If you’re looking to register for UAE Corporate Tax in 2025, here’s the short version: every business (mainland or free zone) must register through the Federal Tax Authority (FTA) via the EmaraTax portal. You’ll need to gather all relevant documents (trade license, Emirates ID or passport for authorized signatories, and proof of business activities), then follow the on-screen prompts to obtain your Tax Registration Number (TRN). Make sure you file returns within nine months after the close of your financial year or by the specific deadlines set by the FTA (e.g., 21 months after the start of your first tax period if you began operations on or after June 2023). Free zone companies can benefit from a 0% rate if they satisfy “Qualifying Free Zone Person” criteria, while mainland companies and free zone entities with mainland income are generally taxed at 9% on income above AED 375,000. Now, let’s dive into the comprehensive guide below to cover every detail you need.

How to Register Corporate Tax in the UAE: Complete Guide 2025

For decades, the United Arab Emirates (UAE) was known for its business-friendly environment with zero corporate tax for most companies. However, as part of broader economic reforms and diversification, Federal Decree-Law No. 47 of 2022 introduced a federal corporate tax regime effective from 1 June 2023 onward. Under the Federal Tax Authority (FTA), businesses must now register for UAE Corporate Tax and fulfill filing, payment, and recordkeeping obligations.

The shift might feel daunting at first, especially for entrepreneurs and small business owners who’ve never had to file corporate taxes before in the UAE. But rest assured, the FTA has rolled out user-friendly portals (like EmaraTax) and comprehensive guidelines to streamline the registration process.

- 1. What is Corporate Tax Registration?

- 2. Why Corporate Tax Matters in the UAE

- 3. Who Needs to Register for UAE Corporate Tax?

- 4. Key Documents & Requirements

- 5. Understanding the Latest Registration Timelines (2024–2025)

- 6. Steps For Registering UAE Corporate Tax

- 7. UAE Corporate Tax Rates & Exemptions

- 8. Filing Corporate Tax Returns & Payment Obligations

- 9. Maintaining Accurate Financial Records & Compliance

- 10. Deregistration & Ceasing Operations

- 11. Common Mistakes & How to Avoid Them

- 12. Penalties & Non-Compliance Implications

- 13. Frequently Asked Questions (FAQs)

- Q1: Do I have to register for corporate tax if my business is in a free zone and I have no mainland customers?

- Q2: What if my business started operations in 2024 but I still have no taxable profits?

- Q3: Are individuals with a small side hustle or freelancing gig required to register?

- Q4: How do I know if I’m “non-resident”?

- Q5: Can the FTA reject my corporate tax registration?

- Q6: Are there any ongoing fees to maintain my corporate tax registration aside from the tax itself?

- Q7: How long must I keep my financial records?

- 14. Expert Assistance & Next Steps

- 15. Conclusion

1. What is Corporate Tax Registration?

The formal process of registration is meant for corporate organizations. Corporate tax registration here is the legal process. It is how a tax registration number or tax identification number UAE must comply with tax law. The UAE has introduced a corporate tax. It aims to diversify the economy and comply with global tax trends.

When registering for corporate tax, firms show they meet the law. This helps them avoid penalties.

2. Why Corporate Tax Matters in the UAE

The introduction of corporate tax serves multiple objectives:

- Revenue Diversification: Reducing reliance on oil revenues and strengthening non-oil sectors.

- Global Alignment: Meeting international tax standards (e.g., OECD guidelines on transfer pricing).

- Regulatory Compliance: Ensuring the UAE’s position as a transparent, business-friendly hub in line with global economic practices.

Key takeaway: Understanding how to register corporate tax in the UAE ensures you remain compliant, avoid hefty penalties, and maintain the trust of regulators and business partners.

3. Who Needs to Register for UAE Corporate Tax?

In short: Almost all juridical persons (legal entities) and certain natural persons (individuals conducting business activities) must register for corporate tax if they exceed relevant income thresholds or meet specific criteria outlined by the FTA.

1 Mainland Businesses

Any business licensed on the UAE mainland must register for corporate tax—this includes limited liability companies (LLCs), private and public joint stock companies, and branches of foreign companies operating onshore in the UAE. Mainland businesses are generally subject to a 9% rate on taxable income above AED 375,000.

2 Free Zone Businesses

Free Zone entities (including those in financial free zones like DIFC or ADGM) are also required to register, even if they qualify for the 0% tax incentive. Under the law, free zone businesses must not conduct significant mainland operations to maintain their 0% rate. If they do business on the mainland, they typically face the standard 9% corporate tax on relevant income.

