If you’re wondering how to get an e-commerce license in Dubai, here’s the concise version:

- Choose a Setup (Mainland via the Department of Economic Development or a recognized Free Zone).

- Identify Your Activity (E-trader, Portal, or Virtual model).

- Gather Documents (Passport copy, Emirates ID, business plan, etc.).

- Submit Application & Pay Fees (Costs vary from around AED 5,750 upwards).

- Register for VAT & Other Approvals if required.

- Open a Corporate Bank Account for smooth financial transactions.

- Integrate a Payment Gateway and launch your site or platform.

That’s the high-level summary. Read on for a deep dive into every aspect of obtaining an e-commerce license in Dubai, covering all your pressing questions, valuable insights on compliance, cost breakdowns, visa rules, and more.

How to Get Ecommerce License in Dubai? Complete Guide 2025

Dubai has emerged as a global hub for e-commerce, with its market size predicted to reach USD 16.53 billion by 2028 and a compounded annual growth rate (CAGR) of 11.52%. For entrepreneurs looking to capitalize on this rapid expansion, obtaining an e-commerce license is the first crucial step to launch an online business in the United Arab Emirates (UAE).

In this comprehensive guide, we provide a detailed walkthrough on how to get an e-commerce license in Dubai. We will cover every relevant subtopic—from understanding the market and types of licenses available to the step-by-step registration process, costs, compliance, and even the best practices in digital marketing. Whether you are planning to operate solely online or combine an online presence with a physical storefront, this article addresses your primary concerns and questions with factual accuracy, real-life examples, and expert insights.

- Understanding the E-commerce Market in Dubai

- What is an E-commerce License?

- Types of E-commerce Licenses in Dubai

- Free Zone vs. Mainland E-commerce Licenses

- Steps For E-commerce License in dubai

- Cost Breakdown and Financial Considerations

- Additional Factors and Best Practices

- Case Studies and Real-World Examples

- Frequently Asked Questions (FAQs)

- Conclusion

Understanding the E-commerce Market in Dubai

A. Market Growth and Financial Figures

Dubai’s e-commerce market is thriving. According to recent statistics, the sector reached a market value of USD 3.9 billion in 2020, with a significant year-on-year increase of 53%. Experts forecast that by 2028, this figure could soar to USD 16.53 billion. These financial figures underscore the dynamic shift from traditional brick-and-mortar retail to digital commerce, driven by high internet penetration, increased smartphone usage, and government initiatives to foster a digital economy.

Key financial figures include:

- 2020 Market Value: USD 3.9 billion

- Forecast for 2028: USD 16.53 billion

- CAGR: 11.52%

This robust growth makes Dubai an attractive destination for starting an e-commerce business.

B. Key Benefits of Operating in Dubai

Dubai offers several compelling advantages for e-commerce entrepreneurs:

- Thriving Consumer Base: With over 9.46 million internet users as of 2024, Dubai boasts a diverse and tech-savvy population.

- Strategic Geographic Location: Situated at the crossroads of Africa, Asia, and Europe, Dubai facilitates seamless international trade.

- Tax Advantages: Enjoy favorable tax regimes, including potential exemptions from corporate and income tax, and no sales tax (VAT) on exports.

- Streamlined Business Setup: The Department of Economic Development (DED) and free zone authorities offer efficient processes for business registration.

- Advanced Infrastructure: World-class logistics, high-speed internet connectivity, and state-of-the-art facilities support seamless e-commerce operations.

- Government Support: Proactive initiatives and supportive policies enhance the business environment.

What is an E-commerce License?

A. Definition and Scope

An e-commerce license is an official authorization that permits individuals or companies to engage in online trading activities within Dubai. This license enables the sale of goods and services via digital channels such as websites, mobile applications, and social media platforms. Whether you plan to operate solely as an online business or complement a physical store, having the appropriate e-commerce license is mandatory to ensure compliance with local regulations.

B. Primary and Secondary Entities

At the heart of obtaining an e-commerce license are key entities and regulatory bodies that oversee the process:

- Primary Entities:

- Secondary Entities:

- Federal Tax Authority (FTA): Involved in VAT registration and compliance.

- Local Banks: Provide corporate banking services required for processing payments.

- Payment Gateway Providers: Although we refer to these generically, they facilitate secure online transactions.

