Establishing a business in Hamriyah Free Zone (HFZ), Sharjah, offers strategic advantages including 100% foreign ownership, zero corporate and personal taxes, and full profit repatriation. HFZ provides cost-effective licensing options starting from AED 11,000, streamlined company formation processes, and access to state-of-the-art infrastructure such as warehouses, industrial plots, and executive offices. Its prime location near Sharjah International Airport and deep-water seaports facilitates seamless global trade, making it ideal for industries like manufacturing, logistics, petrochemicals, and marine services. HFZ’s investor-friendly policies and robust facilities position it as a premier destination for business setup in the UAE.

Company Formation & Business Setup in Hamriyah Free Zone Sharjah

Hamriyah Free Zone (HFZA) is a world-class business hub located in Sharjah, one of the most industrially vibrant emirates of the United Arab Emirates (UAE). Established in 1995, HFZA spans over 2,590 hectares and is strategically positioned on the Arabian Gulf, giving it unparalleled access to global markets. With over 6,500 businesses from 160+ countries, HFZA has emerged as a key driver of the UAE’s economic growth.

This free zone is not just about its strategic location—it’s about opportunity. Businesses operating in HFZA enjoy a tax-free environment, 100% foreign ownership, and customs duty exemptions. Whether you are a startup, a medium-sized enterprise, or a multinational corporation, HFZA offers a platform to grow and thrive.

The free zone is particularly attractive to industries such as:

- Oil and Gas

- Petrochemicals

- Steel and Construction

- Logistics

- Food Packaging

- Marine Services

HFZA’s modern infrastructure, investor-friendly policies, and efficient business setup process make it one of the most competitive free zones in the UAE.

Why Choose Hamriyah Free Zone?

Setting up a business in the UAE is a significant decision, and selecting the right free zone is crucial. Here’s why Hamriyah Free Zone stands out:

A. Strategic Location

HFZA is positioned in a prime location on the Arabian Gulf with direct access to the Indian Ocean, making it a gateway for international trade. Its proximity to Sharjah International Airport, three major seaports, and well-connected road networks ensures seamless transportation of goods and services.

B. Tax-Free Environment

One of the biggest advantages of HFZA is its 100% exemption from corporate and personal income taxes, allowing businesses to maximize profits. This tax-free status is particularly beneficial for companies engaged in international trade and large-scale operations.

C. Full Foreign Ownership

Unlike many business models in the UAE, HFZA allows 100% foreign ownership without requiring a local partner. This gives investors complete control over their business operations and decisions.

D. Flexible Business Setup

HFZA offers a streamlined business setup process, enabling companies to get started within 1–2 weeks. Whether you need a license for trading, manufacturing, or services, HFZA provides options tailored to your needs.

E. Industry-Specific Support

From marine services and steel manufacturing to food packaging and petrochemicals, HFZA offers specialized facilities and infrastructure to support various industries.

F. Cost-Effective Solutions

HFZA is known for its affordable operating costs, including competitive license fees, low utility costs, and economical workforce availability. This makes it an ideal choice for small and medium-sized enterprises (SMEs) looking to optimize expenses.

Key Benefits of Setting Up a Business in HFZA

Here are the standout benefits of choosing Hamriyah Free Zone for your business:

A. 100% Ownership

HFZA allows full foreign ownership, giving you complete control over your company without the need for a local sponsor. This is a significant advantage for international businesses.

B. Tax-Free Operations

Businesses in HFZA are exempt from:

- Corporate taxes

- Personal income taxes

- Import and export duties

This ensures maximum profitability and competitiveness.

C. Full Repatriation of Profits

You can transfer 100% of your profits and capital back to your home country, offering complete financial flexibility.

D. Custom Duty Exemption

Companies operating in HFZA benefit from duty-free trading, which is especially advantageous for businesses involved in import/export activities.

E. Affordable Energy Costs

HFZA provides access to low-cost utilities, with electricity priced at $0.05 per KWA and water at $8.17 per 1,000 gallons. This is a major cost-saving factor for manufacturing and industrial operations.