3 Non-Resident Persons & Permanent Establishments

A non-resident person might be subject to UAE corporate tax if they maintain a Permanent Establishment (PE) or have a nexus in the UAE. For instance:

- A foreign company that opens a branch office (PE) must register within six to nine months of establishing that branch.

- A non-resident person with certain “nexus” activities (e.g., deriving income in the UAE) may be required to register within three months of meeting the requirements.

4 Natural Persons

Individuals who carry on a business or business activity (beyond salaried employment or passive investments) may need to register if their turnover surpasses AED 1 million in a given tax year. This ensures the system covers freelancers, sole proprietors, and self-employed consultants who generate significant business revenue.

Recommended: Business Setup in Dubai – Hassle-Free Company Formation

4. Key Documents & Requirements

To streamline your UAE Corporate Tax Registration, gather these critical items in advance:

- Valid Trade License: Up-to-date and matching the company’s activities.

- Emirates ID or Passport of the Authorized Signatory: Proves identity of the person responsible for registering the company.

- Proof of Authorization (like a Power of Attorney if applicable).

- Business Activity Details: Outline what your company does, especially if you have multiple branches.

- Branch Information: For each branch under the same legal entity, note the trade license details and shareholding structure.

- Ownership Records: If applicable, show stakeholder information (usually needed if an individual owns ≥ 25% of the entity).

Pro tip: Keep these documents in digital format (PDF/Word) under 5 MB each for easy uploading on EmaraTax.

5. Understanding the Latest Registration Timelines (2024–2025)

The FTA has outlined specific deadline windows for corporate tax registration, especially after Decision No. 3 of 2024 took effect on 1 March 2024. It prescribes structured timelines for resident, non-resident, and natural persons to register under Federal Decree-Law No. 47 of 2022. Here’s a quick overview:

1 Entities Formed Before 1 March 2024

If your commercial license was issued before 1 March 2024, you must register according to a month-by-month schedule throughout 2024. For example:

- License issuance Jan–Feb → Deadline by 31 May 2024

- License issuance Mar–Apr → Deadline by 30 June 2024

- License issuance Dec → Deadline by 31 December 2024

If a company has multiple trade licenses, use the one with the earliest issuance date to determine the correct deadline.

2 Entities Formed On or After 1 March 2024

For companies established on or after 1 March 2024:

- If incorporated under UAE law, register within 3 months of the company’s establishment date.

- If established under foreign law but effectively managed in the UAE, register within 3 months after the end of the first financial year.

3 Non-Resident Persons

- Pre–1 March 2024: If recognized as non-resident due to a Permanent Establishment, register within nine months from the PE’s creation. If recognized via a nexus, register within three months of 1 March 2024.

- On or After 1 March 2024: For PEs formed post–1 March 2024, the deadline is six months from PE creation. For nexus-based non-residence, the window is three months from establishing that nexus.

4 Natural Persons

Resident individuals engaged in business activities crossing the AED 1 million turnover threshold in a calendar year have until 31 March of the following year to register. Non-resident individuals who meet corporate tax requirements must register within 3 months of meeting those requirements.

5 Penalties for Late Registration

Failing to register within these timelines triggers administrative penalties (in line with Cabinet Decision No. 75 of 2023), which can reach up to AED 10,000 for delayed registration. Additional fines may apply for incomplete or incorrect filings.

