A salary certificate in the UAE is an official document issued by an employer, confirming an employee’s income, job position, and employment details. It’s essential for financial transactions like applying for loans, opening bank accounts, processing visas, or securing rental agreements. Employers typically issue this document on company letterhead, stamped and signed by authorized personnel. In Dubai, obtaining a salary certificate usually involves a formal request through your HR department. Understanding the format and requirements ensures a smooth application for both personal and professional needs.

How to Get Salary Certificate Dubai UAE -Salary Certificate Format.

If you’re working in Dubai—or anywhere else in the United Arab Emirates—chances are, you’ll need a salary certificate at some point. Whether you’re applying for a personal loan, opening a bank account, renting an apartment, or sponsoring a family member’s visa, this document is your official proof of income and employment.

But how exactly do you request one? What’s the difference between a salary slip and a salary certificate? And is attestation really necessary? In this comprehensive guide, we’ll answer all these questions and more. We’ll also share tips on dealing with tricky HR policies, mention key government authorities like the Ministry of Human Resources and Emiratisation (MOHRE), Ministry of Foreign Affairs and International Cooperation (MOFAIC), and even show you a sample salary certificate format to ensure you don’t miss any important detail.

We’ll also explore the role of digital HR systems, which many modern companies use to issue certificates online. By the end, you’ll have a complete roadmap to getting your salary certificate in Dubai or any other emirate, plus a clear understanding of how to attest it for official or international use. Let’s dive in!

- What Is a Salary Certificate in the UAE?

- Why Do You Need a Salary Certificate?

- Salary Certificate vs. Salary Slip

- Key Entities & Terms in Salary Certificates

- Salary Certificate Format in the UAE

- 7. Steps to Request a Salary Certificate in the UAE

- Attestation of a Salary Certificate in the UAE

- Legal Consequences & Employee Rights

- Digital HR Systems & Online Issuance

- Real-Life Case Studies

- Common Mistakes & How to Avoid Them

- Frequently Asked Questions (FAQs)

- Q1: How long is a salary certificate valid in the UAE?

- Q2: Do I need to attest my salary certificate for a local bank loan?

- Q3: What if my employer refuses to provide a certificate?

- Q4: Can I use the same salary certificate for multiple purposes?

- Q5: What’s the difference between gross salary and net salary?

- Q6: Is a salary slip the same as a salary certificate?

- Q7: Do I need a salary certificate to sponsor my family?

- Q8: Can I get my salary certificate attested online?

- Q9: Will my bank statements replace a salary certificate?

- Q10: Is there a fee to request a salary certificate from my employer?

- Additional Tips for a Smooth Process

- Conclusion

What Is a Salary Certificate in the UAE?

A salary certificate in the UAE is a formal document issued by your employer that confirms your income, job title, date of employment, and often includes a breakdown of basic salary, allowances, and net pay. It’s typically printed on official company letterhead, stamped with the company seal, and signed by an authorized representative—usually someone in the HR department.

Quick Facts:

- Validity: Most salary certificates are valid for about three months.

- Purpose: Used in financial and legal transactions (credit cards, loans, visas, etc.).

- Format: Must include essential details like employee name, ID, net salary, and date of issue.

If you’re wondering, “Why can’t I just use my pay slip?”—a salary slip (or payslip) simply shows monthly earnings and deductions, whereas a salary certificate is a formal verification of your overall financial standing and employment status. That’s why banks, government offices, and landlords often prefer a salary certificate over a slip.

Why Do You Need a Salary Certificate?

A. Bank Loans & Credit Cards

Banks want to verify your income stability and creditworthiness before approving loans or credit cards. A salary certificate provides reliable proof of your monthly earnings, length of employment, and job stability—key factors lenders look for.

B. Visa Applications

Whether you’re sponsoring a family member or renewing your own work visa, government authorities might request a salary certificate to ensure you meet the minimum income requirements.

C. Rental Agreements

Property owners and real estate agents often ask for a salary certificate to confirm that you can comfortably afford the rent, especially for high-end properties in places like Downtown Dubai or Dubai Marina.

D. Government Services & Benefits

Certain government services, like obtaining a driver’s license or availing specific benefits, might require proof of income. A salary certificate validates your employment and income eligibility.

E. Other Financial Transactions

From buying a car on installment to opening a bank account for a salary transfer, salary certificates come in handy in various scenarios that demand income verification.

