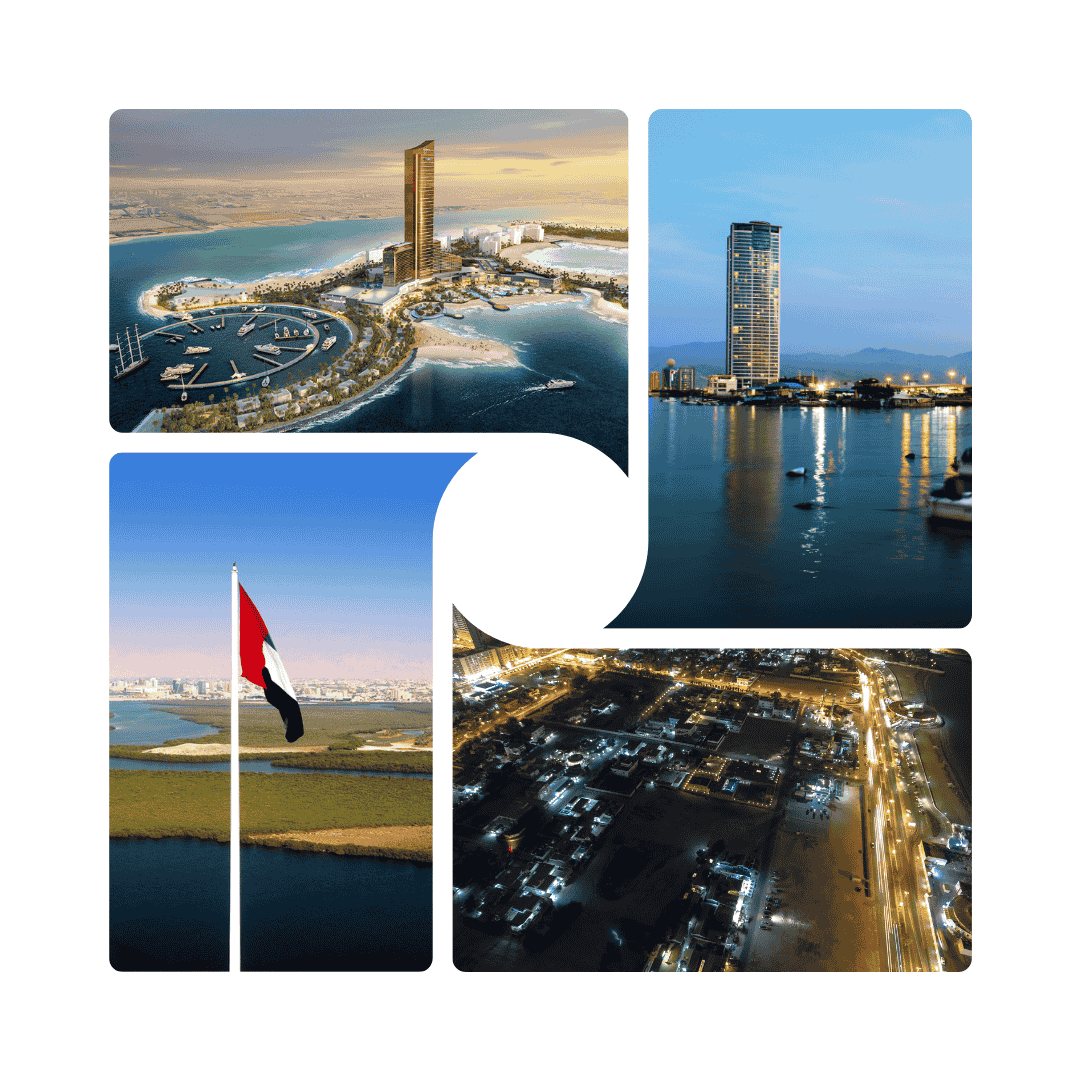

Business setup in RAK

Are you looking for a cost-effective way to expand or start your next venture in the UAE? Business setup in RAK (Ras Al Khaimah) provides a streamlined process for Ras Al Khaimah business registration, competitive licensing options in a Ras al Khaimah free zone, and direct access to RAKEZ—a renowned economic zone. With strategic advantages and solid government backing, it’s no surprise that entrepreneurs see RAK business as a promising gateway. Whether partnering with a trusted rak company or going it alone, Ras Al Khaimah stands out as a hub for growth and innovation.

Essential Steps for Business Setup RAK

Key Steps for Company Formation and Business Setup RAK.

Key Benefits of Business Setup RAK

1

100% Foreign Ownership

RAK allows full foreign ownership of businesses, which means investors can retain complete control over their company without needing a local partner.

2

Cost-Effective Setup

The regulatory framework in RAK is designed to support business activities with streamlined processes for company formation and licensing.

3

No Income Tax

Businesses in RAK benefit from a tax-friendly environment, including no corporate or personal income tax, no value-added tax (VAT), and no customs duties on imports and exports.

4

Ease of Business Expansion

RAK geographical position provides easy access to major markets in the Middle East, Africa, and Asia.

- This is particularly advantageous for international entrepreneurs looking to establish a presence in the UAE market.

- The Ras Al Khaimah Investment Authority (RAKIA) offers various incentives to attract foreign investment, making it easier for businesses to start and grow.

- This significantly reduces the overall cost of doing business and enhances profitability.

- Its proximity to Dubai and well-developed infrastructure, including international airports and seaports, facilitate efficient logistics and trade operations.

Frequently Asked Questions about Business setup RAK

Business opening in RAK is necessary to fulfil the following requirements:

1. Choose your business activity

2. Choose the legal category

3. Registration of Trade name

4. Approval from relevant authorities

5. Business license

Some of the most common legal structures which one can incorporate within the RAK Mainland, such as

1. Company Limited Liability (LLC)

2. Joint Venture Company

3. Public/Private Shareholding Company

4. Free Zone Company

5. International Business Company (IBC)

Yes, non-residents can open businesses in the UAE. The government of the UAE welcomes foreign investment.

A RAKFTZ company registration fee is at AED 7,000 and the annual service charge is AED 1,200.