To get a Dual Business License in Dubai, start by choosing a free zone authorized to offer dual licensing (such as DAFZA or DIFC). First, obtain your free zone license, then secure a No-Objection Certificate (NOC) from the free zone. With the NOC, apply for a mainland license from the Department of Economic Development (DED). Ensure your business activities are eligible under both licenses, comply with all visa sponsorship rules, and finalize any special approvals needed for certain industries. Once approved, you can legally operate in both the free zone and Dubai’s mainland market—enjoying tax exemptions, 100% foreign ownership, and wider customer reach throughout the UAE.

How to Get a Dual Business License in Dubai, UAE

In the fast-moving world of UAE commerce, Dual Business License is more than a buzzword. it is a gateway to operate across two different jurisdictions with a single overarching structure. Whether foreign investor observing the profitable local market or a free zone business seeking mainland expansion, dual licensing offers a strategic advantage that can’t be ignored.

The United Arab Emirates is known for its strong infrastructure, tax-friendly policies, and global business environment. However, free zones traditionally limit your ability to trade directly within the local UAE market unless they involve local distributors or form separate partnerships. That why the concept of dual licensing has gained immense popularity: it lets you retain those free zone tax exemptions, 100% foreign ownership, and streamlined regulations while also unlocking the doors to mainland trade and government contracts.

From cost savings to visa sponsorship advantages, there are countless reasons why entrepreneurs and corporations find a dual license system not just desirable but essential for scaling up in the UAE. In the sections ahead, we’ll study the entire process—beginning with the basic definitions and topping in a step-by-step guide on how to get a dual license in Dubai.

Understanding the Dual Business License System

A. What Is a Dual Business License in Dubai, UAE?

Dual license in Dubai essentially grants a free zone company the legal status to operate simultaneously in the mainland. In simpler term, you,re holding two licenses:

- A free zone license ensures you keep enjoying tax benefits, foreign ownership, and reduced bureaucracy.

- A mainland license, typically issued by the Department of Economic Development (DED), authorizing you to trade directly within the local market and, in many cases, bid for lucrative government contracts.

The idea is to fuse the best of both worlds into a single cohesive framework—no local agent or local sponsor is typically required (depending on the free zone’s agreements), and you can skip renting a separate mainland office if your free zone has a dual licensing arrangement with the relevant mainland authority.

B. Legal Framework & Key Entities

Different emirates and free zones manage dual licensing through various MoUs with the DED or ADDED. Dubai has many free zones, like Dubai Airport Free Zone (DAFZA) and Dubai International Financial Centre (DIFC). Abu Dhabi features Abu Dhabi Global Market (ADGM) and Khalifa Industrial Zone Abu Dhabi (KIZAD), among others. These free zones make agreements with mainland authorities. This allows your free zone entity to operate under a single roof.

Legally, the free zone company is the main entity. The mainland extension acts as a “branch” but avoids the formalities of a full foreign branch. This means you don’t need separate Ministry of Economy registration. You also skip the usual need for an Emirati partner, as long as your business activity is recognized under the dual licensing agreement.

C. Mainland vs Free Zone vs Dual Licensing

- Mainland License:

- Having a Dual license in dubai, you will be able to be fully authorized to trade anywhere in the UAE, including the local market.

- It may require a local partner (if outside the legal frameworks permitting 100% foreign ownership).

- Access to government contracts but typically more bureaucratic steps.

- Free Zone License:

- Enjoy 100% foreign ownership and tax exemptions.

- Limited to trading within the free zone or internationally.

- Quick setup and fewer regulatory limitations.

- Dual Licensing:

- Combines the advantages of both: tax-friendly environment plus direct access to the mainland.

- Usually no different local partner or additional office space onshore.

- Must stick to compliance rules in both jurisdictions.