Recommended: Legal Requirements for Business Setup in Dubai – COFOCSP

Salary Certificate vs. Salary Slip

Salary Certificate:

- Issued on request and often addresses a specific purpose (e.g., “To Whom It May Concern” or to a named institution).

- Printed on official company letterhead with signatures and stamps.

- Serves as official proof of your job and income.

- May need attestation for official or international use.

Salary Slip:

- A monthly record of earnings and deductions.

- Typically auto-generated through HR or payroll systems each payday.

- Less formal—not always accepted for official transactions that require employer verification.

- Usually does not need attestation (rarely used for formal verification).

In short, your salary slip shows how much you got paid and how it was broken down for a particular month, while your salary certificate is a formal letter confirming that information on a broader, more official level.

Key Entities & Terms in Salary Certificates

A. MOHRE (Ministry of Human Resources and Emiratisation)

MOHRE oversees labor laws in the UAE. While they typically don’t issue salary certificates, they do protect employee rights. If your employer refuses to provide a salary certificate without reason, MOHRE is where you’d file a complaint.

Recommended: All You Need to Know MOHRE Enquiry Services in UAE

B. MOFAIC (Ministry of Foreign Affairs & International Cooperation)

If you need to use your salary certificate outside the UAE—or for formal applications like immigration—MOFAIC attestation is often mandatory. They verify the authenticity of official documents for international recognition.

C. Chamber of Commerce

Before MOFAIC attestation, many documents (including salary certificates) require Chamber of Commerce stamping to confirm the employer’s legitimacy. Fees vary by emirate, usually ranging from AED 100–200.

D. IVS Global

IVS Global processes affidavits and attestations for certain nationalities, often in collaboration with embassies and consulates. For instance, those earning below AED 10,000 might need an IVS Global affidavit before further attestation.

E. Employee ID, Emirates ID & Passport Number

Your Employee ID is an internal reference in your organization. Emirates ID is your national identity card, and the Passport Number identifies you internationally. Including these helps banks, landlords, and authorities verify your identity.

F. Trade License Number

For companies registration in the UAE, the Trade License Number is a legal identifier issued by the Department of Economic Development (or a Free Zone Authority). It often appears on official documents to prove the business is legitimate.

G. Basic Salary, Gross Salary, and Net Salary

- Basic Salary: The core amount you earn before any allowances.

- Gross Salary: Your basic salary plus allowances (housing, transport, etc.).

- Net Salary: What you take home after deductions (like social security or other contributions).