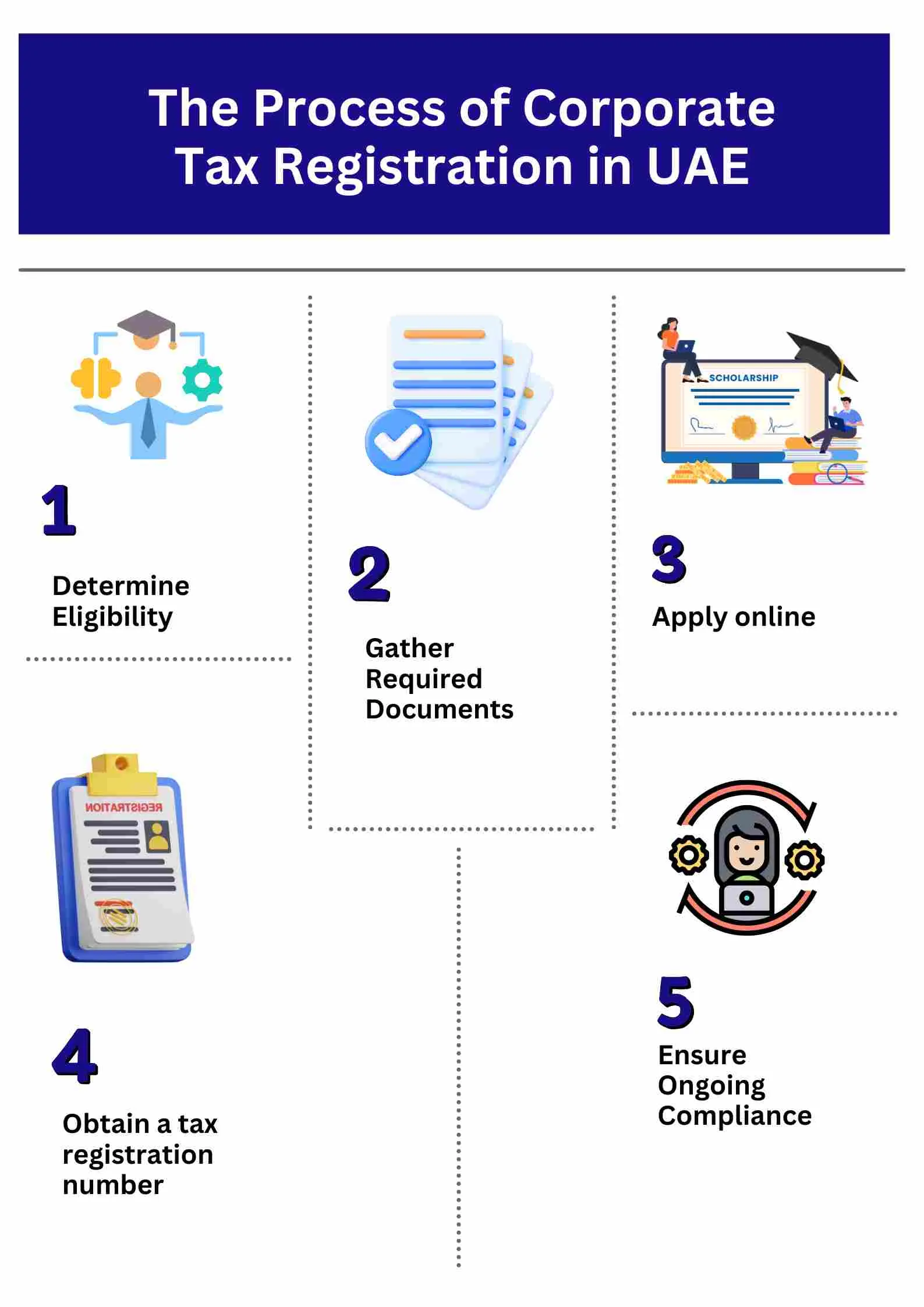

6. Steps For Registering UAE Corporate Tax

Registering for corporate tax is a self-service process via the EmaraTax portal. Below is a concise, yet comprehensive, step-by-step breakdown.

Step 1 – Accessing the EmaraTax Portal

- Website: Navigate to the FTA’s official website (tax.gov.ae) and click on EmaraTax or access directly via the EmaraTax portal link.

- UAE Pass: You can log in using your UAE Pass for added convenience or create an EmaraTax account if you don’t already have one.

Step 2 – Creating or Updating Your Profile

- New Users: Provide basic personal details, verify your email/phone, and set up a secure password.

- Existing Users: Update your profile to ensure that your Emirates ID, contact details, and business info are correct.

Step 3 – Linking Taxable Persons

If you or your company is not yet listed under your EmaraTax profile:

- Add a Taxable Person by entering details like trade license number, legal entity type, and licensing authority.

- Confirm the link so you can access all future corporate tax functionalities under your profile.

Step 4 – Completing the Corporate Tax Registration Application

Within EmaraTax:

- Select “Register” under the Corporate Tax tab.

- Choose the Entity Type: Mainland LLC, Free Zone Entity, Branch, or Foreign Company, etc.

- Enter Business Details: Legal name in English and Arabic, trade license info, date of license issuance, etc.

- Add Business Activities: Indicate the industries or activities your entity engages in (e.g., consulting, trading).

- Provide Ownership/Stakeholder Info: For owners with ≥ 25% stake, input their details.

- Branch Information: If you operate multiple branches, specify each branch’s license and activities.

- Authorized Signatory: Include Emirates ID/passport details of the signatory and attach relevant proof of authorization.