Benefits of Having Dual License in Dubai

A. Market Expansion & Profitability

Operating under a dual license breaks down market barriers, letting you’ serve local customers without middlemen. If you sell products or services that appeal to the UAE populace, your potential for revenue skyrockets. You can also take part in local tenders, tapping into a sector that free zone businesses alone often can’t access.

B. Cost Savings & Time Efficiency

Surprisingly, dual licensing can be more cost-effective than setting up separate company for free zone and mainland. You usually continue using your’ existing free zone office instead of renting new mainland premises, drastically cutting overhead costs.

Moreover, time-saving is crucial:

Getting a standalone mainland license from scratch can be lengthy; the dual license in the UAE pathway tends to be expedited due to formal agreements between the free zone and DED.

C. Operational Flexibility & Governance

A dual license system lets you use a free zone license for activities like imports, exports, and international trade. You can also use a mainland license for local distribution or services. This split can simplify compliance and help you optimize both parts of your business for better results. Plus, you’re regulated by both the free zone authority, which offers specialized support, and the DED, which ensures local compliance. This setup makes your business stable and well-managed.

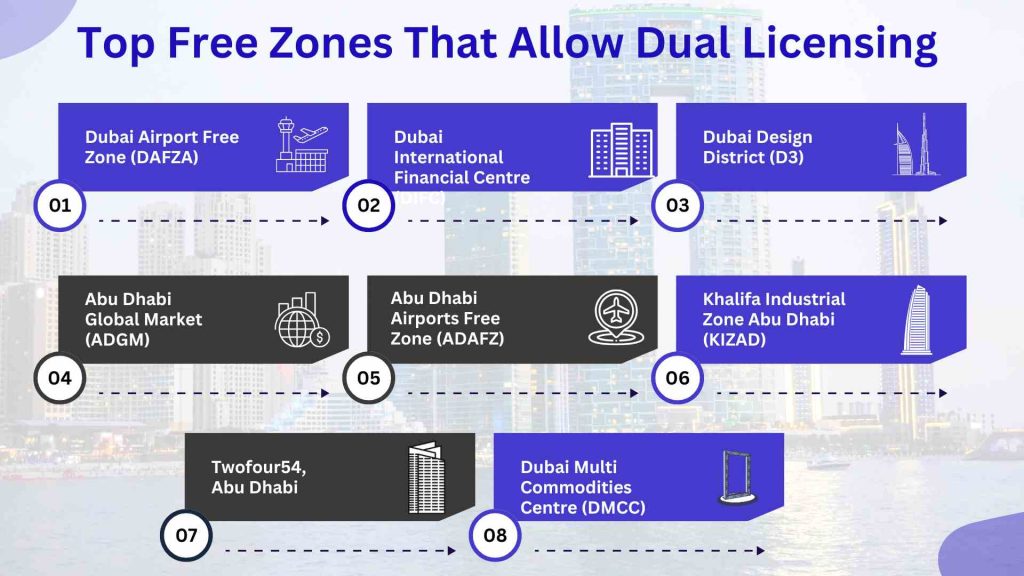

Top Specific Free Zones That Allow Dual Business License

Several free zones across the UAE have partnered with mainland authorities to facilitate dual licensing. Below are some key players each recognized for robust infrastructure, strategic location, and collaboration with Department of Economic Development (DED) or Abu Dhabi Department of Economic Development (ADDED).

A. Dubai Airport Free Zone (DAFZA)

DAFZA stands out for its prime location near Dubai International Airport. It’s particularly attractive for industries reliant on fast logistics and global connectivity. The MoU between DAFZA and the DED enables a DAFZA dual license to free zone entities, so you can streamline operations in both jurisdictions.

B. Dubai International Financial Centre (DIFC)

DIFC is a top financial hub that supports businesses in banking, finance, insurance, and professional services. It has teamed up with Dubai’s DED. This partnership allows dual licensing for DIFC companies. Now, it is easier for them to serve local clients.