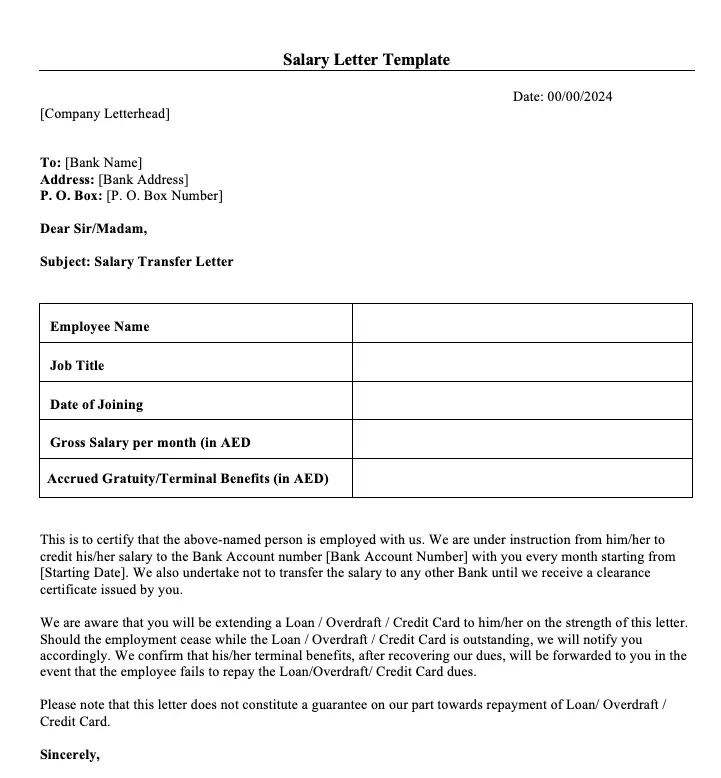

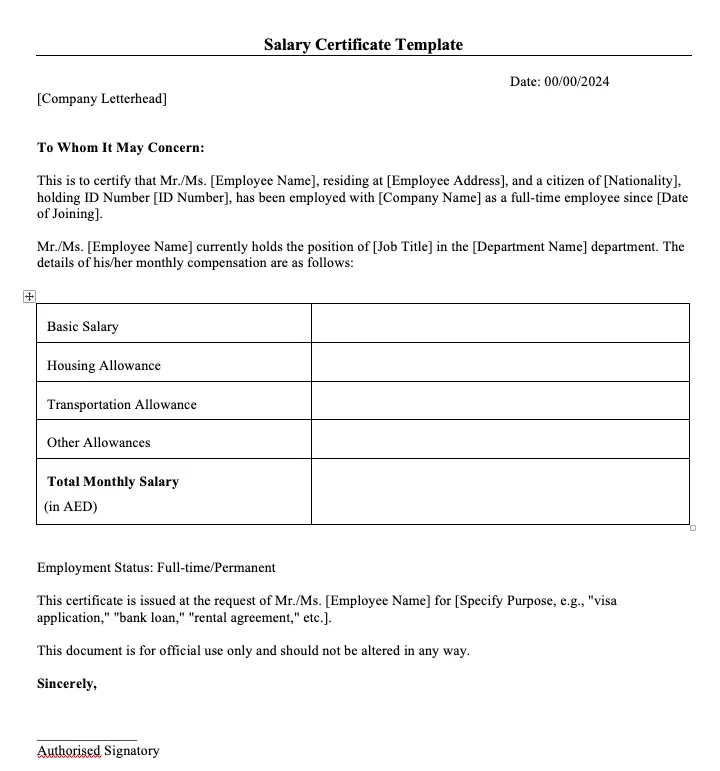

Salary Certificate Format in the UAE

A. Essential Elements

When you look at a salary certificate format UAE sample, you’ll notice these core elements:

- Company Letterhead & Logo

- Date of Issuance

- Employee Details: Full name, job title, employee ID, Emirates ID or Passport Number

- Salary Breakdown: Basic salary, allowances, net salary

- Deductions (if any)

- Purpose Statement (e.g., for a loan, visa, or rental)

- Authorized Signatory: Signature, designation, and stamp

- Validity Period (often implied to be three months)

2 Sample Salary Certificate Format

[Company Letterhead & Logo]

Date: [DD/MM/YYYY]TO WHOM IT MAY CONCERN

This is to certify that Mr./Ms. [Employee Name], holding Emirates ID [000-0000-0000-000] and Passport Number [A1234567], is currently employed by [Company Name], bearing Trade License Number [XXXXXXXX], as a [Job Title] since [Date of Joining].

Employee Details:

- Employee ID: [Employee ID Number]

- Department: [Department Name]

- Contract Type: [Permanent/Contractual]

Monthly Salary Breakdown:

- Basic Salary: AED [Amount]

- Housing Allowance: AED [Amount]

- Transportation Allowance: AED [Amount]

- Other Allowances: AED [Amount]

- Gross Salary: AED [Total Gross Amount]

- Deductions (if any): AED [Deduction Amount]

- Net Salary: AED [Gross – Deductions]

This certificate is issued upon the employee’s request for [purpose, e.g., Loan Application, Visa Sponsorship, Rental Agreement, etc.].

Authorized Signatory:

[Name & Signature]

[Designation]

[Company Stamp]Contact: [Phone/Email]

This certificate is valid for three months from the date of issue.

Feel free to ask your HR department for a PDF or Word version so you can share it easily. Some companies already have a downloadable template on their intranet or digital HR system.

7. Steps to Request a Salary Certificate in the UAE

Requesting a salary certificate is usually straightforward, but it can vary slightly from company to company. Here’s a detailed guide:

Step 1: Clarify the Purpose

Figure out why you need the certificate—whether it’s for a bank loan, credit card, visa application, or rental contract. This helps HR include the right details and ensures the document meets the requirements of the requesting institution.

Step 2: Contact the HR Department

Reach out via email, phone call, or an internal HR portal. Keep your communication polite but clear. If your company has a digital HR system, you may simply fill out a request form online.

Step 3: Provide Required Information

Share:

- Your full name (as on official documents)

- Employee ID

- Emirates ID or Passport Number (if needed)

- The purpose of the certificate

- Any special instructions (for instance, if the bank wants it addressed specifically to them)

Step 4: Write a Formal Request

In some companies, you might need to draft a formal letter. Be concise:

- State your purpose (e.g., “I need the salary certificate to apply for a personal loan at XYZ Bank.”)