F. Flexible Lease Terms

HFZA offers 15-year leases for industrial plots, extendable by another 25 years, allowing businesses to plan for long-term growth.

G. Advanced Infrastructure

From pre-built warehouses and modern office spaces to industrial plots equipped with utilities, HFZA provides world-class facilities designed for productivity and scalability.

H. Skilled Workforce Availability

HFZA’s location in Sharjah ensures access to a pool of talented professionals, supported by on-site staff accommodations and recreation facilities to maintain employee well-being.

I. Easy Access to Global Markets

With connections to three seaports and Sharjah International Airport, HFZA facilitates easy access to markets in Africa, Asia, and Europe, making it a prime choice for global trade businesses.

J. Industry-Focused Support

HFZA caters to a wide range of industries, providing specialized infrastructure and support for:

- Marine services: Shipbuilding, dry docking, and repair.

- Oil and gas: Facilities for petrochemical storage and bulk handling.

- Logistics: Warehouses and storage solutions for supply chain operations.

Hamriyah Free Zone is more than just a free zone—it’s a platform that empowers businesses to succeed in the UAE and beyond. With its investor-friendly policies, strategic advantages, and cost-effective solutions, HFZA is a top choice for entrepreneurs and businesses looking to expand in the Middle East.

Let me know if you’d like additional sections or further refinements!