C. Dubai Design District (D3)

D3 focuses on creative industries, from fashion and design to art and media. Its partnership with DED opens the door to a dual license system that fosters collaboration between the free zone’s innovative environment and Dubai’s vibrant retail, marketing, and cultural scene.

D. Abu Dhabi Global Market (ADGM)

ADGM stands as Abu Dhabi’s rising financial hub, located on Al Maryah Island. It has an active dual license arrangement with ADDED (Abu Dhabi Department of Economic Development), allowing regulated entities to function in both ADGM and the mainland with minimal fuss.

E. Abu Dhabi Airports Free Zone (ADAFZ)

For aviation or logistics-centered businesses, ADAFZ is ideal. Close to Abu Dhabi International Airport, it aids companies needing quick global reach while offering a dual license option to expand into Abu Dhabi’s mainland market.

F. Khalifa Industrial Zone Abu Dhabi (KIZAD)

KIZAD caters to industrial and manufacturing companies looking for large-scale facilities. Its strategic location by Khalifa Port makes it an attractive hub for shipping and distribution. The dual license initiative, in partnership with ADDED, ensures these manufacturers can also tap into the broader Emirati market.

G. Twofour54, Abu Dhabi

If you’re in the media, entertainment, or creative industries, Twofour54 stands out. Positioned as a media zone, it supports content creation, digital marketing, and more. Through Abu Dhabi’s mainland licensing authority, it allows dual license holders to serve clients beyond the free zone realm.

H. Dubai Multi Commodities Centre (DMCC)

DMCC is known for commodities trading. It has a deal with the DED for a dual license. This lets you trade onshore and offshore. With over 15,000 companies, DMCC is located in Jumeirah Lakes Towers. It supports a global trading network that fits well with the local supply chain.

Dual Business License Eligibility & Requirements

While dual licensing is a phenomenal concept, it’s not universal. Each free zone-DED agreement comes with its own rules, so it’s vital to understand the eligibility criteria and legal restrictions.

A. Business Activities Eligible for Dual Licensing

- Service Activities: Consulting, marketing, IT, etc.

- Trading Activities: Some free zones let you trade specific goods onshore if your products are approved.

- Professional Licenses: Doctors, lawyers, engineers, and other specialists can apply but may need extra approvals from regulators.

- Remember, not all activities qualify for a dual license. Check with your free zone to see if they have the necessary approvals from the Department of Economic Development or ADDED.

B. Legal Structure & Compliance

Technically, your free zone company remains the main entity. The mainland “branch” uses the dual license to legally function onshore without being a true foreign branch. Yet, you must fulfill compliance measures with both the free zone authority and the DED (or ADDED). This includes:

- Ensuring your business activities match in both licenses.

- Following regulatory guidelines for each jurisdiction.

- Maintaining valid NOCs, if required, from the free zone.

C. Visa & Employment Considerations

A key point in dual licensing is that you usually can’t register staff with the Ministry of Labor for the mainland part. All staff must stay under free zone visas. If you need workers for onshore operations, you’ll likely manage them through the free zone entity. This way, they will have free zone resident visas. For many businesses, this setup is easier than handling separate HR processes in different areas.

Steps for How to Get Dual Business License in Dubai

Here’s a general seven-steps roadmap to securing a dual license in Dubai.

Step 1: Select a Free Zone Authorized for Dual Licensing

Start by researching which free zones have an active agreement with the DED. Check your industry match, cost structures, location preferences, and free zone reputation. For instance, if you’re in financial services, a hub like DIFC might be best; for aviation or logistics, you might prefer DAFZA.

Step 2: Obtain Your Free Zone License

Next, apply for a free zone license. This involves:

- Choosing the legal structure (e.g., Free Zone Limited Liability Company).

- Submitting required documents: passport copies, business plan, etc.

- Paying initial fees and finalizing share capital requirements if applicable.

Once approved, you’ll receive your free zone trade license, articles of incorporation, and other official documentation.