- Mention the deadline (if any)

- Provide all personal details required (full name, job title, employee ID)

Step 5: Submit Your Request

Send your request via:

- Email to HR or the relevant department

- Online portal if your organization uses a digital HR system

- In-person request forms if the company requires a physical document

Timeline for Issuance

Most companies take 1–5 working days to process a salary certificate request. In free zones, HR might consult the Free Zone Authority for certain verifications, which can add a day or two. Overall, it’s a simple process that shouldn’t take too long.

Attestation of a Salary Certificate in the UAE

Attestation is the process of verifying an official document’s authenticity. You’ll often need it if the salary certificate is for foreign use—like applying for a visa abroad or presenting it to a foreign embassy.

A. Step-by-Step Attestation Process

Step 1: Company Attestation

Your HR department must sign and stamp the certificate, confirming it’s authentic.

Step 2: Chamber of Commerce

Next, get a stamp from the Chamber of Commerce in the emirate where your company is registered. Fees vary (AED 100–200).

Step 3: Ministry of Foreign Affairs (MOFA)

Head to a MOFA branch to get the highest level of attestation. You’ll pay an attestation fee (often around AED 150).

Step 4: Consulate/Embassy (If Required)

If you need the document recognized in a specific country, you may need further attestation from the relevant embassy or consulate in the UAE.

B. Online Attestation via MOFAIC

To streamline the process, MOFAIC offers an online attestation service. Here’s how it works:

- Register on the MOFAIC website or use the mobile app.

- Upload your salary certificate and supporting documents (e.g., Emirates ID, passport copy).

- Pay the attestation fees online.

- Track your application status via the portal.

- Obtain the e-stamped document (digital attestation) once approved.

C. Attestation Fees & Additional Costs

- MOFAIC attestation generally costs AED 150 (plus a small e-Dirham fee).

- Chamber of Commerce stamping might be AED 100–200.

- Courier fees if you opt for document pick-up and delivery.

- IVS Global fees, if your nationality or salary bracket requires an affidavit (e.g., for certain income thresholds).

D. Income-Based Requirements (Below AED 10,000 vs. Above AED 10,000)

In some cases, especially for certain visa applications, individuals earning below AED 10,000 may need extra steps:

- IVS Global Affidavit: Confirming income details.

- Possibly more paperwork or additional bank statements.

If you earn above AED 10,000, you may need a Chamber of Commerce stamp alongside your company’s attestation. Always verify with the requesting authority or your HR department.

Legal Consequences & Employee Rights

A. False Documentation

Presenting fake salary certificates or altering details is illegal in the UAE. Penalties can include:

- Fines

- Legal action

- Possible deportation for expatriates

It’s crucial to ensure all information on your salary certificate is accurate and up-to-date.

B. Employer Refusal to Issue a Salary Certificate

Under UAE labor laws, you generally have the right to request a salary certificate. If your employer refuses:

- Clarify the reason—they might have an internal process.

- If refusal persists, contact MOHRE to file a complaint.

- The employer could face fines or legal penalties if found non-compliant.

C. Where to File Complaints

- MOHRE (Ministry of Human Resources and Emiratisation) for labor disputes.

- Free Zone Authority if your company is registered in a free zone.

- Legal counsel for more serious cases of non-compliance or fraud.

Digital HR Systems & Online Issuance

Some forward-thinking companies in Dubai and across the UAE use digital HR platforms where employees can:

- Request a salary certificate online.

- Track the request status.

- Download the final PDF or receive a digitally signed version.

This can cut down processing times significantly. However, even digitally issued certificates often need a physical stamp and signature for official use—so be sure to confirm with your bank or the requesting authority.

Pro Tip: Ask if your company uses software like SAP SuccessFactors or Oracle HCM, which may have a module for generating official documents instantly.