These entities ensure that your business meets all legal and regulatory requirements while providing support services that are critical to your online operations.

Types of E-commerce Licenses in Dubai

Dubai offers multiple types of e-commerce licenses to cater to various business models and operational scales. Here, we discuss the three primary types available:

A. E-Trader License

The E-Trader License is designed for small-scale, home-based online businesses. Issued by the Department of Economy and Tourism (DET) in Dubai, this license allows entrepreneurs—primarily UAE and GCC nationals—to sell products through social media channels.

Key Characteristics:

- Single Ownership: Only one owner is permitted.

- No Physical Store: Does not allow the operation of a brick-and-mortar outlet.

- Limited Visa Allocation: Typically, this license does not offer business visas.

- Budget-Friendly: This is one of the most cost-effective options for starting an online business.

B. Portal License

The Portal License is suited for businesses that plan to operate online platforms connecting buyers and sellers. This type of license is ideal for establishing an online marketplace or a listing website.

Key Characteristics:

- Broader Eligibility: Available to both residents and non-residents.

- Diverse Business Activities: Enables operations across multiple sectors, from retail to reservation services.

- Cost-Effective: Generally more affordable than a general trading license.

- Enhanced Functionality: Supports multi-vendor operations and enables online advertising.

C. Virtual Company License

For overseas investors or non-residents aiming to establish an e-commerce presence in Dubai, the Virtual Company License is the optimal choice.

Key Characteristics:

- Remote Setup: Allows business registration without a physical office or warehouse.

- Limited Commercial Activities: Typically covers digital services such as computer programming, design, and advertising.

- Foreign Investment Friendly: Facilitates 100% foreign ownership with streamlined procedures.

Free Zone vs. Mainland E-commerce Licenses

One critical decision for e-commerce entrepreneurs in Dubai is choosing between a free zone license and a mainland license. Both options have unique advantages and compliance requirements.

Free Zones in Dubai

Free zones offer specialized business environments with numerous incentives. Here are some key free zones for e-commerce:

A. DMCC (Dubai Multi Commodities Centre)

- Overview: DMCC is a leading free zone known for its robust infrastructure and diverse business activities.

- Benefits: Offers competitive licensing fees, streamlined registration, and a supportive network for international traders.

- Ideal For: Businesses that require access to global markets and sophisticated logistics support.

B. RAKEZ (Ras Al Khaimah Economic Zone)

- Overview: RAKEZ is renowned for its cost-effective solutions and flexibility.

- Benefits: Low licensing costs, minimal capital requirements, and straightforward procedures.

- Ideal For: Small-to-medium enterprises (SMEs) and startups looking for an affordable entry point.

C. Dubai South

- Overview: Dubai South is strategically located near Dubai International Airport, offering excellent connectivity.

- Benefits: Integrated logistics, state-of-the-art facilities, and efficient business setup processes.

- Ideal For: E-commerce businesses that rely on efficient shipping and logistics.

D. Dubai CommerCity (DCC)

- Overview: Dubai CommerCity (DCC) is a purpose-built free zone for e-commerce ventures, designed to provide a comprehensive ecosystem for digital businesses.

- Benefits: Attractive investment incentives such as 100% foreign ownership, zero corporate tax, and full repatriation of capital and profits.

- Ideal For: Businesses with international aspirations and those seeking a highly specialized e-commerce environment.

Mainland Licensing with the Department of Economic Development (DED)

Mainland licenses are issued by the Department of Economic Development (DED) and allow businesses to operate directly within the local market.

Key Features:

- Direct Access: Businesses can trade directly with the local UAE market without the need for a local agent.

- Comprehensive Business Scope: Allows a wide range of business activities, including both online and offline operations.

- Enhanced Credibility: Operating with a DED license enhances trust among local consumers and partners.

- Visa Provision: Typically includes a greater allocation of business visas compared to free zone licenses.