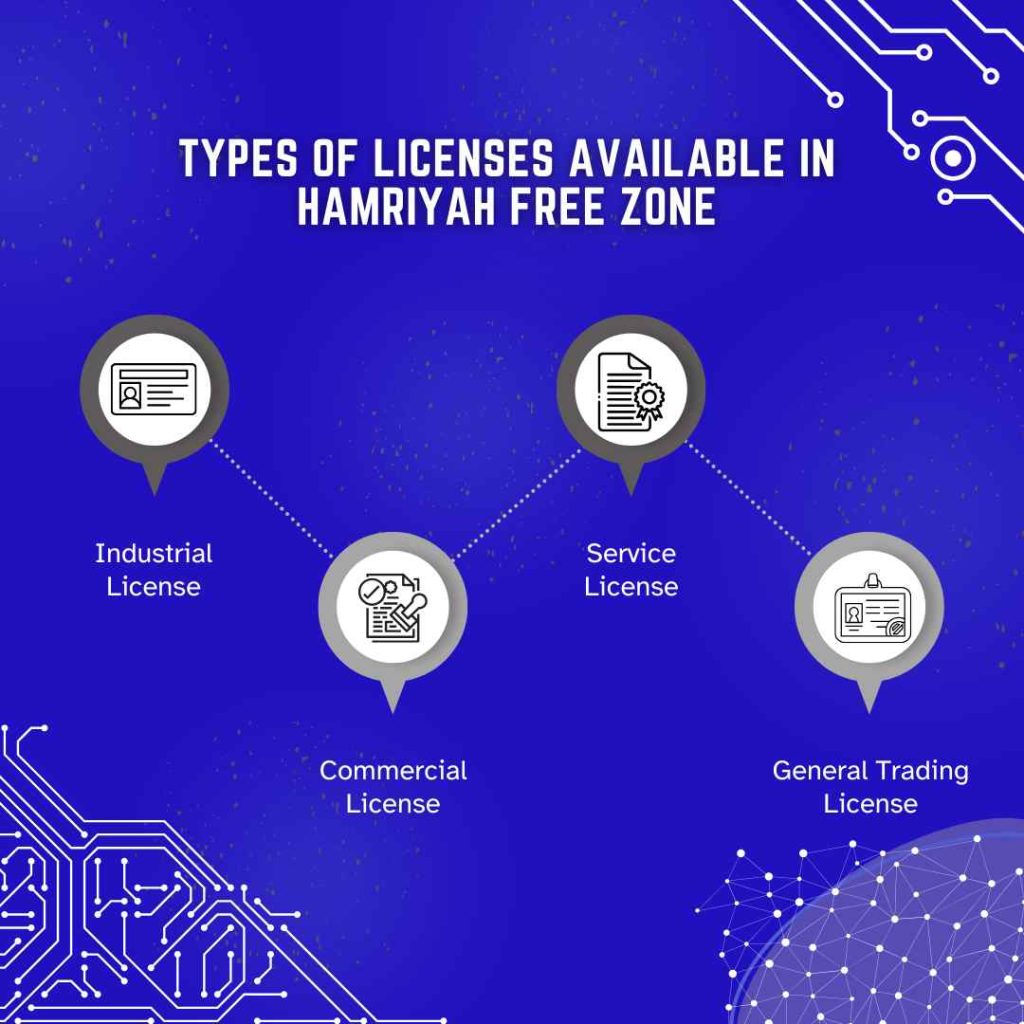

Types of Licenses Available in Hamriyah Free Zone

Know that when choosing your license while setting up in Hamriyah Free Zone Sharjah, it is important in practicing your business functions. Picking from the licenses provided by the free zone, the businesses can choose licenses that suit their needs the best.

A. Industrial License

- Industrial License Designed and intended for manufacturing, production, and assembly firms who wish to establish industrial plants.

B. Commercial License

- Commercial License is Ideal for trading concerns such as import/export and distribution.

C. Service License

- Targeting consultancy firms, IT solutions, and other professional service-delivering organizations.

D. General Trading License

- Enables the swapping of a variety of products, and thus the versatility of most kinds of commercial activities.

Review our business setup in UAE services to find out which license is best for you.

Recommended: Trade License Renewal Dubai: A Complete 2025 Guide

Infrastructure and Facilities at Hamriyah Free Zone

Hamriyah Free Zone has adequate infrastructure and facilities to accommodate many types of industries today. This free zone aims to meet the needs of its sectors, from manufacturing to logistics.

A. World-Class Facilities

- Industrial Zones: accommodation facilities for large industries and small industries, respectively.

- Warehousing: versatile storage systems with career logistics backup.

- Office Spaces: Beautifully furnished or even partially fitted office spaces that can also be in an executive fitout.

- Land Plots: It is open for big industrial and commercial production and use only.

B. Connectivity and Accessibility

- Location advantages include its closeness to Sharjah International Airport and the main seaports.

- Very good transport corridors to Dubai and other emirates.

- Flexibility in integration with global supply chain networks.

For additional information on types of facilities that can be found in the Hamriyah Free Zone Sharjah, visit the official website of the Hamriyah Free Zone Sharjah.

Comparison: Hamriyah Free Zone vs Other UAE Free Zones

When setting up a business in the UAE, choosing the right free zone is a critical decision. Hamriyah Free Zone Authority (HFZA) is one of the top contenders, but how does it compare to other free zones like SHAMS, RAKEZ, and IFZA? Here’s a side-by-side comparison to help you decide.

A. Licensing Costs

HFZA offers competitive pricing for licenses, starting at AED 11,000, which includes flexible options for trading, manufacturing, and services.

- SHAMS (Sharjah Media City): Known for its affordability, SHAMS licenses start at AED 5,750, but they are more focused on media and creative industries.

- RAKEZ (Ras Al Khaimah Economic Zone): License costs begin at AED 11,440 and are ideal for SMEs and trading businesses.

- IFZA (International Free Zone Authority): Costs start from AED 12,900, with strong focus on general trading and e-commerce.

B. Strategic Location

HFZA is located on the Arabian Gulf, offering direct access to global trade routes. Its proximity to Sharjah International Airport and three seaports, including Khor Fakkan Port, makes it perfect for industries relying on logistics and shipping.

- SHAMS: Located in Sharjah city, it offers convenience for businesses focused on the local market but lacks direct port access.

- RAKEZ: Positioned in Ras Al Khaimah, this free zone provides access to the northern UAE markets and some port facilities.

- IFZA: Situated in Dubai, IFZA offers access to the vibrant business environment of Dubai, but at a higher cost.

C. Industries Supported

HFZA stands out for its focus on heavy industries such as oil and gas, marine services, and steel manufacturing. It also supports logistics, trading, and construction.

- SHAMS: Primarily supports media, creative, and digital businesses.

- RAKEZ: A mix of trading, manufacturing, and service industries.

- IFZA: General trading, IT, and e-commerce are its main focus areas.