Real-Life Case Studies

- Ahmed’s Loan Application

Ahmed needed a personal loan to pay for a new car. He quickly requested a salary certificate through his HR portal. The bank also wanted Chamber of Commerce stamping. Ahmed scheduled a visit and paid AED 120 for the stamp. The entire process took five working days, after which Ahmed got his loan approved. - Sara’s Visa Sponsorship

Sara sponsored her sister’s visa. The immigration office asked for her salary certificate to verify she met the minimum salary requirement. Sara’s employer used an older manual system, so it took a week to process. She then used MOFAIC’s online attestation service to finalize the document for official use, saving multiple in-person visits. - Ravi’s Rental Agreement

Ravi found a new apartment but needed a salary certificate to reassure the landlord about his rent-paying capacity. He requested it from HR, but they insisted on a formal letter. He drafted one, stating the purpose (rental agreement) and provided his full details. Within three days, he had the certificate, showed it to the landlord, and secured the lease.

These examples highlight the varied uses of salary certificates in the UAE—from bank loans to immigration processes to real estate transactions.

Common Mistakes & How to Avoid Them

- Incorrect Personal Details

Always check your name, employee ID, and passport number. A small typo can cause major delays. - Using an Old Template

HR guidelines change. Make sure you get the latest salary certificate format with updated signatories and stamps. - Forgetting Attestation

For overseas or official uses, skipping the attestation step can invalidate your certificate. - Not Following Up

Sometimes HR departments get busy. If you don’t hear back within the expected timeline, send a friendly reminder. - Assuming a Salary Slip Is Enough

Many banks or government offices won’t accept a salary slip in place of a formal certificate.

Frequently Asked Questions (FAQs)

Q1: How long is a salary certificate valid in the UAE?

Typically three months. Some institutions might want one that’s even more recent (e.g., within the last 30 days).

Q2: Do I need to attest my salary certificate for a local bank loan?

Usually not. Local banks trust official company letterheads. Attestation is more common for visa or foreign use.

Q3: What if my employer refuses to provide a certificate?

You can escalate the issue to MOHRE or your Free Zone Authority. Employers are generally obligated to issue it.

Q4: Can I use the same salary certificate for multiple purposes?

Yes, if it’s To Whom It May Concern and still valid. However, some banks or landlords want the certificate addressed specifically to them.

Q5: What’s the difference between gross salary and net salary?

Gross salary is your base pay plus allowances. Net salary is what’s left after deductions (like social security).

Q6: Is a salary slip the same as a salary certificate?

No, a salary slip details monthly earnings and deductions. A salary certificate is an official letter verifying your employment and total income.

Q7: Do I need a salary certificate to sponsor my family?

Often yes, especially if there’s a minimum income requirement for sponsorship. Check the latest immigration rules for specifics.

Q8: Can I get my salary certificate attested online?

Yes, MOFAIC offers an online attestation service. You’ll need to upload the document, pay the fee, and track the process digitally.

Q9: Will my bank statements replace a salary certificate?

Typically, no. Banks usually ask for an official letter from your employer. Bank statements alone may not suffice for certain procedures.

Q10: Is there a fee to request a salary certificate from my employer?

- Generally, no. Most employers issue it free of charge, though some may charge an administrative fee. Always check your HR policies.

Additional Tips for a Smooth Process

- Ask for a Digital Copy: Even if you need a physical copy, having a PDF can be handy for online applications.

- Check for the Right Signatory: Some banks insist the certificate be signed by an HR manager, not just any staff member.

- Keep a Record: Store your old salary certificates in a safe place. They can be useful for reference or if you need to prove your employment history.

- Downloadable Template: If your HR department doesn’t have a standard format, you might suggest they create or use a downloadable template. This can speed up the process.

- Engage a PRO: If you’re pressed for time or dealing with multiple document attestations, consider hiring a Public Relations Officer (PRO). They can handle the back-and-forth with government offices.

- Use a Courier: Some attestation services let you courier the documents to the relevant department, saving you in-person trips.

Conclusion

Getting a salary certificate in Dubai or anywhere in the UAE is a straightforward yet vital process. It’s more than just a piece of paper—it’s your official proof of income, job title, and employment stability, often needed to secure loans, credit cards, rental agreements, or immigration benefits. By understanding the key entities—like MOHRE, MOFAIC, Chamber of Commerce, and IVS Global—and knowing how to request and attest this document, you’ll breeze through bureaucratic processes with minimal hassle.

Remember to double-check every detail for accuracy, stay aware of attestation requirements, and follow up politely if there are delays. Also, keep an eye out for digital HR systems that can streamline everything from requesting your certificate to receiving an attested, stamped version. If you ever run into issues—such as an employer’s refusal to provide a certificate—don’t hesitate to reach out to MOHRE or seek legal advice.