Step 3: Secure a No-Objection Certificate (NOC)

With your free zone license, you usually need an NOC from the free zone authority. This document confirms that you can extend your activities to the mainland. This step is crucial. DED won’t issue a dual license without written confirmation from the free zone.

Step 4: Apply for Your Mainland License via the DED

Armed with the NOC, you can approach the Department of Economic Development:

- Fill out the dual license application form.

- Attach your free zone license, NOC, and any additional supporting documents (e.g., lease agreements if needed).

- Pay the applicable fees.

DED officials review the file to ensure compliance with local laws and that your chosen business activities are permissible under their dual licensing scheme.

Step 5: Handle Special Approvals & Regulatory Checks

Certain industries—like healthcare, finance, or legal services—may need extra approvals from sector-specific authorities. In Dubai, these might include the Dubai Health Authority, the Central Bank, or other agencies. Address any outstanding regulatory checks quickly to avoid delays.

Step 6: Finalize Visa & Sponsorship Arrangements

Under a dual license, your employees typically remain on free zone visas. If you plan to add more staff, you might need to request an increased visa quota or larger office space inside the free zone. Communicate these needs early to ensure seamless expansions.

Step 7: Commence Operations in Both Jurisdictions

With all approvals in place, you’re free to trade and offer services across both the free zone and the mainland. Your mainland license from DED is official, so you can engage local customers, sign deals with government bodies, and leverage new opportunities across the Emirates.

Dual License Costs & Budgeting

A. Factors Influencing Your Licensing Costs

Licensing fees in the UAE vary based on:

- Free Zone selection: Some free zones are premium, while others offer discounted packages.

- Business activities: Specialized activities might require higher fees or additional approvals.

- Office requirements: Although you might not need separate mainland premises, certain free zones do mandate a minimum office size.

- Visa quota: More employees means higher visa fees and associated costs.

B. Cost Breakdown & Typical Fee Ranges

While costs differ widely, here’s a rough breakdown for a dual license scenario:

- Free Zone License Setup: Approximately AED 10,000 – 30,000+ depending on location and type of license.

- Mainland License: Ranges from AED 5,000 – 15,000+ (covering DED fees, trade name registration, initial approvals, etc.).

- NOC Fee: Some free zones charge a nominal fee (anywhere from AED 1,000 to 3,000) for the No-Objection Certificate.

- Visa & Sponsorship: AED 3,000 – 5,000+ per visa, subject to free zone policies.

These figures are only indicative. Always request an updated fee schedule from the relevant free zone and DED before you finalize your budgeting.

C. Strategies for Optimizing Expenses

- Negotiate: Certain free zones provide custom packages if your activities match their key sectors.

- Bundle Services: Free zones sometimes package visa quotas, office space, and licensing into one affordable deal.

- Plan Long-Term: If you plan for growth, think about future visa costs and make sure your license allows for expansion.

- Monitor Renewals: Keep track of renewal fees and deadlines. Delays or lapses can incur hefty fines.

FAQS

Here are some common questions about dual licensing in Dubai and the UAE. These questions include important keywords and phrases that users often search for.

Q1: Can I Hire Mainland Staff Under a Dual License?

You usually hire and sponsor all employees under the free zone entity. The dual license does not allow for separate Ministry of Labor registration for the mainland branch. This setup works for many businesses, but check your free zone’s rules on visa quotas and minimum office space.

Q2: Are All Activities Eligible for Dual Licensing?

No, not all activities qualify. Each free zone and the Department of Economic Development (DED) has a list of approved activities for dual licensing. Highly regulated sectors like healthcare, legal services, and education may need extra approvals or might not be eligible under some free zones.

Q3: Do I Need Additional Office Space on the Mainland?

Often, no. One main benefit of a dual license is that you can use your free zone office for both areas. However, some free zones or activities may still require a physical presence onshore. Always check with your free zone and DED guidelines.