D. Facilities

HFZA provides modern offices, customizable warehouses, and industrial plots with affordable utility rates. Additionally, its deep-water ports and 7-meter inner harbor make it ideal for maritime and shipping businesses.

- SHAMS: Limited to small offices and co-working spaces.

- RAKEZ: Offers industrial plots, warehouses, and flexi-desks for startups.

- IFZA: Known for shared offices and affordable desk spaces.

E. Tax Benefits

All free zones in the UAE, including HFZA, offer 0% corporate tax, personal tax exemptions, and duty-free trade. However, HFZA’s cost efficiency and focus on industry-specific support give it an edge.

Recommended: Business Setup In Freezone – COFOCSP

Industries Thriving in Hamriyah Free Zone

Hamriyah Free Zone is home to a wide range of industries. Its strategic location, specialized infrastructure, and flexible licensing make it a haven for businesses across multiple sectors. Here are the key industries flourishing in HFZA:

A. Oil and Gas

HFZA supports the oil and gas industry with dedicated petrochemical storage facilities, bulk handling terminals, and specialized industrial plots. Its proximity to ports ensures seamless shipping of oil-related products.

B. Logistics and Supply Chain

With access to three seaports, Sharjah International Airport, and well-connected roads, HFZA is a prime location for logistics companies. Businesses benefit from duty-free trade, affordable warehouses, and efficient supply chain solutions.

C. Steel and Construction

Steel and construction businesses thrive in HFZA due to its tailored industrial land, low energy costs, and access to raw materials through nearby shipping channels. HFZA is a key supplier for the booming construction industry in the Middle East.

D. Marine Services

Hamriyah Free Zone’s 7-meter-deep inner harbor and shipbuilding facilities make it a hub for dry docking, ship repairs, and maritime services. The zone is designed to cater to the growing demand for marine infrastructure.

E. Food Packaging

HFZA’s affordable operational costs and specialized infrastructure make it ideal for food packaging and processing companies. Its location ensures smooth export of food products to GCC and global markets.

F. Petrochemicals

The zone offers bulk handling facilities and a well-developed industrial base for petrochemical companies. This industry benefits from HFZA’s proximity to shipping routes and access to skilled labor.

G. Trading and E-Commerce

HFZA supports general trading and e-commerce businesses with flexible licenses, duty exemptions, and access to global markets. Its modern warehouses and office spaces cater to businesses handling imports and exports.

H. Renewable Energy

With a growing focus on sustainability, HFZA has also become attractive to renewable energy companies. Its infrastructure supports manufacturing and assembly for solar and wind energy equipment.

I. Why Industries Thrive in HFZA

- Cost-Efficiency: Affordable licensing, low utility costs, and competitive operational expenses attract businesses.

- World-Class Infrastructure: HFZA provides tailored facilities for each industry, including warehouses, industrial plots, and office spaces.

- Strategic Access: Its location on the Arabian Gulf allows businesses to reach global markets efficiently.

- Investor-Friendly Policies: HFZA’s commitment to 100% foreign ownership, tax-free operations, and customizable solutions makes it a preferred choice for diverse industries.

Hamriyah Free Zone offers the ideal environment for industries to grow and flourish. Whether you’re in logistics, manufacturing, or services, HFZA provides the resources and infrastructure you need to succeed in the UAE’s competitive market.

Cost of Business Setup in Hamriyah Free Zone (HFZA)

Setting up a business in the Hamriyah Free Zone (HFZA) is cost-effective compared to many other free zones in the United Arab Emirates (UAE). HFZA offers competitive pricing for licenses, office spaces, warehouses, and other facilities, making it an excellent choice for startups, small and medium enterprises (SMEs), and large corporations. Here’s a breakdown of the costs involved.