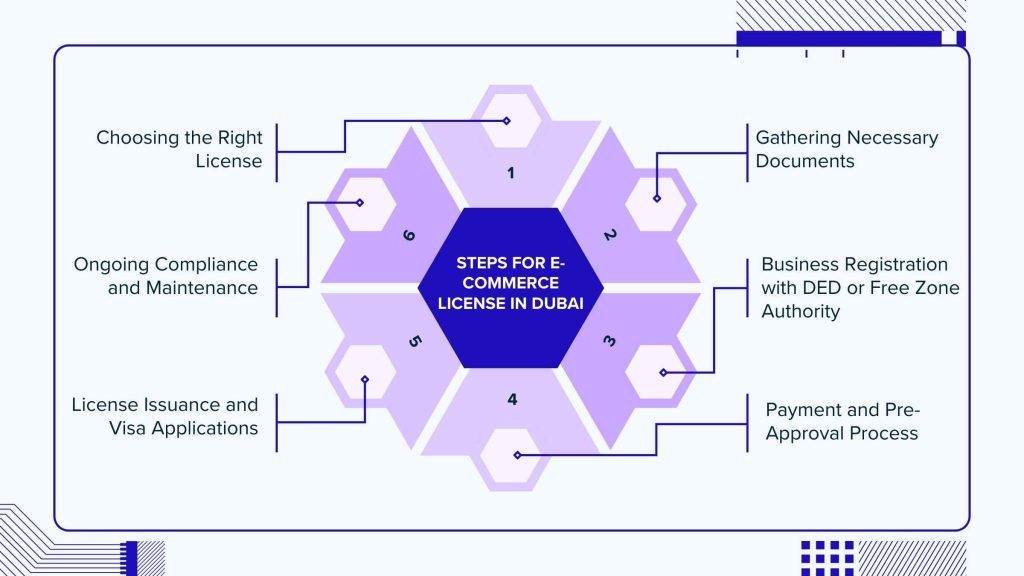

Steps For E-commerce License in dubai

Obtaining an e-commerce license in Dubai involves a series of methodical steps. Below is a detailed process to guide you through the registration and approval procedure.

Step 1: Choosing the Right License

Your journey begins with selecting the license that aligns best with your business model:

- Assess your Business Model: Determine if you plan to operate solely online, via social media channels, or alongside a physical store.

- Review License Options: Compare the E-Trader License, Portal License, and Virtual Company License.

- Consider Jurisdiction: Decide whether a mainland or free zone license suits your operational needs.

Example:

A startup planning to sell niche fashion accessories via Instagram and Facebook might find the E-Trader License most suitable. In contrast, an entrepreneur aiming to create a multi-vendor marketplace may opt for a Portal License.

Step 2: Gathering Necessary Documents

Documentation is a critical part of the application process. While the specific requirements may vary slightly between the DED and free zone authorities, the general documents include:

- Company Name Reservation: Ensure the chosen name complies with UAE naming conventions.

- Business Activity Details: Clearly outline your online business operations.

- Identification Documents: Valid passport copies, Emirates ID, and visa copies (if applicable) for all partners.

- Ownership Structure: Details on share ratios and company structure.

- Proof of Address: Complete contact details for all shareholders.

- Photographs: Recent passport-sized photos as required.

Case Study:

Consider an entrepreneur who successfully registered an online retail store by preparing a detailed business plan, including market analysis and projected revenue. This comprehensive documentation accelerated the pre-approval process.

Step 3: Business Registration with DED or Free Zone Authority

After gathering your documents, the next step is to register your business:

- For Mainland: Submit your application to the DED, ensuring that all details are accurate and complete.

- For Free Zones: Approach the relevant free zone authority (e.g., DMCC, RAKEZ, Dubai South, or DCC) and submit your documents as per their guidelines.

- Initial Approval: Both jurisdictions usually require pre-approval before processing the complete application. This phase might involve a nominal fee to initiate the process.

Key Tip:

Double-check all documents for accuracy to prevent delays during the initial review.

Step 4: Payment and Pre-Approval Process

Once your documents are submitted:

- Payment: A payment is typically required to begin the processing of your application. Licensing fees may start from AED 5,750, depending on the jurisdiction and type of license.

- Pre-Approval: Most free zones process the application within 3 to 7 days, while mainland applications might be approved on the same day or within two days.

Step 5: License Issuance and Visa Applications

After successful pre-approval:

- License Issuance: Digital copies of your e-commerce license are issued. Some free zones might later send original documents.

- Visa Processing: If your e-commerce license package includes visas, the immigration process will begin after the license is issued. These visas are crucial for establishing a presence in Dubai and may extend to employees and family members.

