, and your office space needs. Expect to pay for registration fees, commercial licence, and annual renewals. Office rental costs are higher than other free zones because of DIFC’s premium infrastructure.

Q2. What Facilities Are Available for DIFC Businesses?

DIFC offers top-tier office spaces, business centres, event venues, retail outlets, hotels, art galleries, and easy access to major financial institutions. This setup supports both work and leisure, creating a lively community.

Q3. How Long Does DIFC Company Setup Take?

- Non-Regulated Entities: About 6-8 weeks from application to getting your commercial licence.

- Regulated Entities: 4-6 months, because of the extra DFSA approval steps.

Q4. How to Get a DIFC Visa?

DIFC businesses can sponsor employees, shareholders, and their families for UAE residence visas. After getting your Commercial Licence, start the visa application process through DIFC’s online portals or use authorized service providers.

Q5. What Are the Types of Licences in DIFC?

- Non-Regulated Commercial Licence: For general business activities, issued by the ROC.

- DFSA-Regulated Licence: For banks, insurance companies, asset managers, and other financial services.

- Special Purpose Company (SPC) Licence: For structured financing, securitization, and similar activities.

Q6. How Do I Renew My DIFC Licence?

Renew your licence every year through the Registrar of Companies. Pay the renewal fee and send any updated documents, like audited financial statements or changes in shareholders.

Q7. How Many Companies Operate in DIFC?

DIFC hosts over 2,500 registered companies from around the world. This includes big banks, law firms, consultancies, fintech startups, and retail businesses.

Q8. Is DIFC an Offshore Jurisdiction?

Even though DIFC offers zero corporate tax and 100% foreign ownership, it is not an offshore jurisdiction. DIFC is an onshore free zone with a well-known regulatory framework, clear governance, and strong compliance standards, unlike traditional offshore areas.

5. Conclusion

The Dubai International Financial Centre (DIFC) is a leader in the global financial world. With its flexible legal structures and strict DFSA regulations, DIFC is a top choice for businesses looking to grow, innovate, and gain trust in the Middle East, Africa, and South Asia region.

By choosing DIFC, you’re not just joining a premium free zone—you’re becoming part of an award-winning community of top industry leaders, financial institutions, and service providers. Whether you want to set up a non-regulated consultancy or a fully regulated financial institution, DIFC gives you the tools, legal clarity, and market opportunities to succeed.

Ready to take the next step?

- Contact our experts to help you through the registration process.

- Schedule a consultation to see how DIFC fits your business needs.

- Start your application and place your company in one of the world’s most prestigious financial centers.

Embrace opportunities and innovation—set up your business in DIFC and unlock endless possibilities in the lively MEASA market.