Step 5 – Review & Declaration

- Check All Data: Make sure everything is accurate—trade license numbers, entity type, personal details.

- Declaration: Tick the box confirming your submission is truthful and complete.

- Submit: Finalize the application.

Step 6 – Obtaining Your Tax Registration Number (TRN)

The FTA typically reviews applications within 20 business days (or less). Once approved, your entity will be assigned a Tax Registration Number (TRN) for corporate tax. Keep this number handy for all future filings, payments, and official communication with the FTA.

7. UAE Corporate Tax Rates & Exemptions

The corporate tax regime is designed with graded rates and specific exemptions.

1 0% Rate on Income Below AED 375,000

For small businesses and startups, any taxable income below AED 375,000 is subject to a 0% tax. This threshold is meant to encourage SME growth and reduce the burden on smaller entities.

2 9% Rate on Income Above AED 375,000

Any taxable income exceeding AED 375,000 is taxed at 9%. Mainland companies generating substantial revenue should budget accordingly and maintain accurate records for compliance.

3 Free Zone Corporate Tax Treatment

Free zone businesses (including financial free zones like DIFC or ADGM) can still enjoy corporate tax incentives at a 0% rate if they meet the criteria for a Qualifying Free Zone Person (QFZP):

- Maintain no or minimal mainland operations.

- Comply with all relevant regulatory requirements of the free zone authority.

- Engage only in permitted activities within the zone or outside the UAE.

4 Other Exemptions & Key Points

- Extraction of Natural Resources: Remains subject to Emirate-level corporate taxation, thus generally exempt from federal corporate tax.

- Capital Gains & Dividends: Gains earned from qualifying shareholdings may be exempt from corporate tax.

- Intra-Group Transactions: Qualifying reorganizations and transactions between group entities can be exempt if conditions are met.

8. Filing Corporate Tax Returns & Payment Obligations

Under the self-assessment system, businesses must:

- File a single consolidated corporate tax return within nine months of their financial year-end.

- Pay any tax due by the filing deadline.

For instance, if your financial year ends on 31 December 2024, your first corporate tax return and payment would be due by 30 September 2025. If your fiscal year ends on 31 May 2024, you’d have until 28 February 2025 to file.

Remember: If you fail to file or pay on time, additional penalties can apply on top of your corporate tax liability.

9. Maintaining Accurate Financial Records & Compliance

Maintaining solid financial records isn’t just a best practice—it’s a legal requirement for corporate tax compliance in the UAE.

1 Importance of Proper Bookkeeping

- Audit Readiness: The FTA or other authorities might request financial statements. Well-kept books speed up the process and minimize disputes.

- Penalty Avoidance: Incomplete records can lead to penalties or rejections of tax returns.

- Strategic Insights: Accurate data helps you evaluate profits, identify inefficiencies, and optimize cash flow.

2 Audits & Transfer Pricing Considerations

Following OECD guidelines, the UAE’s corporate tax law includes transfer pricing provisions for related-party transactions. Businesses must maintain transfer pricing documentation (i.e., Master File and Local File) to demonstrate that related-party deals are at arm’s length.

10. Deregistration & Ceasing Operations

If your company ceases activity, you must deregister from the FTA. This involves:

- Filing a final tax return.

- Settling any outstanding tax liabilities.

- Submitting a deregistration application through EmaraTax.

Once approved, you’ll no longer be liable for corporate tax obligations, but you must keep relevant records for a statutory retention period (often 5 years) in case of audits.

11. Common Mistakes & How to Avoid Them

1. Delaying Registration

Some businesses assume they can wait until the last minute to register. In reality, missing the FTA’s deadlines triggers penalties of up to AED 10,000.

Solution: Mark your calendar or set reminders to register before your designated deadline.

2. Incomplete or Incorrect Information

Errors in your application (e.g., wrong license number, missing trade license attachments) can cause delays or rejections.

Solution: Double-check your data, ensure it matches official documents, and keep PDF files under 5 MB.

3. Poor Record-Keeping

Storing receipts in random files or ignoring monthly statements can create huge complications at year-end.

Solution: Invest in a reliable accounting system and track all revenue and expenses meticulously.

4. Not Understanding Free Zone vs. Mainland Obligations

Free zone businesses that generate mainland income or have significant onshore operations might lose their 0% benefit.

Solution: Clarify your business activities with a tax consultant if your free zone entity serves mainland clients.