Step 6: Ongoing Compliance and Maintenance

Obtaining your license is only the beginning. Ongoing compliance is vital:

- Regulatory Compliance: Adhere to all UAE regulations, including VAT registration with the Federal Tax Authority.

- Document Renewal: Licenses need to be renewed periodically. Stay updated on any changes in government policies.

- Operational Compliance: Ensure your online business maintains secure technology, accurate digital invoices, and adheres to consumer protection standards.

Cost Breakdown and Financial Considerations

A. License Fees and Additional Expenses

The overall cost of obtaining an e-commerce license in Dubai depends on several factors:

- License Type: E-Trader licenses tend to be the most affordable, while Portal and Virtual Company licenses may carry higher fees.

- Jurisdiction: Costs vary between mainland (DED) and free zones. For example, free zone licensing fees may start at around AED 5,750 and increase based on additional services.

- Additional Expenses: Beyond the basic license fee, consider costs for:

- Office rent (if required)

- Visa processing fees

- Specialized permits or approvals (for regulated products)

- Investor or foreign name registration fees

- Medical insurance for visa applications

B. Tax Benefits and Financial Incentives

Dubai offers significant tax advantages for licensed e-commerce businesses:

- Corporate Tax Exemptions: Many free zones provide 0% corporate tax and full capital and profit repatriation.

- VAT Exemptions on Exports: While VAT registration is mandatory for certain transactions, exports outside the GCC are often zero-rated.

- Financial Incentives: Some free zones offer additional benefits such as flexible payment plans and startup incubation support.

Example:

An online retail startup might find that the tax advantages and low operational costs in Dubai free zones significantly reduce its overall financial burden, enabling reinvestment into marketing and expansion.

Additional Factors and Best Practices

Beyond obtaining a license, several additional factors are crucial for a successful e-commerce operation in Dubai.

A. Payment Gateway and Corporate Banking

Setting up reliable payment solutions and corporate banking is vital:

- Payment Gateways: While specific provider names are not mandatory, ensure you choose a secure and scalable payment gateway to handle online transactions. These gateways should support multi-currency transactions and robust fraud prevention.

- Corporate Banking: Open a corporate bank account with a reputable local bank to facilitate smooth business transactions. Essential documents for banking include your Trade License , company registration certificate, and shareholder details.

B. Logistics and Shipping Solutions

Effective logistics and shipping arrangements are critical for e-commerce:

- Courier Services: Partner with reputable courier companies to ensure timely delivery of products.

- Warehouse Facilities: Depending on your business model, renting warehouse space in Dubai’s industrial areas may be necessary.

- Integrated Solutions: Consider using third-party logistics providers that offer integrated technology solutions for real-time tracking and efficient order fulfillment.

C. Digital Marketing and SEO Strategies

To succeed in Dubai’s competitive e-commerce landscape, invest in robust digital marketing:

- SEO Best Practices: Use a mix of transactional, navigational, commercial, and informational keywords naturally throughout your content. Integrate primary keywords like “e-commerce license Dubai” and related long-tail phrases such as “how to get an e-commerce license in Dubai” in your website content, blogs, and FAQs.

- Social Media Advertising: Leverage platforms like Instagram, Facebook, and LinkedIn to target potential customers and drive traffic.

- Content Marketing: Publish high-value content (case studies, how-to guides, industry trends) that addresses common user pain points and positions your business as an industry leader.

D. Legal Compliance and Cybersecurity

Ensuring legal and cybersecurity compliance is non-negotiable:

- Legal Requirements: Adhere to local regulations such as the Federal Decree-Law No. 14 of 2023 and guidelines set by the DED and free zone authorities.

- Consumer Protection: Implement clear terms and conditions, privacy policies, and digital invoicing practices.

- Cybersecurity Measures: Secure your online platforms with robust cybersecurity protocols to protect sensitive consumer data and maintain trust.

Case Studies and Real-World Examples

Case Study 1: A Successful E-Trader Startup

Background:

A UAE national entrepreneur launched an online fashion boutique using the E-Trader License. The business operated solely through social media channels and rapidly gained traction among local consumers.

Approach:

- Licensing: Chose the E-Trader License due to its low cost and ease of setup.

- Digital Strategy: Leveraged Instagram and Facebook for product promotion.

- Outcomes: Within six months, the business saw a 150% increase in monthly sales, with positive customer reviews enhancing brand credibility.