Q4: Is a Dual License the Same as a Branch?

They are similar but not the same. With a dual license, the mainland extension is labeled as a branch on the DED trade license. It doesn’t require full foreign branch registration with the Ministry of Economy. This saves time and money while keeping you compliant.

Q5: What About Special Sectors Like Healthcare or Education?

These sectors often require special approvals from agencies like the Dubai Health Authority or the Ministry of Education. Sometimes, the free zone and DED set up specific pathways, but always check if your niche qualifies for a dual license. You might need to meet extra training, safety, or facility standards.

Real-World Scenarios & Relatable Examples

Scenario 1: An E-commerce Startup

Imagine launching an e-commerce store to sell handmade crafts in the GCC. You set up in a free zone for 100% foreign ownership and easy customs. You also want to sell to local shops and attend fairs in Dubai. A dual license allows you to create a mainland presence without needing a separate office. This way, you keep your tax exemptions from the free zone while selling in malls or pop-up events on the mainland.

Scenario 2: A Marketing Agency

A marketing agency gets a free zone license for its international clients and tax benefits. With a dual license, the agency can pitch local government departments for PR campaigns. It can sign direct contracts and host events in the city without needing a local agent.

These examples show how entrepreneurs benefit from dual licenses to combine cost-efficiency, market reach, and compliance in a single package.

Expert Tips for Successful Dual Licensing in Dubai

- Plan Early & Pick the Right Free Zone: Look at your sector and client base. Consider your local business potential before choosing a free zone.

- Clarify Visa Needs: If you plan to hire locally, check your visa quota. Think about future expansions in the free zone.

- Understand Regulatory Details: Some high-profile industries need special approvals. Be ready for extra time and fees.

- Monitor Renewals & Fees: Remember to renew both the free zone and mainland licenses on time.

- Seek Professional Help: Hiring an experienced consultant or legal advisor can make compliance easier, especially for specialized activities.

Conclusion & Key Takeaways

Securing a dual license in Dubai blends the best advantages of free zone operations—like 100% foreign ownership, tax benefits, and lower bureaucracy—with the ability to trade freely on the mainland. This synergy can catapult your venture, allowing global expansions while capturing the profitable UAE market.

However, it’s crucial to remember that eligibility, costs, and compliance rules vary among free zones. By choosing a free zone that has a robust agreement with the Department of Economic Development (DED) or Abu Dhabi Department of Economic Development (ADDED), you set yourself up for an efficient licensing journey. From there, a No-Objection Certificate (NOC), the correct business activities, and the right approvals will guide you toward setting up a smooth, dual-licensed entity.

Above all, do your due diligence. Thoroughly compare different free zones, understand the legal implications, and never rush the process. If you manage it well, you can harness both local and international markets under a single cohesive corporate umbrella—and that’s an investment with long-term returns in the UAE’s thriving economy.

Start Your Journey in Dubai with COFOCSP

Undoubtedly, obtaining a dual license in Dubai can open up a world of opportunities for businesses. By holding two licenses, your company can tap into multiple markets and cater to a broader customer base.

While the process of securing a dual license in the UAE might seem daunting, professional guidance makes it smoother and more efficient. At COFOCSP (cofocsp.com), we specialize in Business setup in Dubai, Business Setup in UAE, and business setup in freezone, delivering tailored solutions for every entrepreneur’s needs.

As leading business setup consultants in Dubai, our team has the expertise to handle every facet of Company formation in Dubai—from choosing the ideal free zone and business activity to obtaining licenses, arranging office space, and managing visa requirements. We provide a clear, step-by-step process that ensures a hassle-free and successful launch of your venture.

Don’t limit yourself to just one market when you can conquer two. With COFOCSP’s in-depth knowledge, you can unlock the full potential of a dual license in Dubai and take your business to new heights. Visit us at cofocsp.com and let’s transform your vision into reality!