A. Trade License Costs

The cost of a trade license in HFZA depends on the type of license and the business activity. HFZA offers three main types of licenses: Industrial License, Commercial License, and Service License.

| License Type | Cost (AED) | Details |

|---|---|---|

| Industrial License | Starting from AED 11,000 | For businesses involved in manufacturing, processing, or assembly of products. |

| Commercial License | Starting from AED 11,000 | For trading, importing, exporting, and distributing goods. |

| Service License | Starting from AED 11,000 | For professional services such as consultancy, IT, or media production. |

B. Office Space Costs

HFZA provides a variety of office spaces to suit different business sizes. These include executive suites, shared offices, and virtual offices.

| Office Type | Cost Range (AED/year) | Features |

|---|---|---|

| Virtual Office | AED 11,000 | Cost-effective option for startups; no physical office space required. |

| Shared Office Spaces | AED 15,000–20,000 | Suitable for small teams; includes basic facilities like internet and desks. |

| Executive Office Suites | AED 25,000–35,000 | Fully furnished offices with state-of-the-art communication systems. |

C. Warehouse and Industrial Plot Costs

For businesses requiring storage or manufacturing facilities, HFZA offers pre-built warehouses and customizable industrial plots.

| Facility | Cost Range (AED/year) | Details |

|---|---|---|

| Warehouses | AED 56,000–148,000 | Pre-built warehouses with sizes ranging from 200m² to 600m². |

| Industrial Plots | Variable (based on size) | Tailored land plots for heavy industries, manufacturing, and logistics. |

D. Visa Costs

HFZA provides investor and employee visa options. The visa costs vary depending on the type and validity.

| Visa Type | Cost (AED) | Details |

|---|---|---|

| Investor Visa | AED 3,355 (3 years) | For company owners and shareholders. |

| Employee Visa | AED 3,310 (3 years) | For staff members; includes a refundable deposit of one month’s salary. |

E. Additional Costs

| Expense | Cost (AED) | Details |

|---|---|---|

| Incorporation Fee | AED 4,500 (first year) | One-time fee for company registration; waived for branch companies. |

| Establishment Card | AED 1,860 | Required for visa and immigration processing. |

| Service Fee | AED 2,500/year | Includes access to basic services like customer support and zone-specific utilities. |

| Audit Report Waiver | AED 1,000/year | Optional for companies that do not want to submit financial audit reports annually. |

F. Customizable Packages

HFZA offers flexible business setup packages that include licenses, office spaces, and visa quotas. These packages are ideal for businesses looking to streamline costs.

Example Packages:

- Virtual Office Package: AED 11,000/year, includes 1 license and 1 visa quota.

- Executive Office Package: AED 25,000/year, includes 1 license, 4 visa quotas, and furnished office space.

G. Energy and Utility Costs

HFZA is known for its affordable utility rates, which is a major advantage for manufacturing and industrial businesses.

| Utility | Cost | Details |

|---|---|---|

| Electricity | $0.05 per KWA | Competitive rates for industrial and commercial operations. |

| Water | $8.17 per 1,000 gallons | Ideal for businesses requiring high water usage, such as food packaging. |

H. Cost Comparison with Other UAE Free Zones

Hamriyah Free Zone is one of the most affordable free zones in the UAE. Here’s how it compares:

| Free Zone | Trade License Cost (AED) | Visa Options | Key Features |

|---|---|---|---|

| Hamriyah Free Zone | Starting from AED 11,000 | Customizable | Ideal for manufacturing and trading. |

| SHAMS | AED 5,750 | Limited | Best for media and creative businesses. |

| RAKEZ | AED 11,440 | Customizable | Focuses on SMEs and industrial setups. |

| IFZA | AED 12,900 | Customizable | Strong in e-commerce and trading. |

I. Why HFZA is Cost-Effective

- Flexible Licensing: Tailored license types and packages ensure businesses only pay for what they need.

- Affordable Utilities: Low energy and water costs help reduce operational expenses.

- Customizable Facilities: Businesses can choose from pre-built spaces or design their own industrial plots.

- Long-Term Leases: HFZA offers 15–25 year leases, providing stability and cost predictability.

- Duty-Free Trade: Full exemption from import/export duties minimizes costs for trading businesses.

The Hamriyah Free Zone (HFZA) is one of the most affordable and business-friendly free zones in the UAE. With competitive licensing fees, flexible facility options, and low operational costs, HFZA provides a cost-effective platform for businesses to establish and grow. Whether you’re a small startup or a large industrial company, HFZA’s transparent pricing and investor-focused policies make it an excellent choice.