Case Study 2: A Portal License for a Multi-Vendor Marketplace

Background:

An entrepreneur based outside the UAE aimed to create an online marketplace for artisanal goods. Given the scope and scale, the Portal License was the best fit.

Approach:

- Licensing: Opted for the Portal License, which allowed multi-vendor integration and diverse product listings.

- Platform Development: Invested in a robust e-commerce website and integrated digital payment solutions.

- Outcomes: The marketplace grew to host over 50 vendors within the first year, with strategic marketing resulting in a significant market share within the niche segment.

Case Study 3: Virtual Company License for International Investors

Background:

An overseas investor sought to enter the Dubai e-commerce market without a physical presence. The Virtual Company License provided a flexible, remote setup solution.

Approach:

- Licensing: Registered under the Virtual Company License, focusing on digital services and online retail.

- Operational Strategy: Employed cloud-based technologies and partnered with local logistics providers.

- Outcomes: Achieved rapid market entry and expanded operations to include local and international customers, leveraging Dubai’s advanced infrastructure and tax incentives.

Recommended: Business Setup in Dubai – Hassle-Free Company Formation

Frequently Asked Questions (FAQs)

Q1: What is the difference between an e-commerce license and a general trading license in Dubai?

A: An e-commerce license specifically authorizes online business activities and is tailored for digital commerce, whereas a general trading license covers a broader range of commercial activities, including both online and offline sales.

Q2: Can foreigners obtain an e-commerce license in Dubai?

A: Yes, foreigners can obtain an e-commerce license through free zones like DMCC, RAKEZ, Dubai South, or Dubai CommerCity (DCC), as well as via mainland licensing with the DED. Certain licenses, like the Virtual Company License, are especially geared toward overseas investors.

Q3: Do I need a physical office to apply for an e-commerce license?

A: It depends on the license type. For instance, the E-Trader License does not require a physical office, while other licenses may mandate a registered address or flexi-desk arrangement.

Q4: What is the estimated cost of an e-commerce license in Dubai?

A: Costs can start from approximately AED 5,750, with additional expenses based on factors such as office rent, visa fees, and specialized permits.

Q5: How long does the licensing process take?

A: In free zones, the process can take 3 to 7 days, while mainland applications with the DED might be processed within 1 to 2 days following pre-approval.

Q6: Is VAT registration required for all e-commerce businesses?

A: E-commerce businesses must comply with VAT regulations if their taxable supplies exceed the mandatory registration threshold. However, exports outside the GCC may be zero-rated.

Q7: Which free zone is considered best for an e-commerce business?

A: While the best free zone depends on your business model, Dubai CommerCity (DCC) offers a specialized ecosystem for digital commerce, making it an excellent choice for e-commerce ventures.

Q8: What legal obligations must I adhere to after obtaining an e-commerce license?

A: You must maintain compliance with all UAE regulations, including consumer protection laws, cybersecurity standards, digital invoicing, and ongoing VAT registration with the Federal Tax Authority.

Q9: Can I operate an e-commerce business on social media without a license?

A: No, conducting any online business activities without a valid e-commerce license is illegal in Dubai and may result in significant penalties.

Q10: What are the advantages of a free zone license versus a mainland license?

A: Free zone licenses offer benefits such as 100% foreign ownership, tax exemptions, and streamlined registration processes, while mainland licenses provide direct access to the local market and typically allow for a wider range of business activities.

Conclusion

Acquiring an e-commerce license in Dubai is a critical first step for anyone looking to tap into one of the fastest-growing digital marketplaces in the world. With market projections indicating exponential growth, the decision to start an online business in Dubai is not only timely but also laden with opportunities for global expansion, tax benefits, and enhanced credibility.

This guide has outlined every aspect of the licensing process—from understanding the e-commerce landscape and choosing between free zone and mainland licenses to a detailed, step-by-step registration process and financial considerations. By following these procedures and ensuring strict adherence to legal and regulatory requirements, you can launch your online business with confidence.

By integrating advanced digital marketing strategies, robust logistics, and effective payment solutions, you will be well-equipped to overcome the challenges and harness the benefits of Dubai’s dynamic e-commerce market. We hope that this comprehensive guide has addressed your queries and provided you with actionable insights, paving the way for your successful venture in the UAE’s digital economy.