5. Ignoring Transfer Pricing Rules

Related-party transactions not backed by transfer pricing documentation can lead to compliance breaches.

Solution: Follow OECD standards and maintain a robust paper trail for any inter-company dealings.

12. Penalties & Non-Compliance Implications

In addition to missing registration deadlines, the UAE’s corporate tax law imposes penalties for:

- Late Filing: Fines escalate if you repeatedly file past deadlines.

- Late Payment: Interest charges or penalties for overdue amounts.

- Misrepresentation or Fraud: Severe penalties or legal actions if you intentionally provide false information.

- Record-Keeping Failures: If the FTA deems your financial records insufficient, you may face investigations and penalties.

Key takeaway: Penalties can accumulate, tarnish your reputation, and disrupt your operations. Compliance is always cheaper than non-compliance.

13. Frequently Asked Questions (FAQs)

Q1: Do I have to register for corporate tax if my business is in a free zone and I have no mainland customers?

A1: Yes. All free zone businesses must register, but you may maintain a 0% tax rate if you qualify as a Qualifying Free Zone Person and meet the FTA’s requirements.

Q2: What if my business started operations in 2024 but I still have no taxable profits?

A2: Regardless of profit levels, you’re generally required to register once you begin operations if your entity type falls under the corporate tax law. You might end up paying 0% if your taxable income is below AED 375,000, but you still need to be in the system.

Q3: Are individuals with a small side hustle or freelancing gig required to register?

A3: You must register if your annual turnover crosses the AED 1 million threshold or if your activity is considered a business under the law. If in doubt, consult a tax advisor to clarify your obligations.

Q4: How do I know if I’m “non-resident”?

A4: You’re generally non-resident if you’re incorporated outside the UAE and do not have a management or control base in the UAE. But if you set up a branch (PE) or establish a nexus (specific activities generating UAE income), you’ll likely need to register.

Q5: Can the FTA reject my corporate tax registration?

A5: Rarely, if you provide accurate data. Most rejections happen due to incorrect details or incomplete forms. Always verify your application thoroughly.

Q6: Are there any ongoing fees to maintain my corporate tax registration aside from the tax itself?

A6: While the FTA doesn’t levy an annual registration fee, you must pay the corporate tax due (if any) and comply with deadlines. If you hire a tax consultant, those are separate professional fees.

Q7: How long must I keep my financial records?

A7: Typically, 5 years from the end of the relevant tax period, although certain industries or free zones might require a longer retention. Confirm with the FTA or local authority if you’re unsure.

14. Expert Assistance & Next Steps

Navigating UAE Corporate Tax can feel overwhelming when you have to:

- Register within strict deadlines,

- Understand new legal definitions,

- Keep up with transfer pricing rules,

- Maintain meticulous records.

For peace of mind, partner with corporate tax consultants in Dubai or your respective emirate. They’ll help you:

- Interpret Federal Decree-Law No. 47 of 2022 and Decision No. 3 of 2024,

- Structure your corporate tax strategy (especially if you have cross-border transactions),

- Plan your finances to optimize available exemptions or incentives,

- File returns accurately and on time,

- Represent you in case of audits or queries from the FTA.

Remember: Investing in professional advice often pays for itself by reducing penalties and helping you capitalize on tax benefits.

15. Conclusion

Registering for corporate tax in the UAE is now a core aspect of doing business. From obtaining a Tax Registration Number (TRN) to filing returns and possibly deregistering if you cease operations, the process is straightforward once you understand the FTA’s guidelines and deadlines.

Here’s a final rundown to keep in mind:

- Registration is mandatory for mainland companies, free zone companies, and certain non-resident persons.

- Timelines differ if your entity was formed before or after 1 March 2024—always check the relevant month-based or 3-to-9-month windows.

- The corporate tax rate in the UAE is 0% for income up to AED 375,000, and 9% thereafter. Free Zone businesses can maintain a 0% rate if they don’t engage in mainland operations and comply with zone regulations.

- Penalties for non-compliance can reach AED 10,000 or more. Penalties escalate for missed deadlines, inaccurate filings, or insufficient recordkeeping.

- Use the EmaraTax portal for user-friendly registration and streamlined filing. Keep your documents (e.g., Emirates ID, trade license) ready in digital format.

- For added peace of mind, consult a corporate tax advisor or specialized accounting firm to ensure you remain fully compliant and up to date with any new regulations.

With the right preparation, you’ll breeze through corporate tax registration and focus on what truly matters—growing your business in one of the world’s most dynamic markets.