If you’re ready to start your business in HFZA, consult with a business setup consultant to find the package that best suits your needs.

Steps for Company Formation Hamriyah Free Zone

Basically, the process of setting up an enterprise in Hamriyah Free Zone Sharjah is very fast and hassle-free.

Step 1: Choose Your Business Activity

Choose the right activity from the various activities that we have mentioned above according to our business needs.

Step 2: Decide on the Right License

Select a license type according to your operational activities, which may be in the industrial, trading, or service sectors.

Step 3: Submit Required Documentation

Photos of passports, business plans, and proof of your residential area.

Step 4: Obtain Your License

Finally, get your registration done, and you will obtain your business license.

Step 5: Open a Corporate Bank Account

Open a business account for the easy and efficient running of your business affairs.

Get in touch with the business setup consultants in Dubai for an easy set-up of your company and legal requirements.

Advantages for Specific Industries

While Hamriyah Free Zone is relatively useful for selected industries due to specialized facilities and friendly policy.

A. Manufacturing and Industrial Enterprises

- Availability of the industrial zones or plots of land.

- Facilities and infrastructure must advance to meet the demand of manufacturing.

B. Trading and Logistics Companies

- Proximity to seaports and airports as major centers of traffic.

- The provision of advanced and efficient lines of warehousing and distribution services.

C. SMEs and Startups

- Affordable price suits endeavored small business owners as the packages are designed for.

- The answer is as follows: flexible offices and coworking.

D. Investors and Exporters

- No taxation and 100% profit remittance.

- Sociopolitical factors include the ease of doing business. This is due to simplified customs processes for import/export activities.

Exploring Dubai Freezone License for companies interested in our Freezone for business forays in the United Arab Emirates.

Recommended: FreeZone Companies in UAE: Benefits, Costs 2025

FAQS About Hamriyah Free Zone Sharjah

Q1. Which industries are allowed in Hamriyah Free Zone?

There are several types of licenses available in Hamriyah Free Zone for manufacturing, trading logistics, and service industries.

Q2. Are you allowed to obtain several licenses in Hamriyah Free Zone?

Yes, different operations can be under one entity while being licensed to work in different fields.

Q3. What about the visa is favorable to the employees?

Yes, for the employees and their dependents, the visa processing in Hamriyah Free Zone is made easier.

Q4. Which type of capital is likely to be considered as the minimum capital requirement?

In this case, the minimum capital only differs based on the business type and the license obtained.

Contribution to UAE’s Economy

Hamriyah Free Zone Sharjah plays a vital role in the UAE’s economic development by:

- Fund for foreign investment and industrial development.

- Promoting exports and exports linked business operations through physical and non-physical linkages.

- Relationship between the government and development of SMEs and innovation.

- Employment generation and development of human resources in the region.

Common Mistakes to Avoid When Setting Up a Business in Hamriyah Free Zone (HFZA)

Starting a business in Hamriyah Free Zone (HFZA) can be an exciting journey, but there are a few common mistakes that new business owners often make. By understanding these pitfalls, you can save time, money, and unnecessary hassle.

A. Choosing the Wrong Business License

One of the most common mistakes is selecting the wrong type of license. HFZA offers industrial, commercial, and service licenses, each tailored to specific activities. For example:

- If you’re trading goods, a commercial license is necessary.

- For manufacturing or assembly, an industrial license is required.

Tip: Consult a business setup consultant in Dubai to ensure you choose the right license for your activities.

B. Incomplete Documentation

Incomplete paperwork can delay your business registration process. HFZA requires documents like:

- Passport copies of all shareholders.

- A Memorandum of Association (MOA) for multi-shareholder companies.

- A signed lease agreement for your office or warehouse.

Tip: Double-check the documentation checklist or hire a professional to help with the process.

C. Ignoring Renewal Deadlines

Every business license and visa in HFZA needs to be renewed annually. Missing these deadlines can result in fines or operational delays.

Tip: Set reminders for license and visa renewals to avoid unnecessary penalties.

D. Underestimating Costs

While HFZA is cost-effective, some entrepreneurs overlook additional expenses like:

- Visa fees

- Warehouse rent

- Service charges

Tip: Prepare a detailed budget that includes all potential costs, such as utilities and staff accommodations.

E. Overlooking Facility Requirements

Choosing the wrong office space, warehouse, or industrial plot can hurt your operations. Some businesses opt for smaller facilities to save money, only to outgrow them quickly.

Tip: Plan for future growth when selecting facilities and ensure they meet your operational needs.

F. Neglecting Market Research

Failing to understand the local and international markets can lead to unrealistic expectations. Businesses need to study their industry trends, competitors, and target audience.

Tip: Conduct thorough market research before setting up your business in HFZA.

G. Skipping Professional Help

Many new entrepreneurs attempt to handle the entire setup process themselves, which can lead to mistakes or delays. HFZA’s streamlined process is straightforward, but professional guidance can make it even easier.

Tip: Work with experienced business setup consultants to ensure a smooth process.

Business Success Stories in Hamriyah Free Zone

A. ABC Trading LLC: A Global Trading Giant

ABC Trading LLC, a trading company specializing in industrial goods, chose HFZA for its strategic location and tax-free policies. By utilizing HFZA’s access to three seaports and proximity to the Sharjah International Airport, they were able to expand their operations across Asia, Africa, and Europe.

Key Takeaways:

- The company benefited from custom duty exemptions, which reduced costs significantly.

- HFZA’s world-class warehouses provided them with seamless inventory management.

B. XYZ Logistics: A Supply Chain Powerhouse

XYZ Logistics started as a small logistics company with just five employees. They chose HFZA for its affordable operational costs and state-of-the-art facilities. Over five years, they expanded to serve multiple international clients.

Key Takeaways:

- Low energy costs (electricity at $0.05 per KWA) allowed XYZ to scale up without stretching their budget.

- HFZA’s long-term leases on industrial plots provided them with stability and room to grow.

C. Gulf Steel Industries: Leading the Steel Market

Gulf Steel Industries is a major player in the steel manufacturing sector. HFZA’s specialized industrial plots and access to raw materials through nearby ports helped the company become a market leader in the GCC region.

Key Takeaways:

- HFZA’s low-cost utilities made large-scale manufacturing affordable.

- The 15–25 year renewable leases ensured a secure base for their operations.

D. Blue Wave Marine Services: Revolutionizing Shipbuilding

Blue Wave Marine Services operates in HFZA’s 7-meter-deep inner harbor, offering ship repair, dry docking, and maintenance services. Their decision to establish in HFZA was driven by its marine-focused infrastructure.

Key Takeaways:

- Proximity to clients in the Middle East reduced delivery times and improved customer satisfaction.

- HFZA’s marine facilities supported their growth in one of the region’s most competitive industries.

E. Fresh Pack Foods: Scaling in Food Packaging

FreshPack Foods, a food packaging company, leveraged HFZA’s affordable warehouses and duty-free trade benefits to expand their export business. They now supply packaged goods to Europe and Asia.

Key Takeaways:

- HFZA’s custom duty exemptions allowed them to price their products competitively in global markets.

- The free zone’s advanced logistics support helped streamline their supply chain.

Why These Stories Matter

These success stories highlight how HFZA supports businesses of all sizes and industries. Whether it’s the strategic location, cost-saving advantages, or tailored facilities, HFZA provides everything needed to grow and thrive in today’s competitive global market.

Take the next step: Learn from these businesses and start your journey in Hamriyah Free Zone. With the right planning, you could be the next success story.

Conclusion

Hamriyah Free Zone Sharjah is one of the successful zones, especially for companies that have a desire to succeed in the fiercely competitive business environment. It has good infrastructure and a great environment. They are ideal for any business to thrive. This free zone provides all the essentials for success. It is for manufacturers, traders, and service providers seeking to invest in the region.

The first step in the ladder of success steps forward. Speak to our business setup consultants in Dubai today to understand how your organisation can benefit from FZE in Hamriyah Sharjah and achieve your business vision.rations.